Concept explainers

Allocating selling and administrative expenses using activity-based costing

Shrute Inc. manufactures office copiers, which are sold to retailers. The price and cost of goods sold for each copier are as follows:

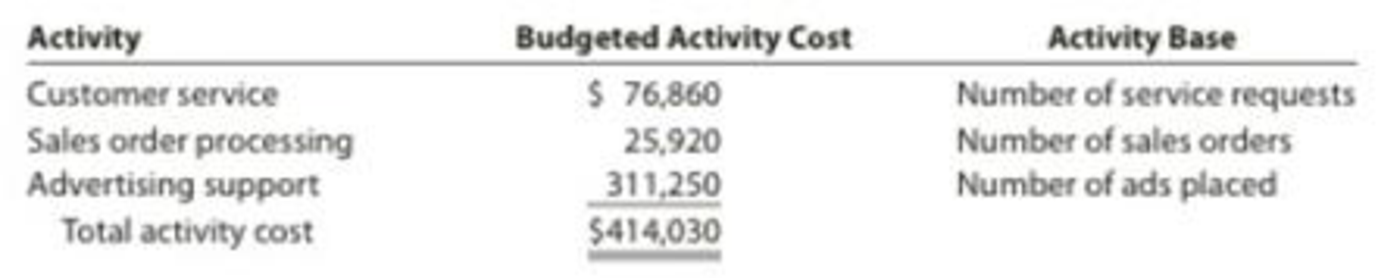

In addition, the company incurs selling and administrative expenses of $414,030. The company wishes to assign these costs to its three major retail customers, The Warehouse, Kosmo Co., and Supply Universe. These expenses are related to its three major nonmanufacturing activities: customer service, sales order processing, and advertising support. The advertising support is in the form of advertisements that are placed by Shrute Inc. to support the retailer’s sale of Shrute copiers to consumers. The budgeted activity costs and activity bases associated with these activities are:

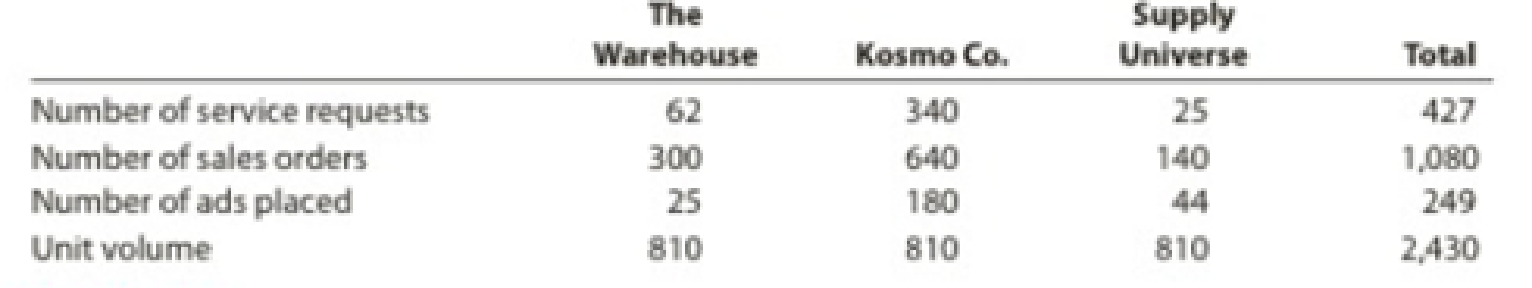

Activity-base usage and unit volume information for the three customers is as follows:

Instructions

Determine the activity rates for each of the three nonmanufacturing activities.

Determine the activity costs allocated to the three customers, using the activity rates in (1).

Construct customer profitability reports for the three customers, dated for the year ended December 31, using the activity costs in (2). The reports should disclose the gross profit and operating income associated with each customer.

Provide recommendations to management, based on the profitability reports in (3).

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardCan you demonstrate the accurate method for solving this General accounting question?arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- I need help with this general accounting question using the proper accounting approach.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College