Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 44P

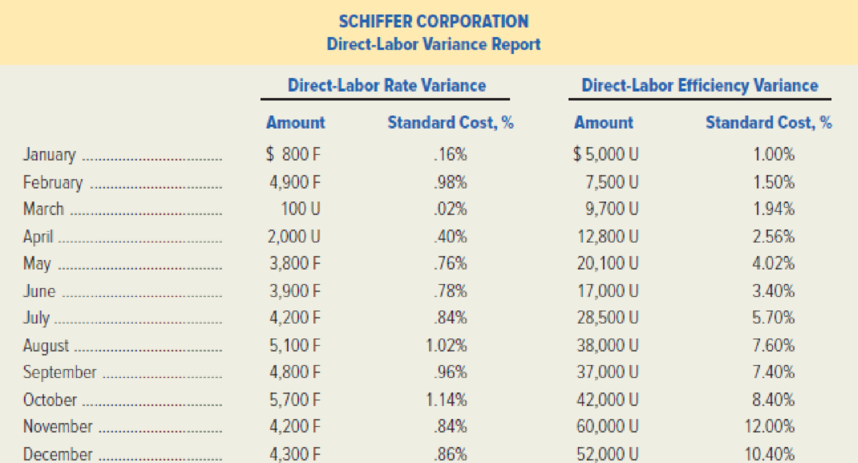

Schiffer Corporation manufactures agricultural machinery. At a recent staff meeting, the following direct-labor variance report for the year just ended was presented by the controller.

Schiffer’s controller uses the following rule of thumb: Investigate all variances equal to or greater than $30,000, which is 6 percent of

Required:

- 1. Which variances would have been investigated during the year? (Indicate month and type of variance.)

- 2. What characteristics of the variance pattern shown in the report should draw the controller’s attention, regardless of the usual investigation rule? Explain. Given these considerations, which variances would you have investigated? Why?

- 3. Is it important to follow up on favorable variances, such as those shown in the report? Why?

- 4. The controller believes that the firm’s direct-labor rate variance has a

normal probability distribution with a mean of zero and a standard deviation of $5,000. Prepare a statistical control chart, and plot the company’s direct-labor rate variances for each month. The critical value is one standard deviation. Which variances would have been investigated under this approach?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Which variances would have been investigated during the year? (Indicate month and type of variance.)

The director of cost management for Odessa Company uses a statistical control chart to help management determine when to

investigate variances. The critical value is 1 standard deviation. The company incurred the following direct-labor efficiency variances

during the first six months of the current year.

January

February

March

April

May

June

$ 300 F

850 U

750 U

950 U

1,100 U

1,480 U

The standard direct-labor cost during each of these months was $24,000. The controller has estimated that the firm's monthly direct-

labor variances have a standard deviation of $1,000.

Required:

2-a. Determine the cutoff value for investigation if the controller's rule of thumb is to investigate all variances equal to or greater than 6

percent of standard cost.

2-b. Based on the cutoff value, which month will have its direct-labor efficiency variance investigated?

Complete this question by entering your answers in the tabs below.

Req 2A

Reg 2B

Determine the cutoff value for investigation if the…

[The following information applies to the questions displayed below.]

The director of cost management for Odessa Company uses a statistical control chart to help management determine

when to investigate variances. The critical value is 1 standard deviation. The company incurred the following direct-labor

efficiency variances during the first six months of the current year.

January

February

March.

April

May

June

$ 250 F

800 U

700 U

908 U

1,050 U

1,200 U

The standard direct-labor cost during each of these months was $19,000. The controller has estimated that the firm's

monthly direct-labor variances have a standard deviation of $950.

Required:

1-a. Draw a statistical control chart and plot the variance data given above.

1-b. Which variances will be investigated?

Chapter 10 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 10 - Prob. 1RQCh. 10 - What is meant by the phrase management by...Ch. 10 - Prob. 3RQCh. 10 - Prob. 4RQCh. 10 - Prob. 5RQCh. 10 - Prob. 6RQCh. 10 - What is the interpretation of the direct-material...Ch. 10 - What manager is usually in the best position to...Ch. 10 - What is the interpretation of the direct-material...Ch. 10 - Prob. 10RQ

Ch. 10 - Prob. 11RQCh. 10 - What is the interpretation of the direct-labor...Ch. 10 - What manager is generally in the best position to...Ch. 10 - What is the interpretation of the direct-labor...Ch. 10 - What manager is generally in the best position to...Ch. 10 - Prob. 16RQCh. 10 - Describe five factors that managers often consider...Ch. 10 - Discuss several ways in which standard-costing...Ch. 10 - Describe how standard costs are used for product...Ch. 10 - Prob. 20RQCh. 10 - Prob. 21RQCh. 10 - Saskatewan Can Company manufactures recyclable...Ch. 10 - Refer to the data in the preceding exercise. Use...Ch. 10 - Cayuga Hardwoods produces handcrafted jewelry...Ch. 10 - During June, Danby Companys material purchases...Ch. 10 - Refer to the data in the preceding exercise. Draw...Ch. 10 - The director of cost management for Odessa Company...Ch. 10 - Due to evaporation during production, Plano...Ch. 10 - Prob. 30ECh. 10 - Refer to the data in Exercise 1022, regarding...Ch. 10 - Saskatewan Can Company manufactures recyclable...Ch. 10 - New Jersey Valve Company manufactured 7,800 units...Ch. 10 - Prob. 34PCh. 10 - During May, Joliet Fabrics Corporation...Ch. 10 - Sal Amato operates a residential landscaping...Ch. 10 - Santa Rosa Industries uses a standard-costing...Ch. 10 - The following data pertain to Colgate-Palmolives...Ch. 10 - Orion Corporation has established the following...Ch. 10 - Associated Media Graphics (AMG) is a rapidly...Ch. 10 - The director of cost management for Portland...Ch. 10 - Ogwood Companys Johnstown Division is a small...Ch. 10 - Quincy Farms produces items made from local farm...Ch. 10 - Schiffer Corporation manufactures agricultural...Ch. 10 - Aqua float Corporation manufactures rafts for use...Ch. 10 - Rocky Mountain Camping Equipment, Inc. has...Ch. 10 - Springsteen Company manufactures guitars. The...Ch. 10 - Springsteen Company manufactures guitars. The...Ch. 10 - European Styles, Inc. manufactures womens blouses...Ch. 10 - MacGyver Corporation manufactures a product called...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using variance analysis and interpretation Last year, Wrigley Corp. adopted a standard cost system. Labor standards were set on the basis of time studies and prevailing wage rates. Materials standards were determined from materials specifications and the prices then in effect. On June 30, the end of the current fiscal year, a partial trial balance revealed the following: Standards set at the beginning of the year have remained unchanged. All inventories are priced at standard cost. What conclusions can be drawn from each of the four variances shown in Wrigleys trial balance?arrow_forwardAnker Company had the data below for its most recent year, ended December 31: Required: Prepare a performance report that shows the variances on an item-by-item basis.arrow_forwardKavallia Company set a standard cost for one item at 328,000; allowable deviation is 14,500. Actual costs for the past six months are as follows: Required: 1. Calculate the variance from standard for each month. Which months should be investigated? 2. What if the company uses a two-part rule for investigating variances? The allowable deviation is the lesser of 4 percent of the standard amount or 14,500. Now which months should be investigated?arrow_forward

- Marten Company has a cost-benefit policy to investigate any variance that is greater than 1,000 or 10% of budget, whichever is larger. Actual results for the previous month indicate the following: The company should investigate: a. neither the materials variance nor the labor variance. b. the materials variance only. c. the labor variance only. d. both the materials variance and the labor variance.arrow_forwardMadison Company uses the following rule to determine whether direct labor efficiency variances ought to be investigated. A direct labor efficiency variance will be investigated anytime the amount exceeds the lesser of 12,000 or 10 percent of the standard labor cost. Reports for the past five weeks provided the following information: Required: 1. Using the rule provided, identify the cases that will be investigated. 2. Suppose that investigation reveals that the cause of an unfavorable direct labor efficiency variance is the use of lower quality direct materials than are usually used. Who is responsible? What corrective action would likely be taken? 3. Suppose that investigation reveals that the cause of a significant favorable direct labor efficiency variance is attributable to a new approach to manufacturing that takes less labor time but causes more direct materials waste. Upon examining the direct materials usage variance, it is discovered to be unfavorable, and it is larger than the favorable direct labor efficiency variance. Who is responsible? What action should be taken? How would your answer change if the unfavorable variance were smaller than the favorable?arrow_forwardThe management of Golding Company has determined that the cost to investigate a variance produced by its standard cost system ranges from 2,000 to 3,000. If a problem is discovered, the average benefit from taking corrective action usually outweighs the cost of investigation. Past experience from the investigation of variances has revealed that corrective action is rarely needed for deviations within 8% of the standard cost. Golding produces a single product, which has the following standards for materials and labor: Actual production for the past 3 months follows, with the associated actual usage and costs for materials and labor. There were no beginning or ending raw materials inventories. Required: 1. What upper and lower control limits would you use for materials variances? For labor variances? 2. Compute the materials and labor variances for April, May, and June. Identify those that would require investigation by comparing each variance to the amount of the limit computed in Requirement 1. Compute the actual percentage deviation from standard. Round all unit costs to four decimal places. Round variances to the nearest dollar. Round variance rates to three decimal places so that percentages will show to one decimal place. 3. CONCEPTUAL CONNECTION Let the horizontal axis be time and the vertical axis be variances measured as a percentage deviation from standard. Draw horizontal lines that identify upper and lower control limits. Plot the labor and material variances for April, May, and June. Prepare a separate graph for each type of variance. Explain how you would use these graphs (called control charts) to assist your analysis of variances.arrow_forward

- Recompute the variances from the second Acme Inc. exercise using $0.0725 as the standard cost of the material and $14 as the standard labor cost per hour. How has your explanation of the variances changed?arrow_forwardIn all of the exercises involving variances, use F and U to designate favorable and unfavorable variances, respectively. E8-1 through E8-5 use the following data: The standard operating capacity of Tecate Manufacturing Co. is 1,000 units. A detailed study of the manufacturing data relating to the standard production cost of one product revealed the following: 1. Two pounds of materials are needed to produce one unit. 2. Standard unit cost of materials is 8 per pound. 3. It takes one hour of labor to produce one unit. 4. Standard labor rate is 10 per hour. 5. Standard overhead (all variable) for this volume is 4,000. Each case in E8-1 through E8-5 requires the following: a. Set up a standard cost summary showing the standard unit cost. b. Analyze the variances for materials and labor. c. Make journal entries to record the transfer to Work in Process of: 1. Materials costs 2. Labor costs 3. Overhead costs (When making these entries, include the variances.) d. Prepare the journal entry to record the transfer of costs to the finished goods account. Standard unit cost; variance analysis; journal entries 1,000 units were started and finished. Case 1: All prices and quantities for the cost elements are standard, except for materials cost, which is 8.50 per pound. Case 2: All prices and quantities for the cost elements are standard, except that 1,900 lb of materials were used.arrow_forwardAs part of its cost control program, Tracer Company uses a standard costing system for all manufactured items. The standard cost for each item is established at the beginning of the fiscal year, and the standards are not revised until the beginning of the next fiscal year. Changes in costs, caused during the year by changes in direct materials or direct labor inputs or by changes in the manufacturing process, are recognized as they occur by the inclusion of planned variances in Tracers monthly operating budgets. The following direct labor standard was established for one of Tracers products, effective June 1, 2012, the beginning of the fiscal year: The standard was based on the direct labor being performed by a team consisting of five persons with Assembler A skills, three persons with Assembler B skills, and two persons with machinist skills; this team represents the most efficient use of the companys skilled employees. The standard also assumed that the quality of direct materials that had been used in prior years would be available for the coming year. For the first seven months of the fiscal year, actual manufacturing costs at Tracer have been within the standards established. However, the company has received a significant increase in orders, and there is an insufficient number of skilled workers to meet the increased production. Therefore, beginning in January, the production teams will consist of eight persons with Assembler A skills, one person with Assembler B skills, and one person with machinist skills. The reorganized teams will work more slowly than the normal teams, and as a result, only 80 units will be produced in the same time period in which 100 units would normally be produced. Faulty work has never been a cause for units to be rejected in the final inspection process, and it is not expected to be a cause for rejection with the reorganized teams. Furthermore, Tracer has been notified by its direct materials supplier that lower-quality direct materials will be supplied beginning January 1. Normally, one unit of direct materials is required for each good unit produced, and no units are lost due to defective direct materials. Tracer estimates that 6 percent of the units manufactured after January 1 will be rejected in the final inspection process due to defective direct materials. Required: 1. Determine the number of units of lower quality direct materials that Tracer Company must enter into production in order to produce 47,000 good finished units. 2. How many hours of each class of direct labor must be used to manufacture 47,000 good finished units? 3. Determine the amount that should be included in Tracers January operating budget for the planned direct labor variance caused by the reorganization of the direct labor teams and the lower quality direct materials. (CMA adapted)arrow_forward

- The president of McGrade Industries wants an analysis prepared to help explain why the variances computed in requirement 1 occurred. Using the worksheet called PRIMEVAR that follows these requirements, calculate the material and labor variances for McGrade Industries. The problem requires you to enter the input in the Data Section as well as formulas in the Answer Section.arrow_forwardFor the month of April, compute the variances, indicating whether it is favorable (F) or unfavorable (U): Q. Direct materials efficiency variance ?arrow_forwardFor the month of April, compute the variances, indicating whether it is favorable (F) or unfavorable (U) Q.Production-volume variance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

What is Risk Management? | Risk Management process; Author: Educationleaves;https://www.youtube.com/watch?v=IP-E75FGFkU;License: Standard youtube license