Concept explainers

Allocating selling and administrative expenses using activity-based costing

Arctic Air Inc. manufactures cooling units for commercial buildings. The price and cost of goods sold for each unit are as follows:

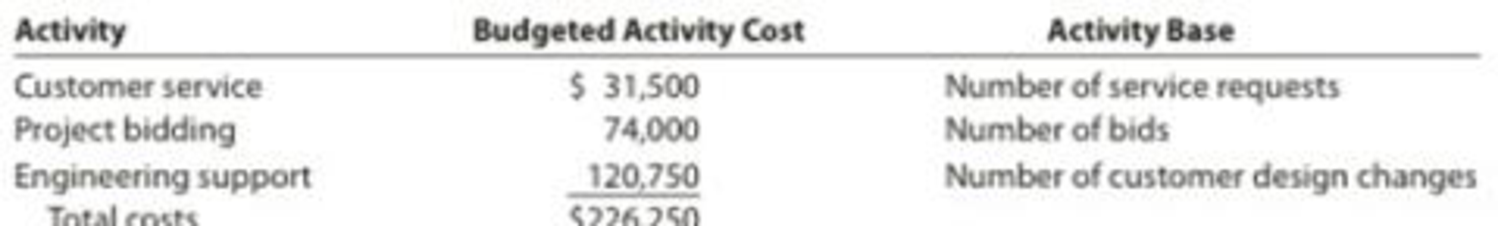

In addition, the company incurs selling and administrative expenses of $226,250. The company wishes to assign these costs to its three major customers, Gough Industries, Breen Inc., and The Martin Group. These expenses are related to three major nonmanufacturing activities: customer service, project bidding, and engineering support. The engineering support is in the form of engineering changes that are placed by the customer to change the design of a product. The budgeted activity costs and activity bases associated with these activities are:

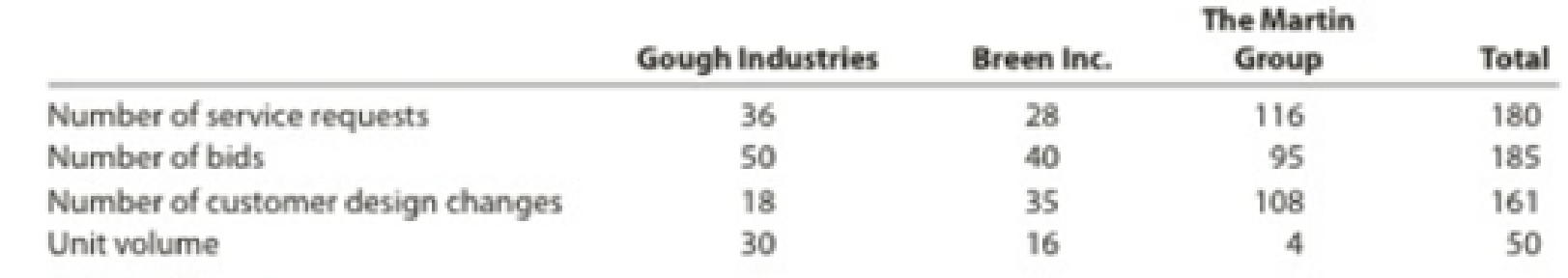

Activity-base usage and unit volume information for the three customers is as follows:

Instructions

- 1. Determine the activity rates for each of the three nonmanufacturing activity pools.

- 2. Determine the activity costs allocated to the three customers, using the activity rates in (1).

- 3. Construct customer profitability reports for the three customers, dated for the year ended December 31, using the activity costs in (2). The reports should disclose the gross profit and operating income associated with each customer.

- 4. Provide recommendations to management, based on the profitability reports in (3).

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting

- Journalize the following transaction: Purchased equipment worth $10,000, paying $4,000 in cash and the balance on credit.arrow_forwardExplain the difference between accrued expense and prepaid expense with examples. No aiarrow_forwardExplain the difference between accrued expense and prepaid expense with examples. Need helparrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College