World Gourmet Coffee Company (WGCC) is a distributor and processor of different blends of coffee. The company buys coffee beans from around the world and roasts, blends, and packages them for resale. WGCC currently has 15 different coffees that it offers to gourmet shops in one-pound bags. The major cost is raw materials; however, there is a substantial amount of manufacturing

Some of the coffees are very popular and sell in large volumes, while a few of the newer blends have very low volumes. WGCC prices its coffee at full product cost, including allocated overhead, plus a markup of 30 percent. If prices for certain coffees are significantly higher than market, adjustments are made. The company competes primarily on the quality of its products, but customers are price-conscious as well.

Data for the 20x1 budget include manufacturing overhead of $3,000,000, which has been allocated on the basis of each product’s direct-labor cost. The budgeted direct-labor cost for 20x1 totals $600,000. Based on the sales budget and raw-material budget, purchases and use of raw materials (mostly coffee beans) will total $6,000,000.

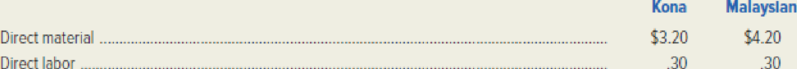

The expected prime costs for one-pound bags of two of the company’s products are as follows:

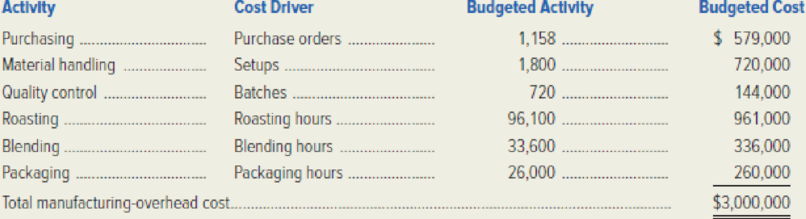

WGCC’s controller believes the traditional product-costing system may be providing misleading cost information. She has developed an analysis of the 20x1 budgeted

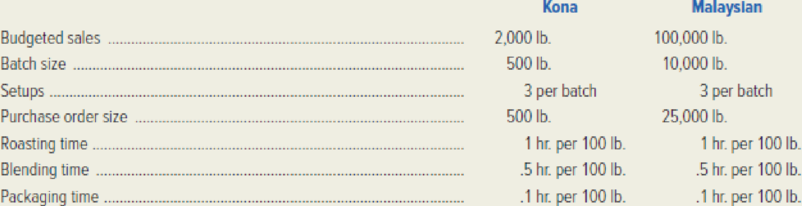

Data regarding the 20x1 production of Kona and Malaysian coffee are shown in the following table. There will be no raw-material inventory for either of these coffees at the beginning of the year.

Required:

- 1. Using WGCC’s current product-costing system:

- a. Determine the company’s predetermined overhead rate using direct-labor cost as the single cost driver.

- b. Determine the full product costs and selling prices of one pound of Kona coffee and one pound of Malaysian coffee.

- 2. Develop a new product cost, using an activity-based costing approach, for one pound of Kona coffee and one pound of Malaysian coffee.

- 3. What are the implications of the activity-based costing system with respect to

- a. The use of direct labor as a basis for applying overhead to products?

- b. The use of the existing product-costing system as the basis for pricing?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Compute the relationship of net income to net salesarrow_forwardZanzibar Limited entered into a lease agreement on July 1 2016 to lease somehighly customized hydraulic equipment to Kaizen Limited. The fair value of theequipment as at that date was $ 700,000. The terms of the lease agreement were: Note: the lease is cancellable but only with Zanzibar’s permission At the end of the lease term, the equipment is to be returned to Zanzibar Limited.On July 1, 2016, Zanzibar incurred $12,000 in legal fees for setting up the lease. Theannual rental payment includes $10, 000 to reimburse the lessor for maintenancefees incurred on behalf of the lessee. Requirements:a) Discuss the nature of the lease using the appropriate criteria. Justify youranswer using calculations where applicable b) Prepare the lease schedule for the Kaizen Limited c) Prepare Kaizen’s journal entries for 2016 & 2017 d) If the lease agreement could be cancelled at any time without penalty.Wouldyour answer in parts a & b change? If yes, explain how and why.arrow_forwardSuppose Chrysler Motors has 720 million shares outstanding with a share price of $68.25, and $30 billion in debt. If in three years, Chrysler has 750 million shares outstanding trading for $76 per share, how much debt will Chrysler have if it maintains a constant debt-equity ratio? Correct Answerarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning