Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 5CE

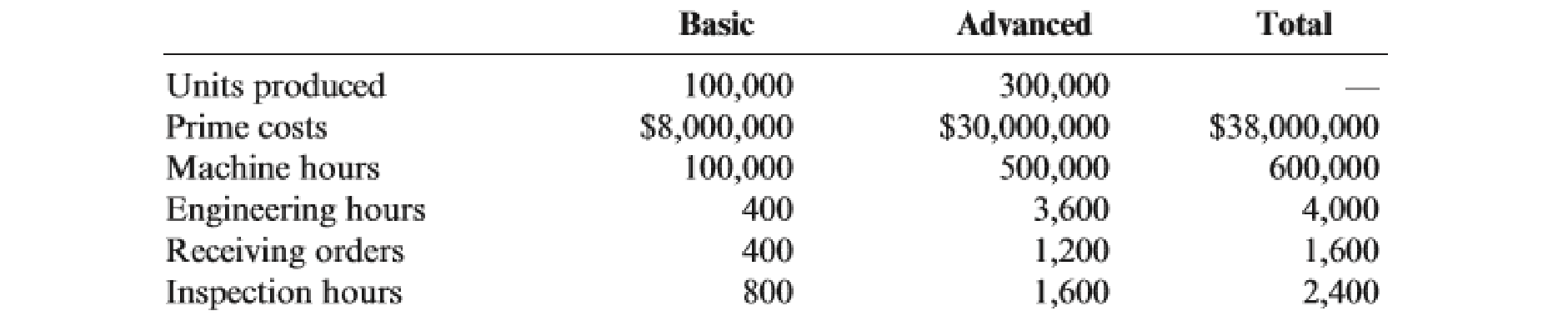

Roberts Company produces two weed eaters: basic and advanced. The company has four activities: machining, engineering, receiving, and inspection. Information on these activities and their drivers is given below.

Required:

- 1. Calculate the four activity rates.

- 2. Calculate the unit costs using activity rates. Also, calculate the overhead cost per unit.

- 3. What if consumption ratios instead of activity rates were used to assign costs instead of activity rates? Show the cost assignment for the inspection activity.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Do fast answer of this general accounting question

Following are financial statement numbers and ratios... Please solve this accounting question

Kindly help me Accounting question

Chapter 4 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 4 - What is a predetermined overhead rate? Explain why...Ch. 4 - Describe what is meant by under- and overapplied...Ch. 4 - Explain how a plantwide overhead rate, using a...Ch. 4 - What are non-unit-related overhead activities?...Ch. 4 - What is an overhead consumption ratio?Ch. 4 - Overhead costs are the source of product cost...Ch. 4 - What is activity-based product costing?Ch. 4 - What are the six steps that define the design of...Ch. 4 - Explain how the cost of resources is assigned to...Ch. 4 - Prob. 10DQ

Ch. 4 - Identify and define two types of activity drivers.Ch. 4 - What are unit-level activities? Batch-level...Ch. 4 - Prob. 13DQCh. 4 - Prob. 14DQCh. 4 - Prob. 15DQCh. 4 - Prob. 1CECh. 4 - Warner Company has the following data for the past...Ch. 4 - Lansing. Inc., provided the following data for its...Ch. 4 - Larsen, Inc., produces two types of electronic...Ch. 4 - Roberts Company produces two weed eaters: basic...Ch. 4 - Golding Bank provided the following data about its...Ch. 4 - Golding Bank provided the following data about its...Ch. 4 - Electan Company produces two types of printers....Ch. 4 - Patterson Company produces wafers for integrated...Ch. 4 - Selected activities and other information are...Ch. 4 - Ripley, Inc., costs products using a normal...Ch. 4 - Predetermined Overhead Rate, Application of...Ch. 4 - Craig Company uses a predetermined overhead rate...Ch. 4 - Departmental Overhead Rates Mariposa, Inc.,...Ch. 4 - McCourt Company produces two types of leather...Ch. 4 - Deoro Company has identified the following...Ch. 4 - Prob. 17ECh. 4 - Secondary Activities Refer to the interview in...Ch. 4 - Bob Randall, cost accounting manager for Hemple...Ch. 4 - Prob. 20ECh. 4 - Bob Randall, cost accounting manager for Hemple...Ch. 4 - Silven Company has identified the following...Ch. 4 - Silven Company has identified the following...Ch. 4 - Gee Manufacturing produces two models of camshafts...Ch. 4 - Cushing, Inc., costs products using a normal...Ch. 4 - Nonunit-level drivers are prominent in...Ch. 4 - Plata Company has identified the following...Ch. 4 - Assume that the inspection activity has an...Ch. 4 - Consider the information given on two products and...Ch. 4 - Primera Company produces two products and uses a...Ch. 4 - Fisico Company produces exercise bikes. One of its...Ch. 4 - Prob. 32PCh. 4 - Glencoe First National Bank operated for years...Ch. 4 - Autotech Manufacturing is engaged in the...Ch. 4 - The Bienestar Cardiology Clinic has two major...Ch. 4 - Reducir, Inc., produces two different types of...Ch. 4 - Refer to the data given in Problem 4.36 and...Ch. 4 - Escuha Company produces two type of calculators:...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem of Financial Accounting: The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 85,000 shares were originally issued and 5,000 were subsequently reacquired. What is the number of shares outstanding?arrow_forwardPlease given correct option general accountingarrow_forwardDetermine the Totalarrow_forward

- Please provide this question solution general accountingarrow_forwardIf a company has project revenues of solve these questionsarrow_forwardThe Kim Company reported total manufacturing costs of $195,000; manufacturing overhead totaling $39,000 and direct materials totaling $48,000. How much is direct labor cost?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY