Concept explainers

Activity-based department rate product costing and product cost distortions

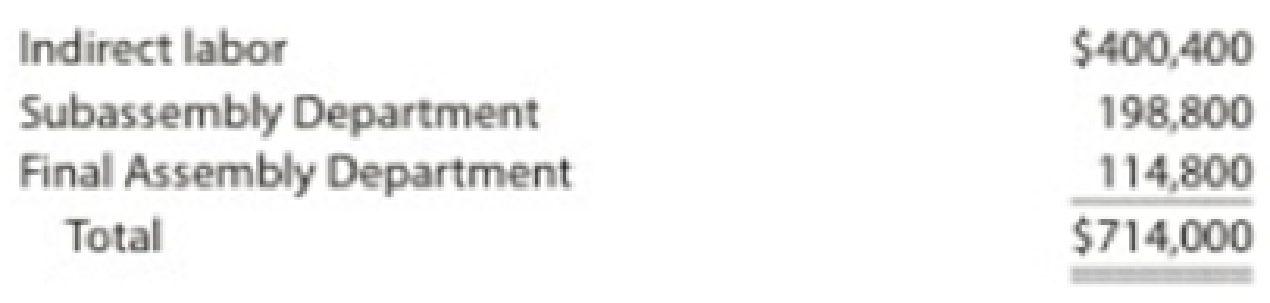

Big Sound Inc. manufactures two products: receivers and loudspeakers. The factory

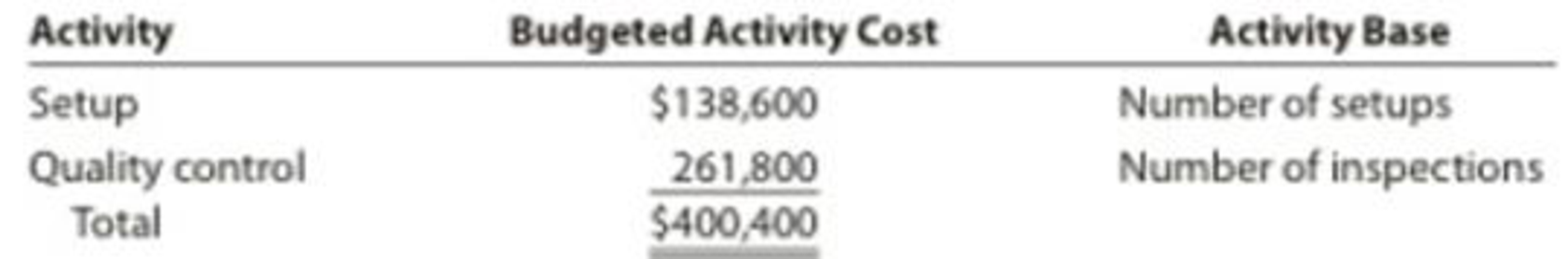

The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows:

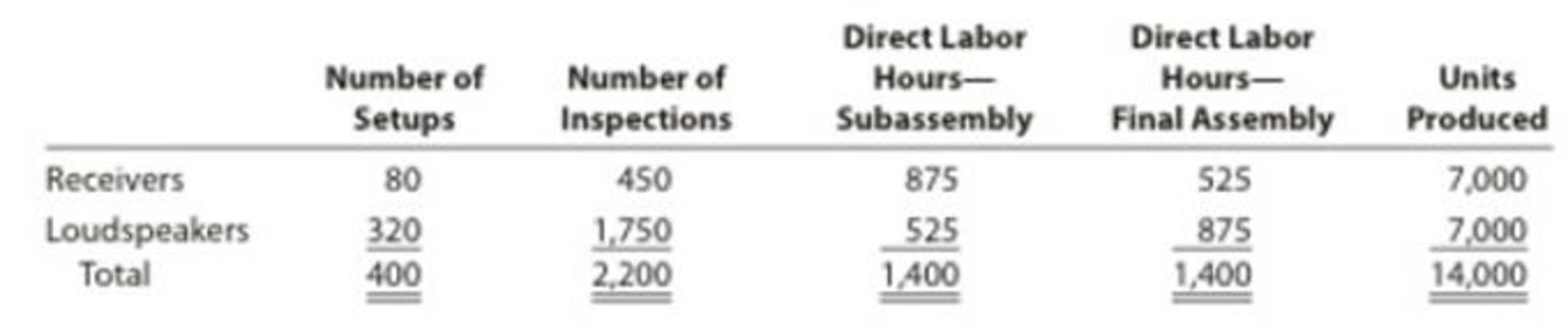

The activity-base usage quantities and units produced for the two products follow:

Instructions

Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is $420,000 and $294,000 for the Subassembly and Final Assembly departments, respectively.

Determine the total and per-unit

Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments.

Determine the total and per-unit cost assigned to each product under activity-based costing.

Explain the difference in the per-unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods. production department factory overhead rate and activity-based costing methods.

1.

Compute the multiple production department overhead rates for both departments.

Explanation of Solution

Multiple production department factory overhead rates: This allocation method identifies different departments in the process of production. The factory overheads are allocated to products based on the overhead rate for each of the production departments.

Formula to compute multiple production department overhead rates:

Multiple production department overhead rate} = Budgeted department factory overheadBudgeted Department allocation base

Activity-based costing (ABC) method: The costing method which allocates overheads to the products based on factory overhead rate for each activity or cost object, according to the cost pooled for the cost drivers (allocation base).

Formula to compute activity-based overhead rate:

Activity-basedoverhead rate} = Budgeted activity costTotal activity-base usage

Compute multiple production department overhead rates for subassembly department.

Multiple production department overhead rate} = Budgeted department factory overheadBudgeted department allocation base= $420,0001,400 DLH= $300 per DLH

Compute multiple production department overhead rates for final assembly department.

Multiple production department overhead rate} = Budgeted department factory overheadBudgeted department allocation base= $294,0001,400 DLH= $210 per DLH

2.

Compute the factory overhead allocated to total and per unit of each product

Explanation of Solution

Compute total factory overhead and per unit overhead allocated for receivers.

| Production Department | Multiple Production Department Overhead Rate | × | Total Number of Budgeted DLH | = | Factory Overhead |

| Subassembly | $300 per DLH | × | 875 DLH | = | $262,500 |

| Final assembly | $210 per DLH | × | 525 DLH | = | 110,250 |

| Total factory overhead costs allocated for receivers | $372,750 | ||||

| Number of units of receivers | ÷ 7,000 units | ||||

| Factory overhead cost per unit of receivers | $53.25 | ||||

Table (1)

Note: Refer to part (A) for value and computation of multiple production department overhead rate.

Compute total factory overhead and per unit overhead allocated for loudspeakers.

| Production Department | Multiple Production Department Overhead Rate | × | Total Number of Budgeted DLH | = | Factory Overhead |

| Subassembly | $300 per DLH | × | 525 DLH | = | $157,500 |

| Final assembly | $210 per DLH | × | 875 DLH | = | 183,750 |

| Total factory overhead costs allocated for loudspeakers | $341,250 | ||||

| Number of units of loudspeakers | ÷ 7,000 units | ||||

| Factory overhead cost per unit of loudspeakers | $48.75 | ||||

Table (2)

Note: Refer to part (A) for value and computation of multiple production department overhead rate.

3.

Compute the activity-based overhead rate for each of the given activities

Explanation of Solution

Compute activity-based overhead rates.

| Computation of Activity-Based Overhead Rates | |||||

| Activity | Activity Cost | ÷ | Total Activity-Base Usage | = | Activity-Based Overhead Rates |

| Setup | $138,600 | ÷ | 400 setups | = | $346.50 per setup |

| Quality control | 261,800 | ÷ | 2,200 inspections | = | $119 per inspection |

| Subassembly | 198,800 | ÷ | 1,400 DLH | = | $142 per DLH |

| Final assembly | 114,800 | ÷ | 1,400 DLH | = | $82 per DLH |

Table (3)

4.

Compute the activity-cost per unit of the products

Explanation of Solution

Compute activity cost allocated per unit of receivers.

| Activity | Activity-Based Overhead Rates | × | Actual Use of Activity-Base (Cost Driver) | = | Activity Cost Allocated |

| Setup | $346.50 per setup | × | 80 setups | = | $27,720 |

| Quality control | $119 per inspection | × | 450 inspections | = | 53,550 |

| Subassembly | $142 per DLH | × | 875 DLH | = | 124,250 |

| Final assembly | $82 per DLH | × | 525 DLH | = | 43,050 |

| Total activity costs allocated to receivers | $248,570 | ||||

| Number of units of receivers | ÷ 7,000 units | ||||

| Activity-based overhead cost per unit of receivers | $35.51 | ||||

Table (4)

Note: Refer to Table (3) for the value and computation of activity allocation rates.

Compute activity cost allocated per unit of loudspeakers.

| Activity | Activity-Based Overhead Rates | × | Actual Use of Activity-Base (Cost Driver) | = | Activity Cost Allocated |

| Setup | $346.50 per setup | × | 320 setups | = | $110,880 |

| Quality control | $119 per inspection | × | 1,750 inspections | = | 208,250 |

| Subassembly | $142 per DLH | × | 525 DLH | = | 74,550 |

| Final assembly | $82 per DLH | × | 875 DLH | = | 71,750 |

| Total activity costs allocated to loudspeakers | $465,430 | ||||

| Number of units of loudspeakers | ÷ 7,000 units | ||||

| Activity-based overhead cost per unit of loudspeakers | $66.49 | ||||

Table (5)

Note: Refer to Table (3) for the value and computation of activity allocation rates.

5.

Discuss the product cost distortion due to multiple production department overhead rate.

Explanation of Solution

The product cost under multiple production department overhead rate approach and ABC approach are different. The product cost is distorted in multiple production department overhead rate approach. Although the time spent for subassembly and final assembly departments for loudspeakers and receivers is in the same ratio, but the setup department and quality control department are not accounted for in multiple department overhead rate method.

Want to see more full solutions like this?

Chapter 4 Solutions

Managerial Accounting

- Please provide the correct solution to this financial accounting question using valid principles.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you explain the steps for solving this General accounting question accurately?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning