Concept explainers

Handy Leather, Inc., produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stencilled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Handy Leather uses the multiple production department factory

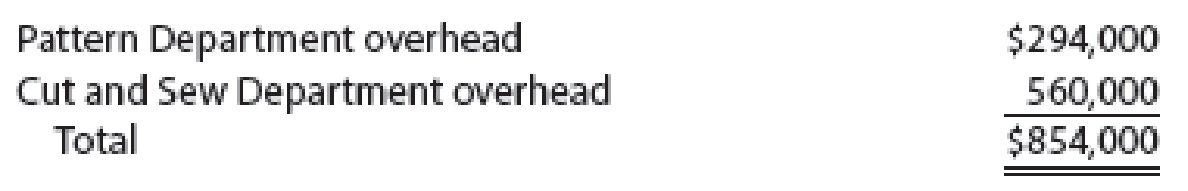

The direct labor estimated for each production department was as follows:

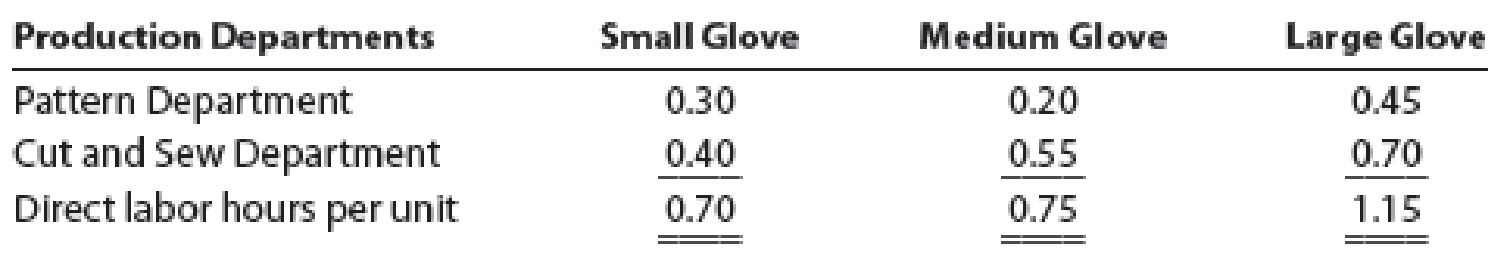

Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows:

- a. Determine the two production department factory overhead rates.

- b. Use the two production department factory overhead rates to determine the factory overhead per unit for each product.

Trending nowThis is a popular solution!

Chapter 4 Solutions

Managerial Accounting

- General accountingarrow_forwardQuestion: The balanced scorecard approach includes a) Only financial measures b) Only non-financial measures c) Both financial and non-financial measures d) Only customer measuresarrow_forwardCould you explain the steps for solving this General accounting question accurately?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub