Concept explainers

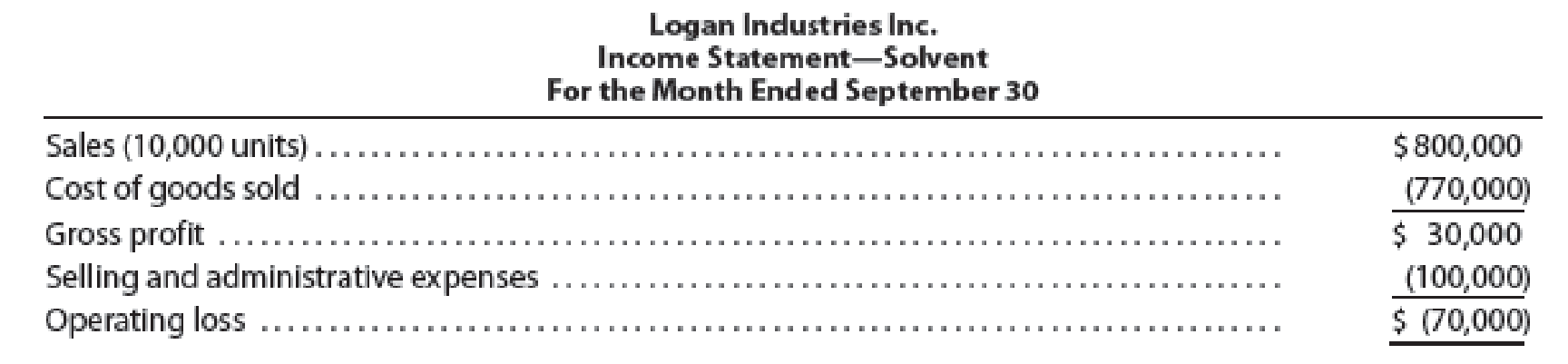

The demand for solvent, one of numerous products manufactured by Logan Industries Inc., has dropped sharply because of recent competition from a similar product. The company’s chemists are currently completing tests of various new formulas, and it is anticipated that the manufacture of a superior product can be started on November 1, one month in the future. No changes will be needed in the present production facilities to manufacture the new product because only the mixture of the various materials will be changed.

The controller has been asked by the president of the company for advice on whether to continue production during October or to suspend the manufacture of solvent until November 1. The following data have been assembled:

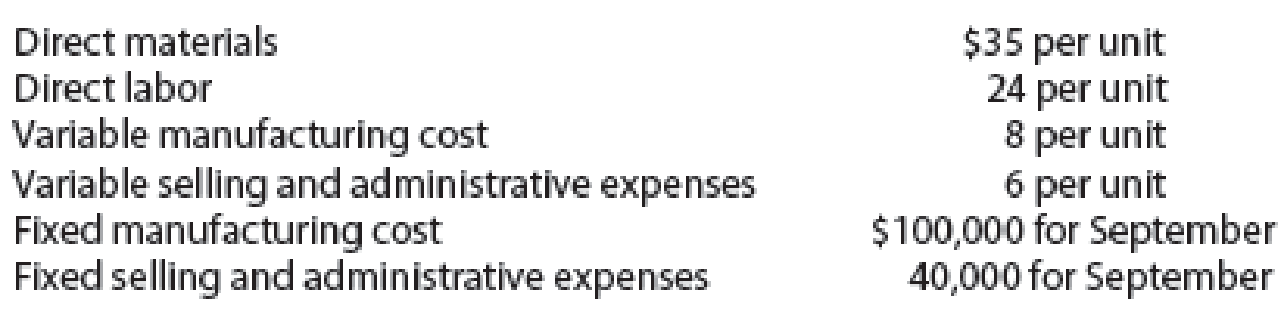

The production costs and selling and administrative expenses, based on production of 10,000 units in September, are as follows:

Sales for October are expected to drop about 40% below those of September. No significant changes are anticipated in the fixed costs or variable costs per unit. No extra costs will be incurred in discontinuing operations in the portion of the plant associated with solvent. The inventory of solvent at the beginning and end of October is not expected to be significant (material).

Instructions

- 1. Prepare an estimated income statement in absorption costing form for October for solvent, assuming that production continues during the month.

- 2. Prepare an estimated income statement in variable costing form for October for solvent, assuming that production continues during the month.

- 3. What would be the estimated operating loss if the solvent production were temporarily suspended for October?

- 4. What advice should you give to management?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Managerial Accounting

- Which inventory method results in higher cost of goods sold when prices are rising?A. FIFOB. LIFOC. Weighted AverageD. Specific Identificationcorrect aarrow_forwardWhich inventory method results in higher cost of goods sold when prices are rising?A. FIFOB. LIFOC. Weighted AverageD. Specific Identification needarrow_forwardWhich inventory method results in higher cost of goods sold when prices are rising?A. FIFOB. LIFOC. Weighted AverageD. Specific Identificationarrow_forward

- no aiI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful. need help but clear amswerarrow_forwardThe income summary account is used:A. To record net cash flowB. Only by service businessesC. During the closing processD. To adjust retained earnings directlyneedarrow_forwardNo AI The income summary account is used:A. To record net cash flowB. Only by service businessesC. During the closing processD. To adjust retained earnings directlyarrow_forward

- Please provide the correct answer with financial accounting questionarrow_forwardHi expert please given correct answer with accounting questionarrow_forwardThe income summary account is used:A. To record net cash flowB. Only by service businessesC. During the closing processD. To adjust retained earnings directlyarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning