Fundamentals of Cost Accounting

6th Edition

ISBN: 9781260708783

Author: LANEN, William

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 5, Problem 35E

Methods of Estimating Costs: High-Low, Ethical Issues

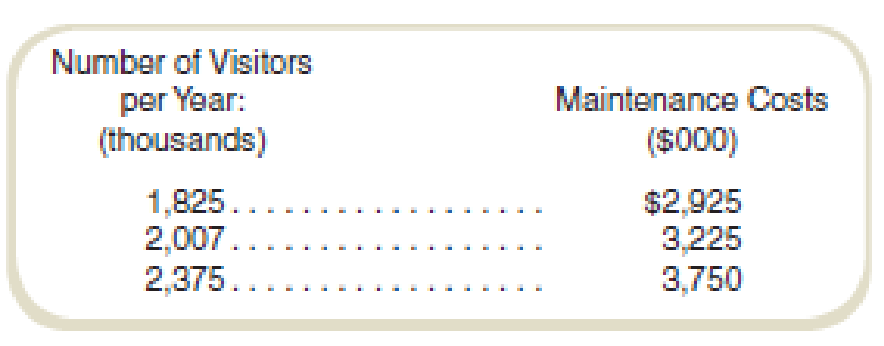

Oak Island Amusements Center provides the following data on the costs of maintenance and the number of visitors for the last three years:

Required

- a. Use the high-low method to estimate the fixed cost of maintenance annually and the variable cost of maintenance per visitor.

- b. The company expects a record 2,600,000 visitors next year. What would be the estimated maintenance costs?

- c. Company management is considering eliminating the maintenance department and contracting with an outside firm. Management is especially concerned with the fixed costs of maintenance. The maintenance manager tells you, the cost analyst, that 2,375,000 visitors is an outlier and should not be used in the analysis. Assume that this will lower estimated fixed costs. Is it ethical to treat this observation as an outlier?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the project expected unit sales? Accounting question

How much does he need before tax of this financial accounting question?

hello teacher please solve questions

Chapter 5 Solutions

Fundamentals of Cost Accounting

Ch. 5 - What are the common methods of cost estimation?Ch. 5 - Prob. 2RQCh. 5 - Under what conditions is the engineering estimates...Ch. 5 - If one wishes simply to prepare a cost estimate...Ch. 5 - When using cost estimation methods based on past...Ch. 5 - Prob. 6RQCh. 5 - What is the difference between R2 and adjusted R2?Ch. 5 - Why are accurate cost estimates important?Ch. 5 - What are three practical implementation problems...Ch. 5 - Why is it important to incorporate learning into...

Ch. 5 - What are some complications that can arise when...Ch. 5 - The following costs are labeled fixed or variable...Ch. 5 - Prob. 13CADQCh. 5 - When preparing cost estimates for account analysis...Ch. 5 - How can one compensate for the effects of price...Ch. 5 - Prob. 16CADQCh. 5 - Prob. 17CADQCh. 5 - A decision maker is interested in obtaining a cost...Ch. 5 - Consider the Business Application item Using...Ch. 5 - A friend comes to you with the following problem....Ch. 5 - After doing an account analysis and giving the...Ch. 5 - In doing cost analysis, you realize that there...Ch. 5 - Prob. 23CADQCh. 5 - Are learning curves likely to affect materials...Ch. 5 - McDonalds, the fast-food restaurant, is known for...Ch. 5 - Prob. 26CADQCh. 5 - A manager asks you for a cost estimate to open a...Ch. 5 - Prob. 28CADQCh. 5 - Methods of Estimating Costs: Engineering Estimates...Ch. 5 - Prob. 30ECh. 5 - Methods of Estimating Costs: Engineering Estimates...Ch. 5 - Prob. 32ECh. 5 - Methods of Estimating Costs: Account Analysis The...Ch. 5 - Methods of Estimating Costs: Account Analysis...Ch. 5 - Methods of Estimating Costs: High-Low, Ethical...Ch. 5 - Methods of Estimating Costs: High-Low Adriana...Ch. 5 - Methods of Estimating Costs: High-Low

Adriana...Ch. 5 - Prob. 38ECh. 5 - Adriana Corporation manufactures football...Ch. 5 - Methods of Estimating Costs: Simple...Ch. 5 - Prob. 41ECh. 5 - Methods of Estimating Costs: High-Low Davis Stores...Ch. 5 - Methods of Estimating Costs: Scattergraph Prepare...Ch. 5 - Prob. 44ECh. 5 - Interpretation of Regression Results: Multiple...Ch. 5 - Interpretation of Regression Results Brodie...Ch. 5 - Prob. 47ECh. 5 - Interpretation of Regression Results: Simple...Ch. 5 - Learning Curves Assume that General Dynamics,...Ch. 5 - Learning Curves Assume that Whee, Cheatham, and...Ch. 5 - Prob. 51ECh. 5 - Learning Curves (Appendix B) Refer to the example...Ch. 5 - Prob. 53PCh. 5 - Prob. 54PCh. 5 - Regressions from Published Data Obtain 13 years of...Ch. 5 - Prob. 56PCh. 5 - High-Low Method, Scattcrgraph Cubicle Solutions...Ch. 5 - High-Low Method, Scattcrgraph Academy Products...Ch. 5 - High-Low, Scattergraph, Issues with Data

Wyoming...Ch. 5 - Interpretation of Regression Results: Simple...Ch. 5 - Interpretation of Regression Results: Simple...Ch. 5 - Interpretation of Regression Results: Multiple...Ch. 5 - Interpretation of Regression Results: Simple...Ch. 5 - Interpretation of Regression Results Brews 4 U is...Ch. 5 - Cost Estimation: Simple Regression The following...Ch. 5 - Prob. 68PCh. 5 - Methods of Cost Analysis: Account Analysis, Simple...Ch. 5 - Learning Curves (Appendix B) Refer to the example...Ch. 5 - Learning Curves (Appendix B) Krylon Company...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ayco Inc. started its operations in 2022. Its sales during 2022, all on account, totalled $700,000. The company collected $500,000 in cash from customers during the year and wrote off $8,000 in uncollectible accounts. The company set up an allowance for doubtful accounts at December 31, 2022, its fiscal year-end, and determined the account balance to be $14,000. The unadjusted balances of selected accounts at December 31, 2023 are as follows: Accounts receivable $ 300,000 Allowance for doubtful accounts (debit) 10,000 Sales revenue (including 80 percent in sales on account) 800,000 Aging of the accounts receivable on December 31, 2023, resulted in an estimate of $11,000 in potentially uncollectible accounts. Required: 1. Prepare the journal entries to record all the transactions during 2022 and post them to appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)…arrow_forwardCalculate the sample size based on the specifications in Buhi's contract. Make sure it is within budget, reasonable to obtain, and that you use appropriate inputs relative to market research best practices. Use the calculator to adjust the sample size statement. Use the agreed-upon sample size in Buhi's contract: 996. In your secondary research, find the target population size (an estimate of those in the United States looking to purchase luggage in the category in the next two years). You will use this target population size for each sample size estimate. Adjust the provided sample size calculator inputs to find the rest of the figures that get you to the agreed-upon sample size. The caveats from Buhi are that you must: Use the market research standard for your confidence level. Use a confidence interval that is better than the market research standard for your confidence interval.arrow_forwardThe partnership of Keenan and Kludlow paid the following wages during this year: Line Item Description Amount M. Keenan (partner) $108,000 S. Kludlow (partner) 96,000 N. Perry (supervisor) 54,700 T. Lee (factory worker) 35,100 R. Rolf (factory worker) 27,200 D. Broch (factory worker) 6,300 S. Ruiz (bookkeeper) 26,000 C. Rudolph (maintenance) 5,200 In addition, the partnership owed $250 to Rudolph for work he performed during December. However, payment for this work will not be made until January of the following year. The state unemployment tax rate for the company is 2.95% on the first $9,000 of each employee's earnings. Compute the following: ound your answers to the nearest cent. a. Net FUTA tax for the partnership for this year b. SUTA tax for this yeararrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

alue Chain Analysis EXPLAINED | B2U | Business To You; Author: Business To You;https://www.youtube.com/watch?v=SI5lYaZaUlg;License: Standard Youtube License