Concept explainers

Interpretation of Regression Results: Simple Regression

Your company is preparing an estimate of its production costs for the coming period. The controller estimates that direct materials costs are $45 per unit and that direct labor costs are $21 per hour. Estimating

The controller’s office estimated overhead costs at $3,600 for fixed costs and $18 per unit for variable costs. Your colleague, Lance, who graduated from a rival school, has already done the analysis and reports the “correct” cost equation as follows:

Overhead = $10,600 + $16.05 per unit

Lance also reports that the correlation coefficient for the regression is .82 and says, “With 82 percent of the variation in overhead explained by the equation, it certainly should be adopted as the best basis for estimating costs.”

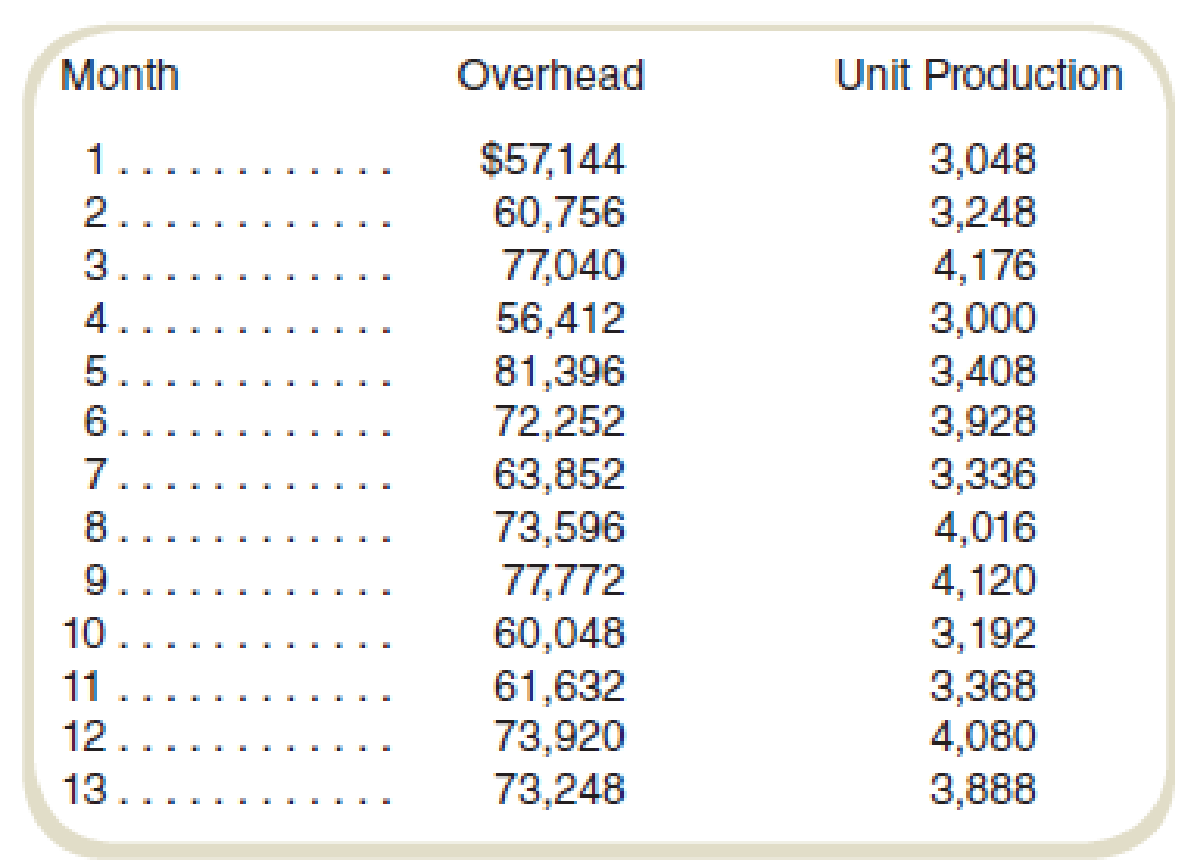

When asked for the data used to generate the regression, Lance produces the following:

Required

The company controller is somewhat surprised that the cost estimates are so different. You have therefore been assigned to check Lance’s equation. You accept the assignment with glee.

Analyze Lance’s results and state your reasons for supporting or rejecting his cost equation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Fundamentals of Cost Accounting

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning