Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 37P

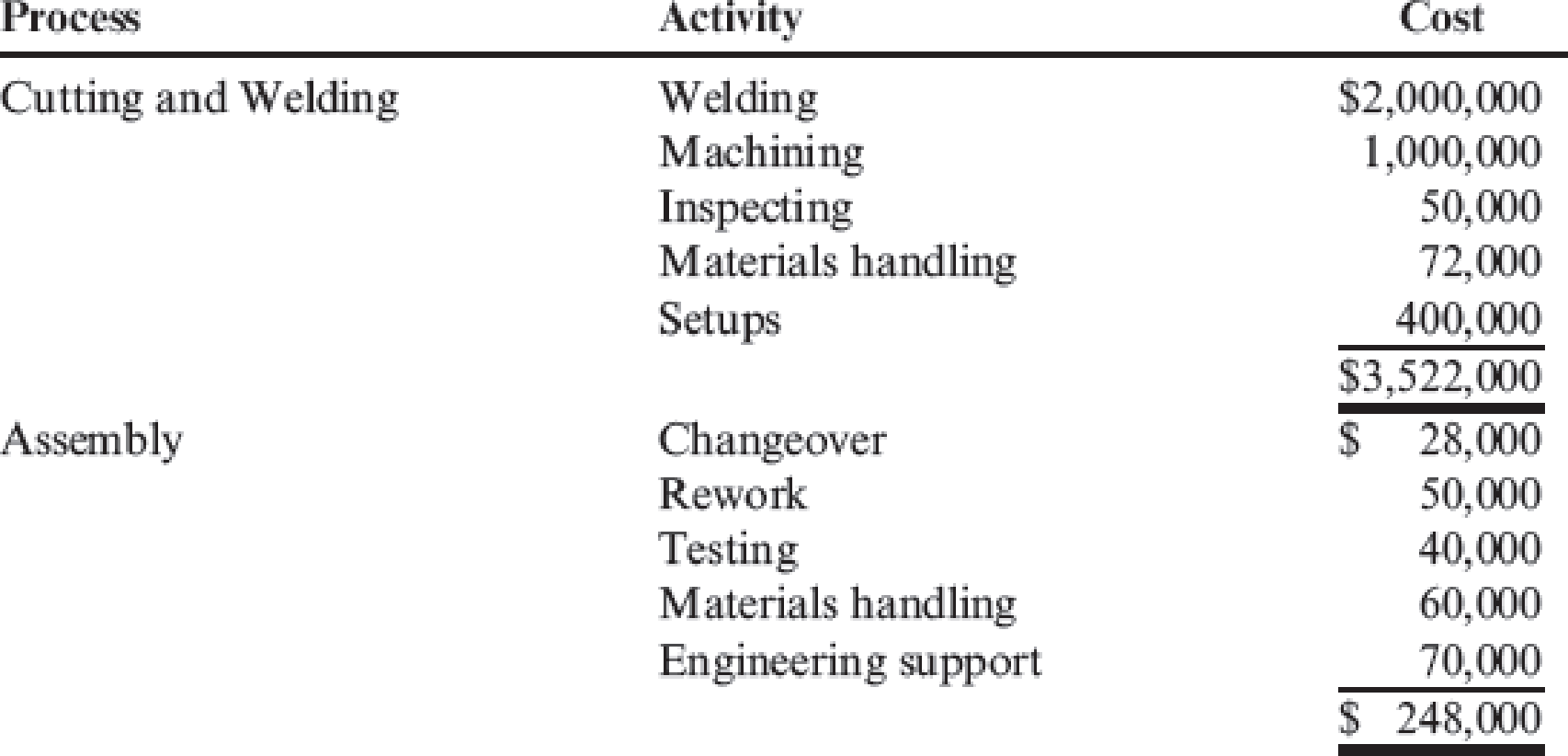

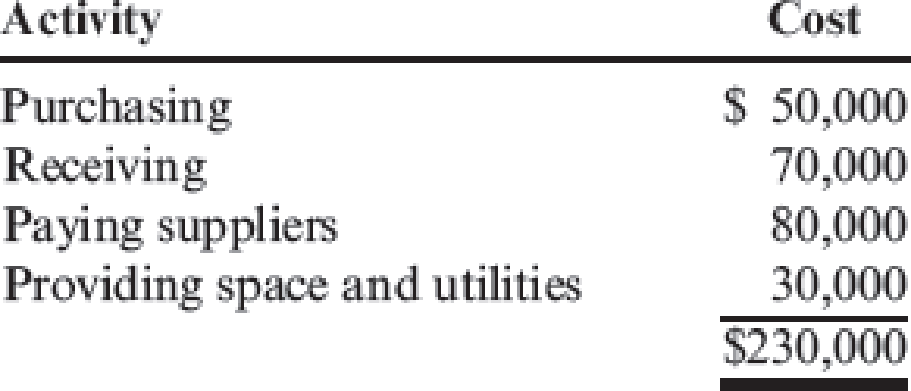

Refer to the data given in Problem 4.36 and suppose that the expected activity costs are reported as follows (all other data remain the same):

The per unit

Required:

- 1. Determine the percentage of total costs represented by the three most expensive activities.

- 2. Allocate the costs of all other activities to the three activities identified in Requirement 1. Allocate the other activity costs to the three activities in proportion to their individual activity costs. Now assign these total costs to the products using the drivers of the three chosen activities.

- 3. Using the costs assigned in Requirement 2, calculate the percentage error using the ABC costs as a benchmark. Comment on the value and advantages of this ABC simplification.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Financial accounting

What is the internal growth rate ? General accounting question

Accounting question

Chapter 4 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 4 - What is a predetermined overhead rate? Explain why...Ch. 4 - Describe what is meant by under- and overapplied...Ch. 4 - Explain how a plantwide overhead rate, using a...Ch. 4 - What are non-unit-related overhead activities?...Ch. 4 - What is an overhead consumption ratio?Ch. 4 - Overhead costs are the source of product cost...Ch. 4 - What is activity-based product costing?Ch. 4 - What are the six steps that define the design of...Ch. 4 - Explain how the cost of resources is assigned to...Ch. 4 - Prob. 10DQ

Ch. 4 - Identify and define two types of activity drivers.Ch. 4 - What are unit-level activities? Batch-level...Ch. 4 - Prob. 13DQCh. 4 - Prob. 14DQCh. 4 - Prob. 15DQCh. 4 - Prob. 1CECh. 4 - Warner Company has the following data for the past...Ch. 4 - Lansing. Inc., provided the following data for its...Ch. 4 - Larsen, Inc., produces two types of electronic...Ch. 4 - Roberts Company produces two weed eaters: basic...Ch. 4 - Golding Bank provided the following data about its...Ch. 4 - Golding Bank provided the following data about its...Ch. 4 - Electan Company produces two types of printers....Ch. 4 - Patterson Company produces wafers for integrated...Ch. 4 - Selected activities and other information are...Ch. 4 - Ripley, Inc., costs products using a normal...Ch. 4 - Predetermined Overhead Rate, Application of...Ch. 4 - Craig Company uses a predetermined overhead rate...Ch. 4 - Departmental Overhead Rates Mariposa, Inc.,...Ch. 4 - McCourt Company produces two types of leather...Ch. 4 - Deoro Company has identified the following...Ch. 4 - Prob. 17ECh. 4 - Secondary Activities Refer to the interview in...Ch. 4 - Bob Randall, cost accounting manager for Hemple...Ch. 4 - Prob. 20ECh. 4 - Bob Randall, cost accounting manager for Hemple...Ch. 4 - Silven Company has identified the following...Ch. 4 - Silven Company has identified the following...Ch. 4 - Gee Manufacturing produces two models of camshafts...Ch. 4 - Cushing, Inc., costs products using a normal...Ch. 4 - Nonunit-level drivers are prominent in...Ch. 4 - Plata Company has identified the following...Ch. 4 - Assume that the inspection activity has an...Ch. 4 - Consider the information given on two products and...Ch. 4 - Primera Company produces two products and uses a...Ch. 4 - Fisico Company produces exercise bikes. One of its...Ch. 4 - Prob. 32PCh. 4 - Glencoe First National Bank operated for years...Ch. 4 - Autotech Manufacturing is engaged in the...Ch. 4 - The Bienestar Cardiology Clinic has two major...Ch. 4 - Reducir, Inc., produces two different types of...Ch. 4 - Refer to the data given in Problem 4.36 and...Ch. 4 - Escuha Company produces two type of calculators:...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Waiting for your solution general accounting questionarrow_forwardAnswer? ? Financial accounting questionarrow_forwardNeither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Income: Joe's salary $ 144,100 Jessie's craft sales 18,400 Interest from certificate of deposit 1,650 Interest from Treasury bond funds 716 Interest from municipal bond funds 920 Expenditures: Federal income tax withheld from Joe's wages $ 13,700 State income tax withheld from Joe's wages 6,400 Social Security tax withheld from Joe's wages 7,482 Real estate taxes on residence 6,200 Automobile licenses (based on weight) 310 State sales tax paid 1,150 Home mortgage interest 26,000 Interest on Masterdebt credit card 2,300 Medical expenses (unreimbursed) 1,690 Joe's employee expenses (unreimbursed) 2,400 Cost of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License