Concept explainers

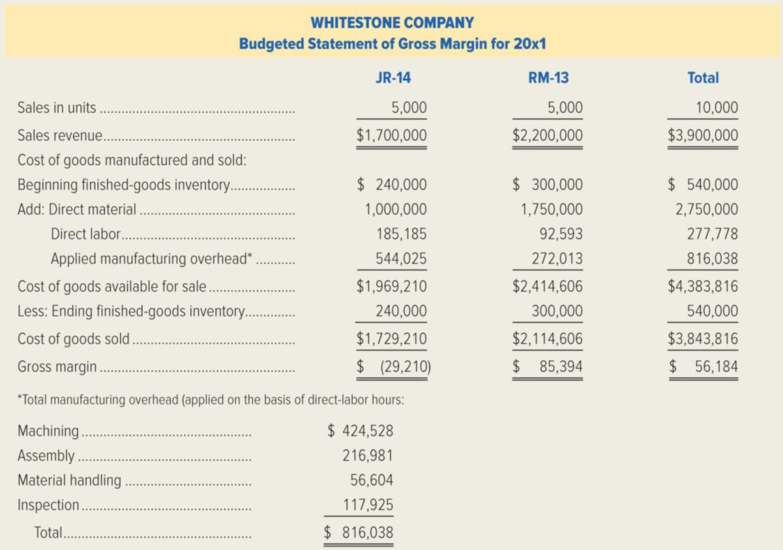

Whitestone Company produces two subassemblies, JR-14 and RM-13, used in manufacturing trucks. The company is currently using an absorption costing system that applies

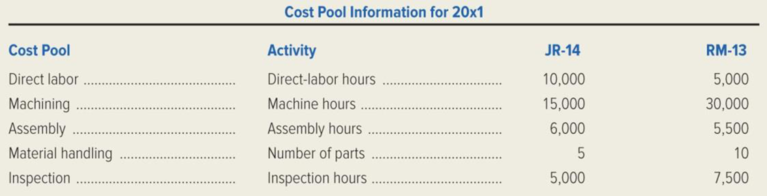

Mark Ward, Whitestone’s president, has been reading about a product-costing method called activity-based costing. Ward is convinced that activity-based costing will cast a new light on future profits. As a result, Brian Walters, Whitestone’s director of cost management, has accumulated cost pool information for this year shown on the following chart. This information is based on a product mix of 5,000 units of JR-14 and 5,000 units of RM-13.

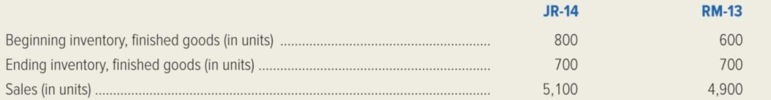

In addition, the following information is projected for the next calendar year, 20x2.

On January 1, 20x2, Whitestone is planning to increase the prices of JR-14 to $355 and RM-13 to $455. Material costs are not expected to increase in 20x2, but direct labor will increase by 8 percent, and all

Whitestone uses a just-in-time inventory system and has materials delivered to the production facility directly from the vendors. The raw-material inventory at both the beginning and the end of the month is immaterial and can be ignored for the purposes of a

Required:

- 1. Explain how activity-based costing differs from traditional product-costing methods.

- 2. Using activity-based costing, calculate the total cost for the following activity cost pools: machining, assembly, material handling, and inspection. (Round to the nearest dollar.) Then, calculate the pool rate per unit of the appropriate cost driver for each of the four activities. (Hint: Refer to Exhibit 5–6, regarding calculation of the pool rate.)

- 3. Prepare a table showing for each product line the estimated 20x2 cost for each of the following cost elements: direct material, direct labor, machining, assembly, material handling, and inspection. (Round to the nearest dollar.)

- 4. Prepare a budgeted statement showing the gross margin for Whitestone Company for 20x2, using activity-based costing. The statement should show each product and a total for the company. Be sure to include detailed calculations for the cost of goods manufactured and sold. (Round each amount in the statement to the nearest dollar.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Poonam's material quantity variance is favorable or unfavorablearrow_forward??arrow_forwardPoonam has a standard of 1.5 pounds of materials per unit, at S6 per pound. In producing 2,000 units, Poonam used 3,100 pounds of materials at a total cost of $18,135. Poonam's material quantity variance is favorable or unfavorable?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning