In Problems 39-47, construct a mathematical model in the form of a linear programming problem. Do not solve.

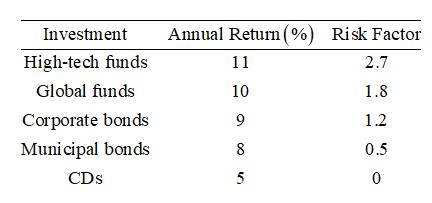

Investment strategy. An investor is planning to divide her investments among high-tech mutual funds, global mutual funds, corporate bonds, municipal bonds, and CDs. Each of these investments has an estimated annual return and a risk factor (see the table). The risk level for each choice is the product of its risk factor and the percentage of the total funds invested in that choice. The total risk level is the sum of the risk levels for all the investments. The investor wants at least

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

FINITE MATHMATICS F/ BUSI...-ACCESS

Additional Math Textbook Solutions

Elementary Statistics (13th Edition)

Thinking Mathematically (6th Edition)

Basic Business Statistics, Student Value Edition

Elementary Statistics

Pre-Algebra Student Edition

- The entire graph of the function g is shown in the figure below. Write the domain and range of g as intervals or unions of intervals. 5 4 -3. 2 3 omain = range ☐ =arrow_forwardAsked this question and got a wrong answer previously: Third, show that v3 = (−√3, −3, 3)⊤ is an eigenvector of M3 . Also here find the correspondingeigenvalue λ3 . Just from looking at M3 and its components, can you say something about the remaining twoeigenvalues? If so, what would you say?arrow_forward3. Consider the sequences of functions f₁: [-π, π] → R, sin(n²x) An(2) n f pointwise as (i) Find a function ƒ : [-T,π] → R such that fn n∞. Further, show that fn →f uniformly on [-π,π] as n → ∞. [20 Marks] (ii) Does the sequence of derivatives f(x) has a pointwise limit on [-7, 7]? Justify your answer. [10 Marks]arrow_forward

- Can you prove this integral equation?Note: It also has an application to prove that 22/7 > π.arrow_forward2. An experiment is set up to test the effectiveness of a new drug for balancing people's mood. The table below contains the results of the patients before and after taking the drug. The possible scores are the integers from 0 to 10, where 0 indicates a depressed mood and 10 indicates and elated mood. Patient Before After 1 4 4 2 3 3 3 6 4 4 1 2 5 6 5 6 1 3 7 4 7 8 6 9 1 4 10 5 4 Assuming the differences of the observations to be symmetric, but not normally distributed, investigate the effectiveness of the drug at the 5% significance level. [4 Marks]arrow_forward1. The number of claims is modelled by a NB2(n, p) (the number of fail- ures before the nth success with probability p of success). The sample x = (x1, x2,,XN) with N = 100 returns N N xj = 754, Σε = 70425. j=1 Estimate the parameters n and p using the point estimates. [5 Marks]arrow_forward

- 93 Y y = f(x) 00 Xarrow_forward3. (i) Consider the following R code: wilcox.test(UK Supermarkets $Salary ~ UKSupermarkets $Supermarket) (a) Which test is being used in this code? (b) What is the name of the dataset under consideration? How would be adapt this code if we had ties? What other command can be used which deals with ties? (ii) Consider the following R code: install packages("nortest") library(nortest) lillie.test (Differences) (a) Assuming the appropriate dataset has been imported and attached, what is wrong with this code? (b) If this code were to be corrected, what would be determined by run- ning it? [3 Marks]arrow_forward1. (i) Give the definition of a metric on a set X. [5 Marks] (ii) Let X = {a, b, c} and let a function d : XxX → [0, ∞) be defined as d(a, a) = d(b,b) = d(c, c) 0, d(a, c) = d(c, a) 1, d(a, b) = d(b, a) = 4, d(b, c) = d(c,b) = 2. Decide whether d is a metric on X. Justify your answer. = (iii) Consider a metric space (R, d.), where = [10 Marks] 0 if x = y, d* (x, y) 5 if xy. In the metric space (R, d*), describe: (a) open ball B2(0) of radius 2 centred at 0; (b) closed ball B5(0) of radius 5 centred at 0; (c) sphere S10 (0) of radius 10 centred at 0. [5 Marks] [5 Marks] [5 Marks]arrow_forward

- (c) sphere S10 (0) of radius 10 centred at 0. [5 Marks] 2. Let C([a, b]) be the metric space of continuous functions on the interval [a, b] with the metric doo (f,g) = max f(x)g(x)|. xЄ[a,b] = 1x. Find: Let f(x) = 1 - x² and g(x): (i) do(f, g) in C'([0, 1]); (ii) do(f,g) in C([−1, 1]). [20 Marks] [20 Marks]arrow_forward1. (i) Explain the difference in application between the Mann-Whitney U test and the Wilcoxon Signed-Rank test, i.e. in which scenarios would each test be used? (ii) What is the main procedure underlying these nonparametric tests? [3 Marks]arrow_forwardf(x) = x + 1; x(x) = x − 2. Solve the equation for x : |f(x)+4(x)| = |f(x)|+|4(x)|. 00arrow_forward

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning