Sales territory and salesperson profitability analysis

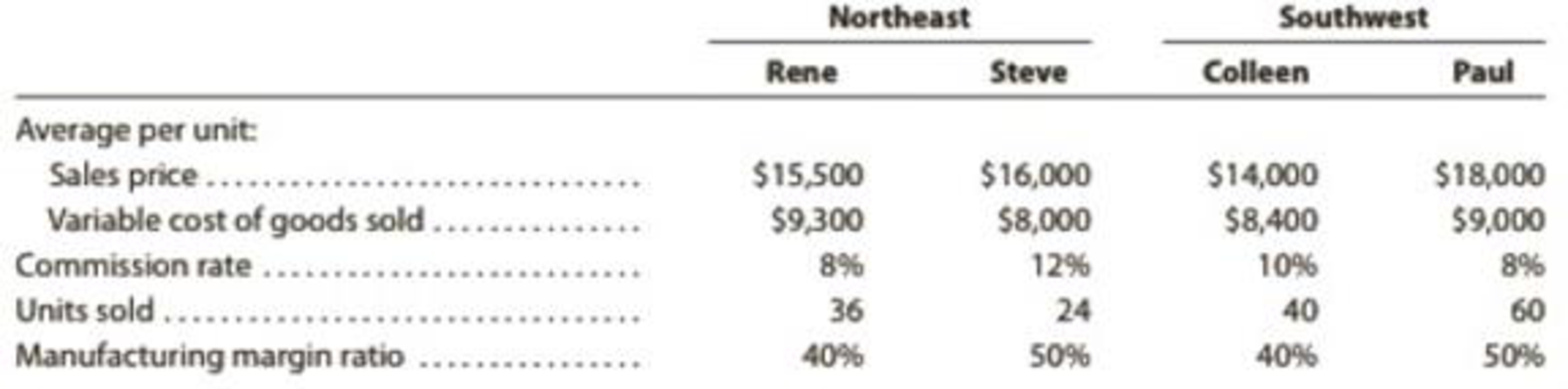

Havasu Off-Road Inc. manufactures and sells a variety of commercial vehicles in the Northeast and Southwest regions. There are two salespersons assigned to each territory. Higher commission rates go to the most experienced salespersons. The following sales statistics are available for each salesperson:

- a. 1. Prepare a contribution margin by salesperson report. Compute the contribution margin ratio for each salesperson.

2. Interpret the report.

- b. 1. Prepare a contribution margin by territory report. Compute the contribution margin for each territory as a percent, rounded to one decimal place.

2. Interpret the report.

A.1.

Calculate the contribution margin ratio for each salesperson.

Explanation of Solution

Variable Costing

Managers frequently use variable costing for internal purposes for taking decision making. The cost of goods manufactured includes direct materials, direct labor, and variable factory overhead. Fixed factory overhead treated as period (fixed) expense.

Contribution Margin

Contribution margin is the excess of manufacturing margin above selling and administrative expenses. Contribution margin is calculated by deducting the variable cost from sales or deducting variable selling and administrative expenses from manufacturing margin.

The contribution margin ratio for each salesperson is as follows:

Rene

| HO Incorporation | |

| Contribution margin by salesperson (Northeast) | |

| Particulars | Rene ($) |

| Sales | 558,000 |

| Less: Variable cost | 334,800 |

| Manufacturing margin | 223,200 |

| Less: Variable selling expense | 44,640 |

| Contribution margin (B) | 178,560 |

| Contribution margin ratio | 32.00% |

Table (1)

Steve

| HO Incorporation | |

| Contribution margin by salesperson (Northeast) | |

| Particulars | Steve($) |

| Sales | 384,000 |

| Less: Variable cost | 192,000 |

| Manufacturing margin | 192,000 |

| Less: Variable selling expense | 46,080 |

| Contribution margin (B) | 145,920 |

| Contribution margin ratio | 38.00% |

Table (2)

Colleen

| HO Incorporation | |

| Contribution margin by salesperson (Southwest) | |

| Particulars | Colleen($) |

| Sales | 560,000 |

| Less: Variable cost | 336,000 |

| Manufacturing margin | 224,000 |

| Less: Variable selling expense | 56,000 |

| Contribution margin (B) | 168,000 |

| Contribution margin ratio | 30.00% |

Table (3)

Paul

| HO Incorporation | |

| Contribution margin by salesperson (Southwest) | |

| Particulars | Paul($) |

| Sales | 1,080,000 |

| Less: Variable cost | 540,000 |

| Manufacturing margin | 540,000 |

| Less: Variable selling expense | 86,400 |

| Contribution margin (B) | 453,600 |

| Contribution margin ratio | 42.00% |

Table (4)

Therefore, contribution margin of Rene is $178,560, Steve is $145,920, Colleen is $168,000, and Paul is $453,600. Contribution margin ratio of Rene is 32%, Steve is 38%, Colleen is 30%, and Paul is 42%.

A.2.

Interpret the profitability report of the salesperson.

Explanation of Solution

Contribution margin and contribution margin ratio of salesperson Paul is higher than the other three salespeople because he sells the more units than others, has a low commission rate, and product mix with high manufacturing margin ratio. Salesperson Rene has a second-highest total contribution margin of $178,560, and Steve has second highest contribution margin ratio of 38%.

B.1.

Calculate the contribution margin ratio for each territory.

Explanation of Solution

The contribution margin ratio for each territory is as follows:

Northeast

| HO Incorporation | |

| Contribution margin by territory | |

| Particulars | Northeast |

| Sales | 942,000 |

| Less: Variable cost | 526,800 |

| Manufacturing margin | 415,200 |

| Less: Variable selling expense | 90,720 |

| Contribution margin (B) | 324,480 |

| Contribution margin ratio | 34.45% |

Table (5)

Southwest

| HO Incorporation | |

| Contribution margin by territory | |

| Particulars | Southwest |

| Sales | 1,640,000 |

| Less: Variable cost | 876,000 |

| Manufacturing margin | 764,000 |

| Less: Variable selling expense | 142,400 |

| Contribution margin (B) | 621,600 |

| Contribution margin ratio | 37.90% |

Table (6)

B. 2.

State the advice regarding the relative profitability of two territories.

Explanation of Solution

The southwest region contribution margin and contribution margin ratio are higher than the northeast region because the southwest region has $698,000 more sales and $297,120 more contribution margin. In addition, the salesperson in the southwest region has the highest unit sold, highest sales price and lowest commission margin. In the northeast region, salespersons are performed very poor than others, and they are trying to improve their sales performance.

Want to see more full solutions like this?

Chapter 7 Solutions

Managerial Accounting

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forward

- Can you explain the correct approach to solve this general accounting question?arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning