Concept explainers

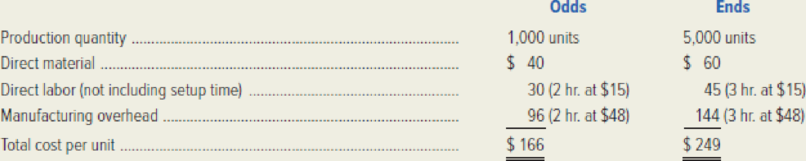

Knickknack, Inc. manufactures two products: Odds and Ends. The firm uses a single, plantwide

Calculation of predetermined overhead rate:

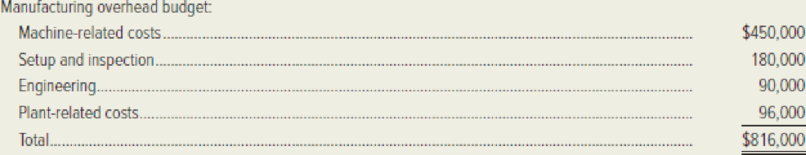

Manufacturing overhead budget:

Predetermined overhead rate:

Knickknack, Inc. prices its products at 120 percent of cost, which yields target prices of $199.20 for Odds and $298.80 for Ends. Recently, however, Knickknack has been challenged in the market for Ends by a European competitor, Bricabrac Corporation. A new entrant in this market, Bricabrac has been selling Ends for $220 each. Knickknack’s president is puzzled by Bricabrac’s ability to sell Ends at such a low cost. She has asked you (the controller) to look into the matter. You have decided that Knickknack’s traditional, volume-based product-costing system may be causing cost distortion between the firm’s two products. Ends are a high-volume, relatively simple product. Odds, on the other hand, are quite complex and exhibit a much lower volume. As a result, you have begun work on an activity-based costing system.

Required:

- 1. Let each of the overhead categories in the budget represent an activity cost pool. Categorize each in terms of the type of activity (e.g., unit-level activity).

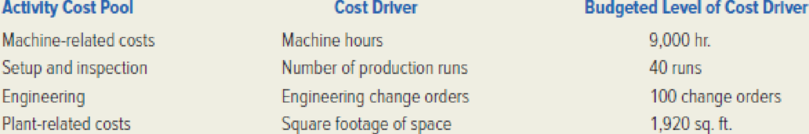

- 2. The following cost drivers have been identified for the four activity cost pools.

You have gathered the following additional information:

- Each Odd requires 4 machine hours, whereas each End requires 1 machine hour.

- Odds are manufactured in production runs of 50 units each. Ends are manufactured in 250-unit batches.

- Three-quarters of the engineering activity, as measured in terms of change orders, is related to Odds.

- The plant has 1,920 square feet of space, 80 percent of which is used in the production of Odds.

For each activity cost pool, compute a pool rate. (Hint: Regarding the pool rate refer to Exhibit 5–6.)

- 3. Determine the unit cost, for each activity cost pool, for Odds and Ends.

- 4. Compute the new product cost per unit for Odds and Ends, using the ABC system.

- 5. Using the same pricing policy as in the past, compute prices for Odds and Ends. Use the product costs determined by the ABC system.

- 6. Show that the ABC system fully assigns the total budgeted

manufacturing overhead costs of $816,000. - 7. Show how Knickknack’s traditional, volume-based costing system distorted its product costs. (Refer to Exhibit 5–10 for guidance.)

1.

Categorize each in terms of the type of activity.

Explanation of Solution

Activity-based costing: It is a method that helps in finding the activities performed by a company and it tracks the indirect costs to the activities of the company that consumes resources.

Categorize each in terms of the type of activity are shown below:

| Activity Cost Pool | Type of Activity |

| I: Machine related costs | Unit-level |

| II: Setup and inspection | Batch- level |

| III: Engineering | Product-sustaining-level |

| IV: Plant-related costs | Facility-level |

Table (1)

2.

Calculate pool rate of each activity cost pool.

Explanation of Solution

| Activity Cost Pool | Cost (A) | Cost drivers (B) | Pool rate (A ÷ B) |

| I: Machine related costs | $450,000 | 9,000 machine hours | $50 per machine hour |

| II: Setup and inspection | $180,000 | 40 runs | $4,500 per run |

| III: Engineering | $90,000 | 100 change orders | $900 per change order |

| IV: Plant-related costs | $96,000 | 1,920 square feet | $50 square feet |

Table (2)

3.

Calculate unit cost for each activity cost pool for odds and ends.

Explanation of Solution

Calculate unit cost for machine related costs for odds.

Calculate unit cost for machine related costs for ends.

Calculate unit cost for setup and inspection costs for odds.

Calculate unit cost for setup and inspection cost for ends.

Calculate unit cost for engineering for odds.

Calculate unit cost for engineering for ends.

Calculate unit cost for plant related costs of Odds.

Calculate unit cost for plant related cost of ends.

4.

Calculate the new product cost per unit for odds and ends using activity based costing.

Explanation of Solution

Calculate the new product cost per unit for odds and ends using activity based costing are given below:

| Particulars | Odds | Ends |

| Direct materials | $40 | $60 |

| Direct labor | $30 | $45 |

| Manufacturing overhead: | ||

| Machine related | $200 | $50 |

| Setup and inspection | $90 | $18 |

| Engineering | $67.50 | $4.50 |

| Plant related | $76.80 | $3.84 |

| Total cost per unit | $504.30 | $181.34 |

Table (3)

5.

Calculate the product costs using the same pricing policy as in the past for odds and ends.

Explanation of Solution

Calculate the product costs using the same pricing policy as in the past for odds and ends.

| Particulars | Odds | Ends |

| New product cost (ABC) (A) | $504.30 | $181.34 |

| Pricing policy (B) | 120% | 120% |

| New target price (A × B) | $605.16 | $217.61 |

Table (4)

6.

Display that the activity based costing system fully assigns the total budgeted manufacturing overhead costs of $816,000.

Explanation of Solution

| Particulars | Odds | Ends | Total |

| Manufacturing overhead costs: | |||

| Machine related | $200 | $50 | |

| Setup and inspection | $90 | $18 | |

| Engineering | $67.50 | $4.50 | |

| Plant-related | $76.80 | $3.84 | |

| Total overhead cost per unit (A) | $434.30 | $76.34 | |

| Production volume (B) | 1,000 | 5,000 | |

| Total overhead cost assigned | $434,300 | $381,700 | $816,000 |

Table (5)

7.

Prepare a table showing traditional based product costing system distorts the product costs of odds and evens.

Explanation of Solution

Prepare a table showing traditional based product costing system distorts the product costs of odds and evens.

| Particulars | Product G | Product T |

| Traditional based costing system - reported cost system | $166.00 | $249.00 |

| Less: Activity based costing system - Reported cost system | $504.30 | $181.34 |

| Traditional system Over costs (Under costs) per unit (A) | ($338.30) | $67.66 |

| Product volume (B) | 1,000 | 5,000 |

| Total amount of cost distortion for entire product line (A × B) | ($338,300) | $338,300 |

Table (1)

Traditional system overcosts ends by $67.66 per unit, and traditional system undercosts odds by $338.30 per unit.

Want to see more full solutions like this?

Chapter 5 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- i want to this question answer of this general accountingarrow_forwardA clothing retailer provides the following financial data for the year. Determine the cost of goods sold (COGS): ⚫Total Sales: $800,000 • Purchases: $500,000 • Sales Returns: $30,000 • Purchases Returns: $40,000 • Opening Stock Value: $60,000 • Closing Stock Value: $70,000 Administrative Expenses: $250,000arrow_forwardsubject : general accounting questionarrow_forward

- BrightTech Inc. had stockholders' equity of $1,200,000 at the beginning of June 2023. During the month, the company reported a net income of $300,000 and declared dividends of $175,000. What was BrightTech Inc.. s stockholders' equity at the end of June 2023?arrow_forwardQuestion 3Footfall Manufacturing Ltd. reports the following financialinformation at the end of the current year: Net Sales $100,000 Debtor's turnover ratio (based on net sales) 2 Inventory turnover ratio 1.25 fixed assets turnover ratio 0.8 Debt to assets ratio 0.6 Net profit margin 5% gross profit margin 25% return on investments 2% Use the given information to fill out the templates for incomestatement and balance sheet given below: Income Statement of Footfall Manufacturing Ltd. for the year endingDecember 31, 20XX(in $) Sales 100,000 Cost of goods sold gross profit other expenses earnings before tax tax @ 50% Earnings after tax Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX(in $) Liabilities Amount Assets Amount Equity Net fixed assets long term debt 50,000 Inventory short term debt debtors cash Total Totalarrow_forwardi need correct answer of this general accounting questionarrow_forward

- Financial Accountingarrow_forwardQuestion 4Waterfront Inc. wishes to borrow on a short-term basis withoutreducing its current ratio below 1.25. At present its current assetsand current liabilities are $1,600 and $1,000 respectively. How muchcan Waterfront Inc. borrow?arrow_forwardQuestion 6During 2019, Bitsincoins Corporation had EBIT of $100,000, a changein net fixed assets of $400,000, an increase in net current assets of$100,000, an increase in spontaneous current liabilities of $400,000,a depreciation expense of $50,000, and a tax rate of 30%. Based onthis information, what is Bitsincoin’s free cash flow?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning