1.

Calculate the material handling rate that would have been used by Person K’s predecessor at Industries NA.

1.

Explanation of Solution

Activity-based costing: It is a method that helps in finding the activities performed by a company and it tracks the indirect costs to the activities of the company that consumes resources.

Calculate the material handling rate that would have been used by Person K’s predecessor at Industries NA.

Working note:

Calculate total material handling department costs.

| Particulars | Amount |

| Payroll | $180,000 |

| Employee benefits | $36,000 |

| Telephone | $38,000 |

| Other utilities | $22,000 |

| Material and supplies | $6,000 |

| $6,000 | |

| Total material handling department costs | $288,000 |

Table (1)

2.a.

Calculate the revised material handling costs to be allocated on a per purchase order basis.

2.a.

Explanation of Solution

Calculate the revised material handling costs to be allocated on a per purchase order basis.

| Particulars | Amount |

| Total material handling department costs | $288,000 |

| Less: Direct costs: | |

| Direct government payroll | $36,000 |

| $7,200 | |

| Direct phone line | $2,800 |

| Material handling costs applicable to purchase orders (A) | $242,000 |

| Total number of purchase orders (B) | 242,000 |

| Material handling cost per purchase order (A ÷ B) | $1.00 |

Table (2)

b.

Discuss the reason behind purchase orders might be a more reliable cost driver than the dollar amount of direct material.

b.

Explanation of Solution

Purchase orders can be a more dependable cost driver than is the dollar amount of direct material, since resources are disbursed in the handling a purchase order. The size of the order does not essentially have an effect on the depletion of resources.

3.

Calculate the change in material handling cost applied to government contracts by NAI as a result of the new cost assignment approach.

3.

Explanation of Solution

There is a $74,600 decrease in the material handling costs allocated to government contracts by NAI as a result of the new allocation method calculated as follows:

| Particulars | Amount |

| Previous Method: | |

| Government material (A) | $2,006,000 |

| Material handling rate (B) | 10% |

| Total (1 =A × B) | $200,600 |

| New Method: | |

| Directly traceable material handling costs ($36,000+($36,000 × 20%) + $2,800)) | $46,000 |

| Purchase orders (80,000 × $1) | $80,000 |

| Total ( 2 = A × B) | $126,000 |

| Net reduction ( 1–2) | $74,600 |

Table (3)

4.

Prepare a

4.

Explanation of Solution

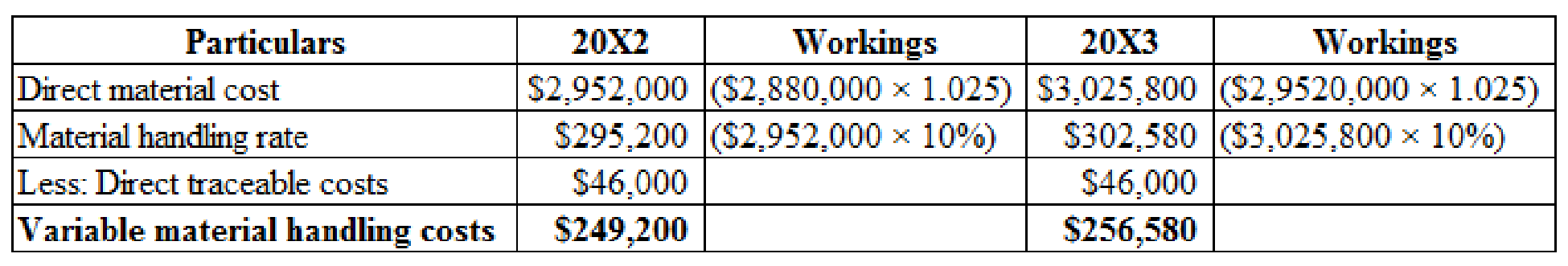

Calculate forecasted variable material handling costs.

Figure (1)

Calculate forecasted purchase orders:

| Particulars | Forecasted Purchase orders | |

| 20X2 ($242,000 × 1.05) | $254,100 | |

| 20X3 ($254,100 × 1.05) | $266,805 | |

| Governmental purchase orders (Purchase orders × 33%) | $83,853 | $88,046 |

Table (4)

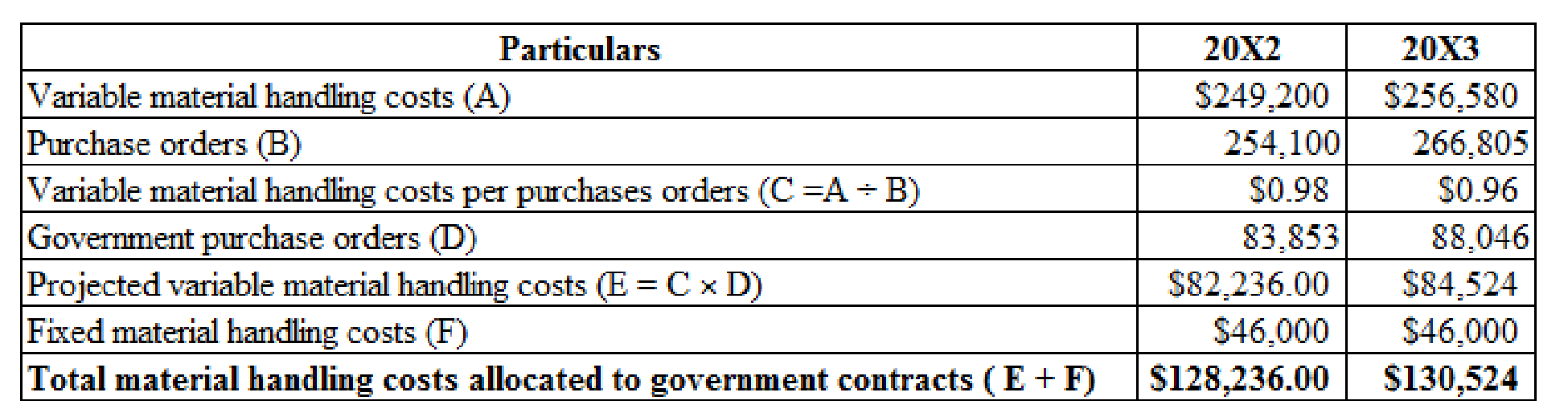

Calculate material handling costs allocated to governmental contracts.

Figure (2)

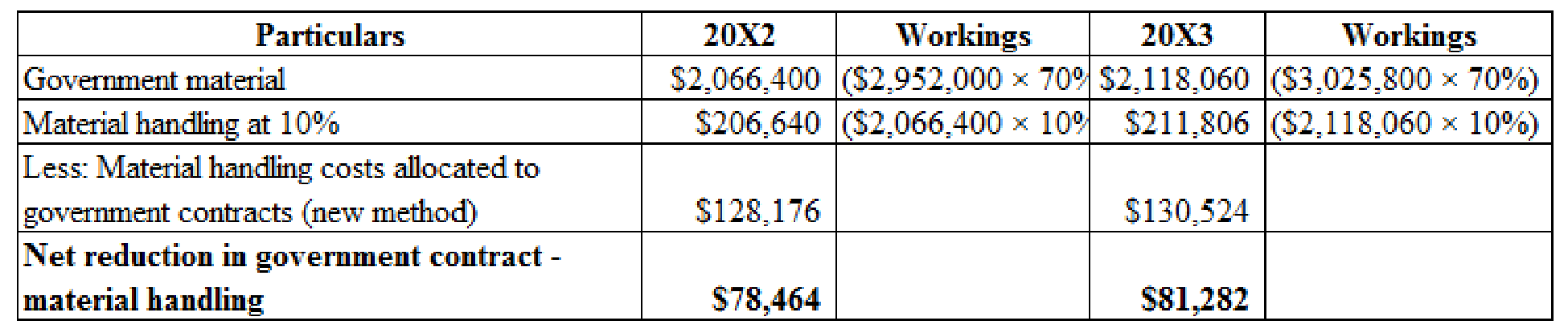

Calculate cumulative dollar impact.

Figure (3)

The cumulative dollar impact of the recommended change in allocating material handling department costs is $234,346 ($74,600 +$78,464 +$81,282).

5.a.

Discuss the reason for Person K has an ethical conflict related to the standards of ethical conduct for

5.a.

Explanation of Solution

Denoting to the standards of ethical conduct for management accountants of Person K faces the following ethical issues are given below:

Competence:

- “Provide decision support information and recommendations that are accurate, clear, consise and timely.”

Integrity:

- “Refrain from engaging in any conduct that would prejudice Person L’s ability to carry out her duties ethically.”

- “Abstain from engaging in or supporting any activity that would discredit person L’s profession.”

Credibility:

- “Disclose all relevant information that could reasonably be expected to influence an intended user’s understanding of the reports analyses or recommendations. Person L has information that Person J should see if he is going to make a reliable judgement about the results of the Government contracts unit.”

b.

Identify the several steps that Person L could take to resolve the ethical conflict.

b.

Explanation of Solution

The steps of Person K could take to resolve these ethical conflicts are as follows:

- Person K should first follow the recognized policies at NAI.

- If this method does not decide the conflict or if such policies do not exist, Person K must communicate the problem with her immediate superior, suppose when it looks that the superior is involved. If the government contracts unit manager, Person P is her controller, then she apparently cannot debate the problem with him. In this case she must go to the next upper managerial level and proceed, up to the audit committee of the board of director, until the conflict is decided.

- She must also discuss the position with an independent advisor to explain the issues involved and find an accepting of possible courses of an action.

- If the ethical conflict still happens after draining all levels of internal review, then person K might have no other course of action than to leave from the company and submit an useful memorandum to an suitable demonstrative of the company.

Want to see more full solutions like this?

Chapter 5 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Jackson, Inc. sponsors a defined-benefit pension plan. The following balance sheet data relates to the plan on December 31, 2018: Plan assets (at fair value), $1,200,000; Accumulated benefit obligation, $1,600,000; Projected benefit obligation, $2,000,000. Contributions of $130,000 were made to the plan during the year. What amount should Jackson report as its pension liability on its balance sheet as of December 31, 2018?arrow_forwardWhat is the net income for this firm? Accounting questionarrow_forwardHi expert please given correct answer with General accountingarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning