Concept explainers

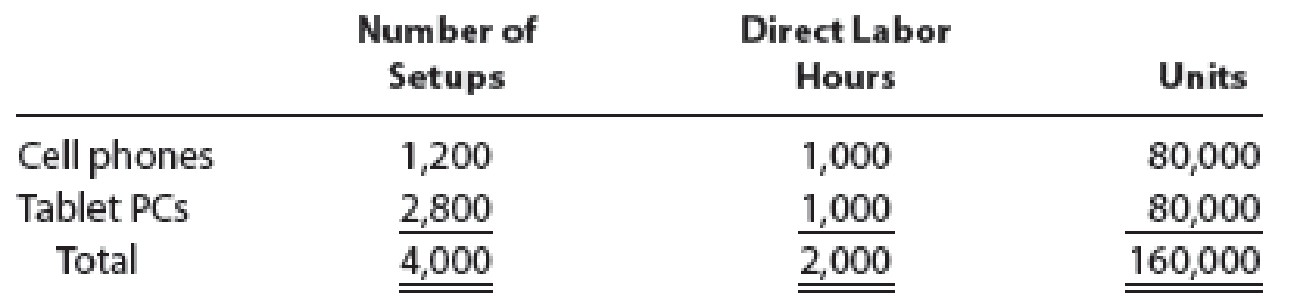

Handbrain Inc. is considering a change to activity-based product costing. The company produces two products, cell phones and tablet PCs, in a single production department. The production department is estimated to require 2,000 direct labor hours. The total indirect labor is budgeted to be $200,000.

Time records from indirect labor employees revealed that they spent 30% of their time setting up production runs and 70% of their time supporting actual production.

The following information about cell phones and tablet PCs was determined from the corporate records:

- a. Determine the indirect labor cost per unit allocated to cell phones and tablet PCs under a single plantwide factory

overhead rate system using the direct labor hours as the allocation base. - b. Determine the budgeted activity costs and activity rates for the indirect labor under activity-based costing. Assume two activities—one for setup and the other for production support.

- c. Determine the activity cost per unit for indirect labor allocated to each product under activity-based costing.

- d. Why are the per-unit allocated costs in (a) different from the per-unit activity cost assigned to the products in (c)?

a.

Compute the indirect labor cost per unit allocated to cell phones and tablet under a single plant wide factory overhead rate system.

Explanation of Solution

Single plant-wide factory overhead rate: The rate at which the factory or manufacturing overheads are allocated to products is referred to as single plant-wide factory overhead rate.

Formula to compute single plant-wide overhead rate:

Activity-based costing (ABC) method: The costing method which allocates overheads to the products based on factory overhead rate for each activity or cost object, according to the cost pooled for the cost drivers (allocation base).

Formula to compute activity-based overhead rate:

Compute the indirect labor cost per unit allocated to cell phones and tablet under a single plant wide factory overhead rate system.

| Types of Products |

Indirect labor cost (A) (2) |

Number of units (B) |

Indirect labor cost per unit |

| Cell phones | $100,000 | 80,000 | $1.25 |

| Tablets | $100,000 | 80,000 | $1.25 |

Table (1)

Working note (1):

Compute the single plant-wide overhead rate using direct labor hour (DLH) as the allocation base.

Working note (2):

Compute the total indirect labor cost for each product.

| Types of Products | Indirect labor hours | × | Single Plant-Wide Overhead Rate (1) | = | indirect labor cost |

| Cell phones | 1,000 | × | $100 per DLH | = | $100,000 |

| Tablets | 1,000 | × | $100 per DLH | = | $100,000 |

Table (2)

b.

Compute the activity-based overhead rate for each of the given activities.

Explanation of Solution

Compute the activity-based overhead rates for each activity.

| Computation of Activity-Based Overhead Rates | |||

| Activity |

Activity Cost (C) |

Total Activity-Base Usage (D) |

Activity-Based Overhead Rates |

| Setup | $60,000 (3) | 4,000 setups | $15 per setup |

| Production support |

140,000 (4) | 2,000 DLH | $70 per DLH |

Table (3)

Working note (3):

Compute the activity cost for setup activity.

Working note (3):

Compute the activity cost for production support activity.

c.

Compute the activity-cost per unit of the each product.

Explanation of Solution

Compute the activity cost allocated per unit of cell phone.

| Activity | Activity-Based Overhead Rates | × | Actual Use of Activity-Base (Cost Driver) | = | Activity Cost Allocated |

| Setup | $15 per setup | × | 1,200 setups | = | $18,000 |

| Production support | $70 per DLH | × | 1,000 DLH | = | 70,000 |

| Total activity costs allocated to cell phones (E) | $88,000 | ||||

| Number of units of cell phone (F) | 80,000 units | ||||

| Activity-based overhead cost per unit of cell phone | $1.10 | ||||

Table (4)

Note: Refer to Table (2) for the value and computation of activity allocation rates.

Compute the activity cost allocated per unit of tablet.

| Activity | Activity-Based Overhead Rates | × | Actual Use of Activity-Base (Cost Driver) | = | Activity Cost Allocated |

| Setup | $15 per setup | × | 2,800 setups | = | $42,000 |

| Production support | $70 per DLH | × | 1,000 DLH | = | 70,000 |

| Total activity costs allocated to tablets (G) | $112,00 | ||||

| Number of units of tablet (H) | 80,000 units | ||||

| Activity-based overhead cost per unit of tablet | $1.40 | ||||

Table (5)

Note: Refer to Table (2) for the value and computation of activity allocation rates.

d.

Discuss the reason why the per unit allocated costs in single plant-wide overhead rate approach is different from the per unit allocated costs in the activity based costing.

Explanation of Solution

The product cost under single plant-wide overhead rate approach and ABC approach are different. The product cost is distorted in single plant-wide overhead rate approach because the time spent for setup production for cell phones and tablets is not in the same ratio as the direct labor hours used in support production for cell phones and tablets.

Want to see more full solutions like this?

Chapter 4 Solutions

Managerial Accounting

- Please provide the accurate answer to this accounting problem using appropriate methods.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardCost of Production Report The debits to Work in Process-Roasting Department for Morning Brew Coffee Company for August, together with Information concerning production, are as follows: Work in process, August 1, 700 pounds, 10% completed *Direct materials (700 x $2.60) Conversion (700 x 10% x $1.00) Coffee beans added during August, 22,000 pounds Conversion costs during August Work in process, August 31, 1,100 pounds, 40% completed Goods finished during August, 21,600 pounds < All direct materials are placed in process at the beginning of production. $1,890* $1,820 70 $1,890 56,100 24,167 ? ? a. Prepare a cost of production report, presenting the following computations: 1. Direct materials and conversion equivalent units of production for August 2. Direct materials and conversion costs per equivalent unit for August 3. Cost of goods finished during August 4. Cost of work in process at August 31 If an amount is zero, enter in "0". For the cost per equivalent unit, round your answer to…arrow_forward

- Please provide the answer to this financial accounting question using the right approach.arrow_forwardPlease help me solve this financial accounting problem with the correct financial process.arrow_forwardV The debits to Work In Process-Roasting Department for Morning Brew Coffee Company for August, together with Information concerning production, are as follows: Work in process, August 1, 700 pounds, 10% completed *Direct materials (700 x $2.60) Conversion (700 x 10% x $1.00) Coffee beans added during August, 22,000 pounds Conversion costs during August Work in process, August 31, 1,100 pounds, 40% completed Goods finished during August, 21,600 pounds All direct materials are placed in process at the beginning of production. a. Prepare a cost of production report, presenting the following computations: 1. Direct materials and conversion equivalent units of production for August 2. Direct materials and conversion costs per equivalent unit for August 3. Cost of goods finished during August 4. Cost of work in process at August 31 $1,890* $1,820 70 $1,890 56,100 24,167 ? ? If an amount is zero, enter in "0". For the cost per equivalent unit, round your answer to the near st cent. Morning…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning