Intermediate Accounting

9th Edition

ISBN: 9781259722660

Author: J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 9.5E

Lower of cost or market

• LO9–1

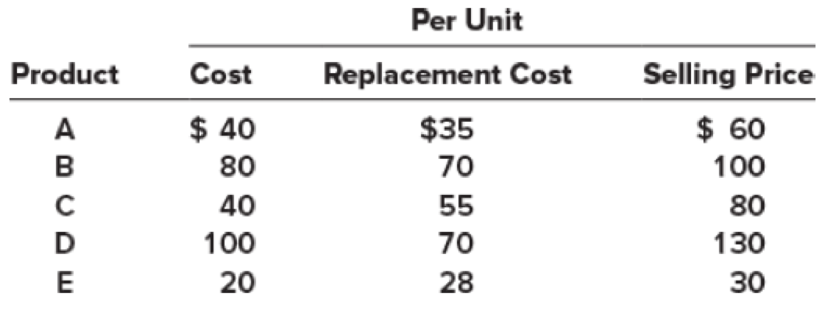

[This is a variation of E 9–2, modified to focus on the lower of cost or market.] The inventory of Royal Decking consisted of five products. Information about the December 31, 2018, inventory is as follows:

Selling costs consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. The normal gross profit percentage is 30% of selling price.

Required:

What unit value should Royal Decking use for each of its products when applying the lower of cost or market (LCM) rule to units of ending inventory?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please explain the solution to this general accounting problem with accurate principles.

Please provide the accurate answer to this financial accounting problem using appropriate methods.

I am looking for the correct answer to this general accounting question with appropriate explanations.

Chapter 9 Solutions

Intermediate Accounting

Ch. 9 - Explain the (a) lower of cost or net realizable...Ch. 9 - What are the various levels of aggregation to...Ch. 9 - Describe the alternative approaches for recording...Ch. 9 - Explain the gross profit method of estimating...Ch. 9 - The Rider Company uses the gross profit method to...Ch. 9 - Explain the retail inventory method of estimating...Ch. 9 - Both the gross profit method and the retail...Ch. 9 - Define each of the following retail terms: initial...Ch. 9 - Explain how to estimate the average cost of...Ch. 9 - Prob. 9.10Q

Ch. 9 - Explain the LIFO retail inventory method.Ch. 9 - Discuss the treatment of freight-in, net markups,...Ch. 9 - Explain the difference between the retail...Ch. 9 - Prob. 9.14QCh. 9 - Prob. 9.15QCh. 9 - Explain the accounting treatment of material...Ch. 9 - It is discovered in 2018 that ending inventory in...Ch. 9 - Identify any differences between U.S. GAAP and...Ch. 9 - (Based on Appendix 9) Define purchase commitments....Ch. 9 - (Based on Appendix 9) Explain how purchase...Ch. 9 - Lower of cost or net realizable value LO91 Ross...Ch. 9 - Lower of cost or net realizable value LO91 SLR...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Prob. 9.5BECh. 9 - Gross profit method; solving for unknown LO92...Ch. 9 - Retail inventory method; average cost LO93 Kiddie...Ch. 9 - Retail inventory method; LIFO LO93 Refer to the...Ch. 9 - Conventional retail method LO94 Refer to the...Ch. 9 - Conventional retail method LO94 Roberson...Ch. 9 - Dollar-value LIFO retail LO95 On January 1, 2018,...Ch. 9 - Dollar-value LIFO retail LO95 This exercise is a...Ch. 9 - Change i n inventory costing methods LO96 In...Ch. 9 - Change in inventory costing methods LO96 In 2018,...Ch. 9 - Inventory error LO97 In 2018, Winslow...Ch. 9 - Inventory error LO97 Refer to the situation...Ch. 9 - Lower of cost or net realizable value LO91 Herman...Ch. 9 - Lower of cost or net realizable value LO91 The...Ch. 9 - Lower of cost or net realizable value LO91 Tatum...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Lower of cost or market LO91 [This is a variation...Ch. 9 - Prob. 9.8ECh. 9 - Prob. 9.9ECh. 9 - Prob. 9.10ECh. 9 - Gross profit method LO92 Royal Gorge Company uses...Ch. 9 - Prob. 9.12ECh. 9 - Retail inventory method; average cost LO93 San...Ch. 9 - Prob. 9.14ECh. 9 - Retail inventory method; LIFO LO93 Crosby Company...Ch. 9 - Prob. 9.16ECh. 9 - Conventional retail method; employee discounts ...Ch. 9 - Retail inventory method; solving for unknowns ...Ch. 9 - Dollar-value LIFO retail LO95 On January 1, 2018,...Ch. 9 - Prob. 9.20ECh. 9 - Dollar-value LIFO retail LO95 Lance-Hefner...Ch. 9 - Prob. 9.22ECh. 9 - Change in inventory costing methods LO96 In 2018,...Ch. 9 - Prob. 9.24ECh. 9 - Error correction; inventory error LO97 During...Ch. 9 - Prob. 9.26ECh. 9 - Inventory error LO97 In 2018, the internal...Ch. 9 - Inventory errors LO97 In 2018, the controller of...Ch. 9 - Concepts; terminology LO91 through LO97 Listed...Ch. 9 - Prob. 9.30ECh. 9 - Prob. 9.31ECh. 9 - Lower of cost or net realizable value LO91 Decker...Ch. 9 - Prob. 9.2PCh. 9 - Lower of cost or market LO91 Forester Company has...Ch. 9 - Prob. 9.4PCh. 9 - Prob. 9.5PCh. 9 - Prob. 9.6PCh. 9 - Retail inventory method; conventional and LIFO ...Ch. 9 - Prob. 9.8PCh. 9 - Prob. 9.9PCh. 9 - Dollar-value LIFO retail method LO95 [This is a...Ch. 9 - Dollar-value LIFO retail LO95 On January 1, 2018,...Ch. 9 - Retail inventory method; various applications ...Ch. 9 - Retail inventory method; various applications ...Ch. 9 - Prob. 9.14PCh. 9 - Inventory errors LO97 You have been hired as the...Ch. 9 - Inventory errors LO97 The December 31, 2018,...Ch. 9 - Integrating problem; Chapters 8 and 9; inventory...Ch. 9 - Purchase commitments Appendix In November 2018,...Ch. 9 - Judgment Case 91 Inventoriable costs; lower of...Ch. 9 - Integrating Case 93 FIFO and lower of cost or net...Ch. 9 - Prob. 9.4BYPCh. 9 - Prob. 9.5BYPCh. 9 - Prob. 9.6BYPCh. 9 - Prob. 9.7BYPCh. 9 - Real World Case 98 Various inventory issues;...Ch. 9 - Prob. 9.9BYPCh. 9 - Judgment Case 910 Inventory errors LO97 Some...Ch. 9 - Ethics Case 911 Overstatement of ending inventory ...Ch. 9 - Analysis Case 912 Purchase commitments Appendix...Ch. 9 - Continuing Cases Target Case LO93, LO94, LO95...Ch. 9 - Prob. 1CCIFRS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License