Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781337517386

Author: WARREN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 8.2.4P

Recording payroll and payroll taxes

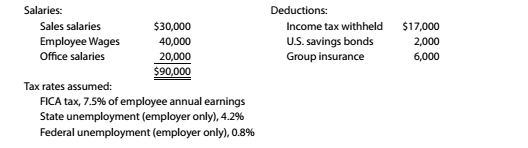

The following information about the payroll for the week ended October 4 was obtained from the records of Simkins Mining Co.:

Instructions

Illustrate the effect un (he accounts and financial statements of recording the liability for the October 4 employer payroll taxes.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

ANSWER

help me to solve this questions financial accounting

Increase it's fixed assets? Find correct option

Chapter 8 Solutions

Survey of Accounting (Accounting I)

Ch. 8 - A business issued a $5,000, 60-day, 12% note to...Ch. 8 - Which of the following taxes are employers usually...Ch. 8 - Prob. 3SEQCh. 8 - Prob. 4SEQCh. 8 - A corporation has issued 25,000 shares of $100 par...Ch. 8 - For most companies, what two types of transactions...Ch. 8 - When are short-term notes payable issued?Ch. 8 - Prob. 3CDQCh. 8 - Prob. 4CDQCh. 8 - Identify the two distinct obligations incurred by...

Ch. 8 - A corporation issues $40,000,000 of 6% bonds to...Ch. 8 - The following data relate to an $8,000,000,7% bond...Ch. 8 - When should the liability associated with a...Ch. 8 - Prob. 9CDQCh. 8 - Prob. 10CDQCh. 8 - Prob. 11CDQCh. 8 - Prob. 12CDQCh. 8 - Prob. 13CDQCh. 8 - A corporation reacquires 18,000 shares of its Own...Ch. 8 - Prob. 15CDQCh. 8 - Prob. 16CDQCh. 8 - Prob. 17CDQCh. 8 - Prob. 18CDQCh. 8 - Effect of financing on earnings per share BSF Co.....Ch. 8 - Evaluate alternative financing plans Obj. 1 Based...Ch. 8 - Current liabilities Zahn Inc. -told 16.000annual...Ch. 8 - Notes payable Obj. A business issued a 90-day. 7%...Ch. 8 - Compute payroll An employee earns $28 per hour and...Ch. 8 - Prob. 8.6ECh. 8 - Prob. 8.7ECh. 8 - Prob. 8.8ECh. 8 - Bond price CVS Caremark Corp. (CVS) 5-3% bonds due...Ch. 8 - Issuing bonds Cyber Tech Inc. produces and...Ch. 8 - Accrued product warranty Back in Time Inc....Ch. 8 - Accrued product warranty Ford Motor Company (F)...Ch. 8 - Prob. 8.13ECh. 8 - Prob. 8.14ECh. 8 - Issuing par stock On January 29. Quality Marble...Ch. 8 - Issuing stock for assets other than cash Obj.5 On...Ch. 8 - Treasury stock transactions Obj.5 Blue Moon Water...Ch. 8 - Prob. 8.18ECh. 8 - Treasury stock transactions Banff Water Inc....Ch. 8 - Cash dividends The date of declaration, date of...Ch. 8 - Prob. 8.21ECh. 8 - Effect of stock split Audrey's Restaurant...Ch. 8 - Prob. 8.23ECh. 8 - Prob. 8.24ECh. 8 - Prob. 8.1.1PCh. 8 - Prob. 8.1.2PCh. 8 - Prob. 8.1.3PCh. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Bond premium; bonds payable transactions Beaufort...Ch. 8 - Prob. 8.3.2PCh. 8 - Bond premium; bonds payable transactions Beaufort...Ch. 8 - Prob. 8.3.4PCh. 8 - Stock transactions for corporate expansion Vaga...Ch. 8 - Dividends on preferred and common stock Yukon Bike...Ch. 8 - Dividends on preferred and common stock Yukon Bike...Ch. 8 - Prob. 8.5.3PCh. 8 - Prob. 8.1.1MBACh. 8 - Prob. 8.1.2MBACh. 8 - Prob. 8.2.1MBACh. 8 - Prob. 8.2.2MBACh. 8 - Prob. 8.2.3MBACh. 8 - Prob. 8.3.1MBACh. 8 - Prob. 8.3.2MBACh. 8 - Prob. 8.3.3MBACh. 8 - Prob. 8.4MBACh. 8 - Prob. 8.5.1MBACh. 8 - Prob. 8.5.2MBACh. 8 - Prob. 8.6.1MBACh. 8 - Prob. 8.6.2MBACh. 8 - Prob. 8.6.3MBACh. 8 - Stock split Using the data from E8-22. indicate...Ch. 8 - Prob. 8.8.1MBACh. 8 - Prob. 8.8.2MBACh. 8 - Prob. 8.8.3MBACh. 8 - Prob. 8.8.4MBACh. 8 - Prob. 8.8.5MBACh. 8 - Prob. 8.8.6MBACh. 8 - Prob. 8.8.7MBACh. 8 - Prob. 8.8.8MBACh. 8 - Prob. 8.9.1MBACh. 8 - Prob. 8.9.2MBACh. 8 - Prob. 8.9.3MBACh. 8 - Prob. 8.9.4MBACh. 8 - Prob. 8.9.5MBACh. 8 - Prob. 8.9.6MBACh. 8 - Debt and price-earnings ratios Lowe's Companies...Ch. 8 - Prob. 8.10.1MBACh. 8 - Prob. 8.10.2MBACh. 8 - Prob. 8.10.3MBACh. 8 - Prob. 8.10.4MBACh. 8 - Prob. 8.10.5MBACh. 8 - Debt and price-earnings ratios Alphabet (formerly...Ch. 8 - Prob. 8.10.7MBACh. 8 - Prob. 8.10.8MBACh. 8 - Prob. 8.11MBACh. 8 - Prob. 8.1.1CCh. 8 - Prob. 8.1.2CCh. 8 - Prob. 8.2.1CCh. 8 - Prob. 8.2.2CCh. 8 - Prob. 8.3.1CCh. 8 - Issuing stock Sahara Unlimited Inc. began...Ch. 8 - Prob. 8.4CCh. 8 - Prob. 8.5.1CCh. 8 - Financing business expansion You hold a 30% common...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

How JOURNAL ENTRIES Work (in Accounting); Author: Accounting Stuff;https://www.youtube.com/watch?v=Y-_Q3rANyxU;License: Standard Youtube License