Concept explainers

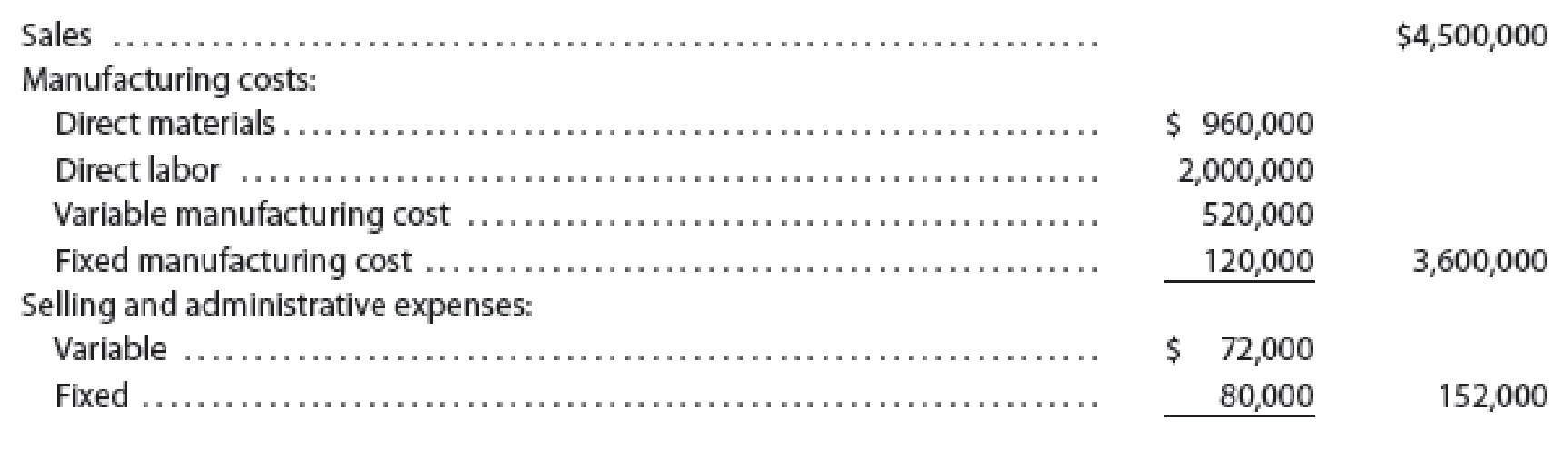

During the first month of operations ended May 31, Big Sky Creations Company produced 40,000 designer cowboy boots, of which 36,000 were sold. Operating data for the month are summarized as follows:

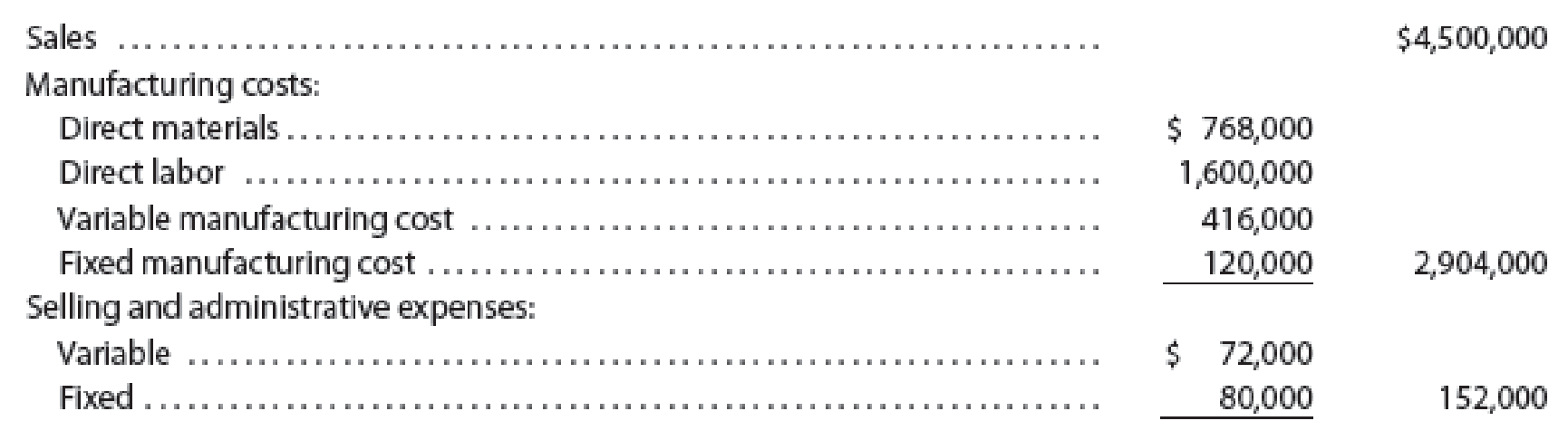

During June, Big Sky Creations produced 32,000 designer cowboy boots and sold 36,000 cowboy boots. Operating data for June are summarized as follows:

Instructions

1. Using the absorption costing concept, prepare income statements for (a) May and (b) June.

2. Using the variable costing concept, prepare income statements for (a) May and (b) June.

3. a. Explain the reason for the differences in operating income in (1) and (2) for May.

b. Explain the reason for the differences in operating income in (1) and (2) for June.

4. Based on your answers to (1) and (2), did Big Sky Creations Company operate more profitably in May or in June? Explain.

1.

Prepare an income statement according to the absorption costing concept for (a) May and (b) June.

Explanation of Solution

Absorption Costing

Absorption costing is compulsory under Generally Accepted Accounting Principles (GAAP) for financial statements circulated to the external users. Under absorption costing, the cost of goods manufactured includes direct materials, direct labor, and factory overhead costs. Fixed factory overhead and variable factory overhead are included as part of factory overhead.

(a)

Prepare an income statement according to the absorption costing concept for May.

| Company BSC | ||

| Absorption costing income statement | ||

| For the month ending May, 31 | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 4,500,000 | |

| Less: Cost of goods sold | ||

| Cost of goods manufactured | 3,600,000 | |

| Inventory on May, 31 (1) | (360,000) | |

| Total cost of goods sold | (3,240,000) | |

| Gross profit | 1,260,000 | |

| Less: Selling and administrative expenses | (152,000) | |

| Operating income | 1,108,000 | |

Table (1)

Working note (1):

Calculate the value of ending inventory, May 31.

(b)

Prepare an income statement according to the absorption costing concept for June.

| Company BSC | ||

| Absorption costing income statement | ||

| For the month ending June, 30 | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 4,500,000 | |

| Less: Cost of goods sold | ||

| Cost of goods manufactured | 2,904,000 | |

| Inventory on May, 31 (1) | 360,000 | |

| Total cost of goods sold | 3,264,000 | |

| Gross profit | 1,236,000 | |

| Less: Selling and administrative expenses | 152,000 | |

| Operating income | 1,084,000 | |

Table (2)

2.

Prepare an income statement according to the variable costing concept for (a) May and (b) June.

Explanation of Solution

Variable Costing

Managers frequently use variable costing for internal purposes for taking decision making. The cost of goods manufactured includes direct materials, direct labor, and variable factory overhead. Fixed factory overhead is treated as period (fixed) expense.

(a)

Prepare an income statement according to the variable costing concept for May.

| Company BSC | ||

| Variable costing income statement | ||

| For the month ending May, 31 | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 4,500,000 | |

| Less: Variable cost of goods sold | ||

| Variable cost of goods manufactured | 3,480,000 | |

| Inventory, May 31 (2) | (348,000) | |

| Total variable cost of goods sold | (3,132,000) | |

| Manufacturing margin | 1,368,000 | |

| Less: Variable selling and administrative expenses | (72,000) | |

| Contribution margin | 1,296,000 | |

| Less: Fixed costs | ||

| Fixed manufacturing costs | 120,000 | |

| Fixed selling and administrative expenses | 80,000 | |

| Total fixed cost | (200,000) | |

| Operating income | 1,096,000 | |

Table (3)

Working note (2):

Calculate the value of ending inventory, May 31.

(b)

Prepare an income statement according to the variable costing concept for June.

| Company BSC | ||

| Variable costing income statement | ||

| For the month ending June, 30 | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 4,500,000 | |

| Less: Variable cost of goods sold | ||

| Variable cost of goods manufactured | 2,784,000 | |

| Inventory on June 1 (1) | 348,000 | |

| Total variable cost of goods sold | 3,132,000 | |

| Manufacturing margin | 1,368,000 | |

| Less: Variable selling and administrative expenses | (72,000) | |

| Contribution margin | 1,296,000 | |

| Less: Fixed costs | ||

| Fixed manufacturing costs | 120,000 | |

| Fixed selling and administrative expenses | 80,000 | |

| Total fixed cost | (200,000) | |

| Operating income | 1,096,000 | |

Table (4)

3 (a)

Identify the reason for the difference between the amount of operating income reported in (1) and (2) for the month of May.

Explanation of Solution

The difference between the absorption and variable costing operating income of $12,000

Increase in inventory = 4,000 units

Fixed factory overhead per unit = $3

The operating income reported for the month of May under absorption costing exceeds the variable costing by $12,000. This difference exists under absorption costing, because $12,000 of fixed manufacturing costs is included in ending inventory of May under absorption costing, while entire fixed manufacturing costs is expensed in the month of May itself under variable costing.

3 (b)

Identify the reason for the difference between the amount of operating income reported in (1) and (2) for the month of June.

Explanation of Solution

The difference between the absorption and variable costing income from operations of $12,000

The operating income reported for the month of June under absorption costing is less than variable costing by $12,000. This difference exists under absorption costing, because $12,000 of fixed manufacturing costs is included in beginning inventory of June under absorption costing, while entire fixed manufacturing costs is expensed in the month of May itself under variable costing.

4.

Identify the month in which Company BSC operates more profitability, based on findings from (1) and (2).

Explanation of Solution

Based on variable costing concept, Company BSC was equally profitable in May and June. Sales and variable cost per unit were the same for both the month and under both concept. Only difference is allocation of $12,000 of fixed manufacturing cost to May 31 ending inventory under absorption costing.

Want to see more full solutions like this?

Chapter 7 Solutions

Managerial Accounting

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you solve this financial accounting question with accurate accounting calculations?arrow_forwardPlease explain the correct approach for solving this financial accounting question.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning