Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 12E

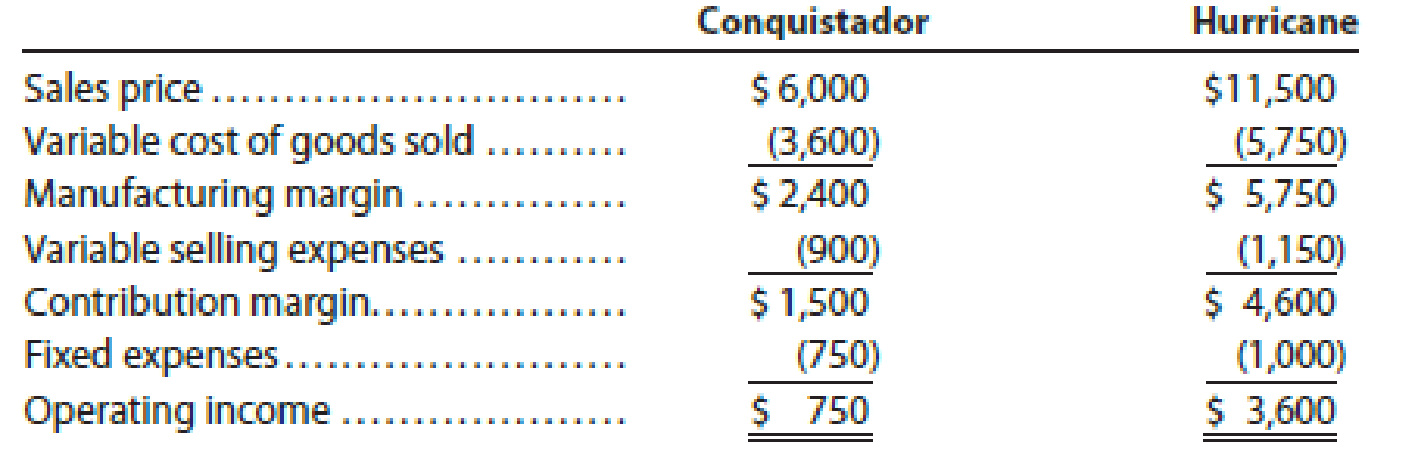

Galaxy Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products:

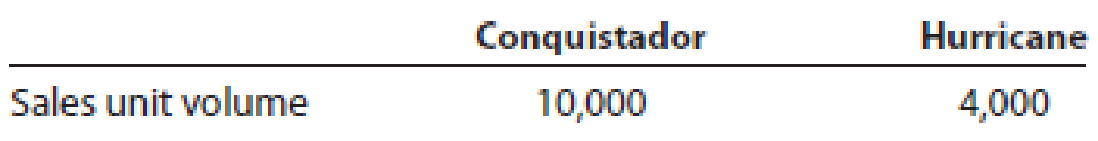

In addition, the following sales unit volume information for the period is as follows:

- a. Prepare a contribution margin by product report. Compute the contribution margin ratio for each.

- b. What advice would you give to the management of Galaxy Sports Inc. regarding the profitability of the two products?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

No AI Answer

What is the labor efficiency variance for May ?

At what point do complex accounting policies become counterproductive to their intended purpose of clear financial reporting? Evaluate the balance between comprehensive documentation and practical usability in accounting systems. Is there a way to maintain thorough records without overwhelming users with excessive detail? What role should simplification play in modern accounting practices?

Chapter 7 Solutions

Managerial Accounting

Ch. 7 - What types of costs are customarily included in...Ch. 7 - Which type of manufacturing cost (direct...Ch. 7 - Which of the following costs would be included in...Ch. 7 - In the variable costing income statement, how are...Ch. 7 - Prob. 5DQCh. 7 - Prob. 6DQCh. 7 - Discuss how financial data prepared on the basis...Ch. 7 - Prob. 8DQCh. 7 - Explain why rewarding sales personnel on the basis...Ch. 7 - Explain why service companies use different...

Ch. 7 - Variable costing Marley Company has the following...Ch. 7 - Prob. 2BECh. 7 - Variable costingsales exceed production The...Ch. 7 - Prob. 4BECh. 7 - Contribution margin by segment The following...Ch. 7 - At the end of the first year of operations, 21,500...Ch. 7 - Gallatin County Motors Inc. assembles and sells...Ch. 7 - Fresno Industries Inc. manufactures and sells...Ch. 7 - On March 31, the end of the first month of...Ch. 7 - On April 30, the end of the first month of...Ch. 7 - On October 31, the end of the first month of...Ch. 7 - The following data were adapted from a recent...Ch. 7 - Estimated income statements, using absorption and...Ch. 7 - The following data were adapted from a recent...Ch. 7 - Prob. 10ECh. 7 - Explain why service companies use different...Ch. 7 - Galaxy Sports Inc. manufactures and sells two...Ch. 7 - Prob. 13ECh. 7 - Sales territory and salesperson profitability...Ch. 7 - Prob. 15ECh. 7 - Prob. 16ECh. 7 - Variable costing income statement for a service...Ch. 7 - Variable costing income statement for a service...Ch. 7 - Prob. 1PACh. 7 - The demand for solvent, one of numerous products...Ch. 7 - During the first month of operations ended May 31,...Ch. 7 - Salespersons report and analysis Walthman...Ch. 7 - Segment variable costing income statement and...Ch. 7 - Absorption and variable costing income statements...Ch. 7 - Income statements under absorption costing and...Ch. 7 - Absorption and variable costing income statements...Ch. 7 - Prob. 4PBCh. 7 - Variable costing income statement and effect on...Ch. 7 - Prob. 1MADCh. 7 - Prob. 2MADCh. 7 - Prob. 3MADCh. 7 - Segment disclosure by Apple Inc. (AAPL) provides...Ch. 7 - Prob. 1TIFCh. 7 - Inventory effects under absorption costing BendOR,...Ch. 7 - Communication Bon Jager Inc. manufactures and...Ch. 7 - Prob. 1CMACh. 7 - Chassen Company, a cracker and cookie...Ch. 7 - Prob. 3CMACh. 7 - Bethany Company has just completed the first month...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine other comprehensive income for 2018arrow_forwardIf the fixed manufacturing overhead volume variance for April was $9,000 unfavorable, then the total Budgeted fixed manufacturing overhead cost for the month was$__.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

- Tartt Enterprises has inventory days of 48, accounts receivable days of 32, and accounts payable days of 27. What is its cash conversion cycle? A.) 40 days B.) 53 days C.) 65 days D.) 80 daysarrow_forwardI am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is Transfer Pricing for Small Businesses?; Author: Nomad Capitalist;https://www.youtube.com/watch?v=_Q6nN3s1Xjs;License: Standard Youtube License