Concept explainers

Lower of cost or net realizable value

• LO9–1

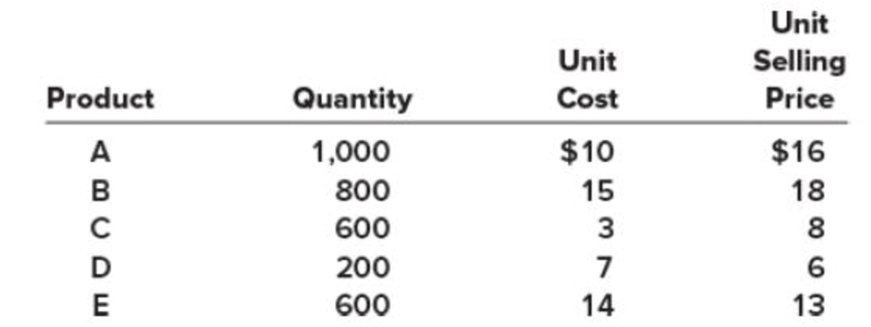

Decker Company has five products in its inventory. Information about the December 31, 2018, inventory follows.

The cost to sell for each product consists of a 15 percent sales commission.

Required:

- 1. Determine the carrying value of inventory at December 31, 2018, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products.

- 2. Determine the carrying value of inventory at December 31, 2018, assuming the LCNRV rule is applied to the entire inventory. Also, assuming inventory write-downs are usual business practice for Decker, record any necessary year-end

adjusting entry.

1.

LCM (Lower of Cost or Market) approach: It is an approach that values the inventory at historical cost or lesser than the market replacement cost. The replacement cost refers to the amount that could be realized from the sale of the inventory.

NRV (Net Realizable Value): It refers to an estimated selling price that a company expects to collect in the form of cash from the customers by the sale of inventory. The value is reduced by the expected cost of completion, disposal and transportation. Sales commission and shipping costs also included in the predictable cost.

To Calculate: The carrying value of inventory at December 31, 2018 by using the rule of LCM and NRV.

Explanation of Solution

The following table shows the carrying value of inventory at December 31, 2018 by using the rule of LCM and NRV.

| Lower of Cost or NRV | |||||

| Product | Units | Unit Cost ($) | Cost ($) | NRV ($) | Inventory value ($) |

| (A) | (B) | (A) × (B) | |||

| A | 1,000 | 10 | 10,000 | 13,600 (1) | 10,000 |

| B | 800 | 15 | 12,000 | 12,240 (2) | 12,000 |

| C | 600 | 3 | 1,800 | 4,080 (3) | 1,800 |

| D | 200 | 7 | 1,400 | 1,020 (4) | 1,020 |

| E | 600 | 14 | 8,400 | 6,630 (5) | 6,630 |

| Total | 33,600 | 37,570 | 31,450 | ||

Table (1)

Working Notes:

Calculate the amount of NRV for product A.

Calculate the amount of NRV for product B.

Calculate the amount of NRV for product C.

Calculate the amount of NRV for product D.

Calculate the amount of NRV for product E.

Therefore, the carrying value of inventory at December 31, 2018 by using the rule of LCM and NRV is $31,450.

2.

Explanation of Solution

The total aggregate inventory cost and aggregate inventory net realizable value is $33,600 and $37,570 respectively. Therefore, the carrying value of inventory at December 31, 2018, using the LCNRV rule applied for entire inventory is $33,600. There is no inventory write-downs as the LCNRV is already recorded at cost.

Want to see more full solutions like this?

Chapter 9 Solutions

Intermediate Accounting

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardgeneral accountingarrow_forwardJennifer Industries allocates overhead based on direct labor costs. Assume Jennifer expects to incur a total of $875,000 in overhead costs and $625,000 in direct labor costs. Actual overhead costs incurred totaled $890,000, and actual direct labor costs totaled $640,000. Jennifer's predetermined overhead rate is: a. 140.00% of direct labor cost. b. 128.13% of direct labor cost. c. 138.90% of direct labor cost. d. 130.95% of direct labor cost.arrow_forward

- Please provide the accurate solution to this financial accounting question using valid calculations.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning