Methods of Estimating Costs: Engineering Estimates

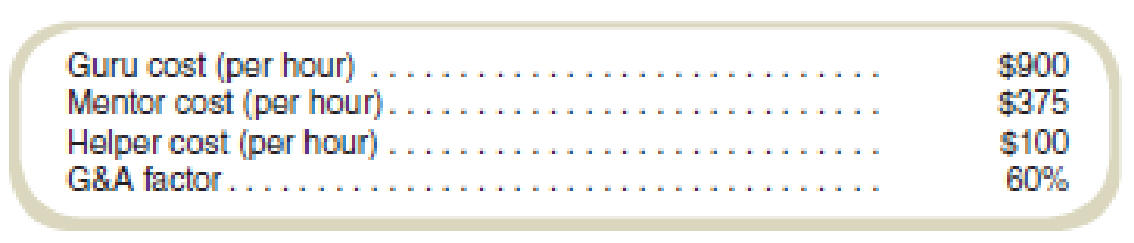

Twain Services offers leadership training for local companies. It employs three levels of seminar leaders, based on experience, education, and management level being targeted: guru, mentor, and helper. When Twain bids on requests for seminars, it estimates the costs using a set of standardized billing rates. It then adds an estimate for travel, supplies, and so on (referred to as out-of-pocket costs). Next it applies a percentage to the total of seminar leader cost and out-of-pocket cost for general and administrative (G&A) expense. The estimates for each of these elements are shown below:

Required

Marcus Foundries has asked Twain for a set of seminars for managers at several levels. The bidding manager at Twain estimates that the work will require 10 guru-hours, 125 mentor-hours, and 150 helper-hours. She estimates out-of-pocket costs to be $25,000. What is the estimated cost of the proposed seminars, based on these estimates?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Fundamentals of Cost Accounting

- Please need answer this general accounting questionarrow_forwardGross profit?? General Accountarrow_forwardSauerbraten Corp. reported 2007 sales ($ in millions) of $2,157 and a cost of goods sold of $1,827. The company uses the LIFO method for inventory valuation. It discloses that if the FIFO inventory valuation method had been used, inventories would have been $63.3 million and $56.8 million higher in 2007 and 2006, respectively. If Sauerbraten used the FIFO method exclusively, it would have reported 2007 gross profit closest to? a. $324. b. $330. c. $337.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College