Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 7PA

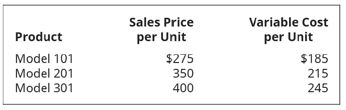

Manatoah Manufacturing produces 3 models of window air conditioners: model 101, model 201, and model 301. The sales price and variable costs for these three models are as follows:

The current product mix is 4:3:2. The three models share total fixed costs of $430,000.

- Calculate the sales price per composite unit.

- What is the contribution margin per composite unit?

- Calculate Manatoah’s break-even point in both dollars and units.

- Using an income statement format, prove that this is the break-even point.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

BC

VERSO

gal

polica

9 €

ABC

4.

140×240 cm

GARDE

HY16-01

•

Vrtni luk

materijal: čelik i plastika

za penjačice

12.99 €

140x240 CM

TO BEAUTIFY YOU

The magnitude of operating leverage for Roshan Enterprises is 3.2 when sales are $200,000 and net income is $40,000. If sales decrease by 5%, net income is expected to decrease by what amount?

Want to this question answer general Accounting

Chapter 3 Solutions

Principles of Accounting Volume 2

Ch. 3 - The amount of a units sales price that helps to...Ch. 3 - A companys product sells for $150 and has variable...Ch. 3 - A companys product sells for $150 and has variable...Ch. 3 - A companys contribution margin per unit is $25. It...Ch. 3 - A company sells its products for $80 per unit and...Ch. 3 - If a company has fixed costs of $6.000 per month...Ch. 3 - Company A wants to earn $5,000 profit in the month...Ch. 3 - A company has wants to earn an income of $60,000...Ch. 3 - A company has pre-tax or operating income of...Ch. 3 - When sales price increases and all other variables...

Ch. 3 - When sales price decreases and all other variables...Ch. 3 - When variable costs increase and all other...Ch. 3 - When fixed costs decrease and all other variables...Ch. 3 - When fixed costs increase and all other variables...Ch. 3 - If the sales mix in a multi-product environment...Ch. 3 - Break-even for a multiple product firm. can be...Ch. 3 - Waskowski Company sells three products (A. B. and...Ch. 3 - Beaucheau Farms sells three products (E, F, and G)...Ch. 3 - A company sells two products, Model 101 and Model...Ch. 3 - Wallace Industries has total contribution margin...Ch. 3 - Macom Manufacturing has total contribution margin...Ch. 3 - If a firm has a contribution margin of $59,690 and...Ch. 3 - If a firm has a contribution margin of $78M90 and...Ch. 3 - Define and explain contribution margin on a per...Ch. 3 - Define and explain contribution margin ratio.Ch. 3 - Explain how a contribution margin income statement...Ch. 3 - In a cost-volume-profit analysis, explain what...Ch. 3 - What is meant by a products contribution margin...Ch. 3 - Explain how a manager can use CVP analysis to make...Ch. 3 - After conducting a CVP analysis, most businesses...Ch. 3 - Explain how for is possible for costs to change...Ch. 3 - Explain what a sales mix is and how changes in the...Ch. 3 - Explain how break-even analysis for a...Ch. 3 - Explain margin of safety and why it is an...Ch. 3 - Define operating leverage and explain its...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - A product has a sales price of $150 and a per-unit...Ch. 3 - A product has a sales price of $250 and a per-unit...Ch. 3 - Maple Enterprises sells a single product with a...Ch. 3 - Marlin Motors sells a single product with a...Ch. 3 - Flanders Manufacturing is considering purchasing a...Ch. 3 - Marchete Company produces a single product. They...Ch. 3 - Brahma Industries sells vinyl replacement windows...Ch. 3 - Salvador Manufacturing builds and sells...Ch. 3 - Salvador Manufacturing builds and sells...Ch. 3 - Use the information from the previous exercises...Ch. 3 - Company A has current sales of $10,000,000 and a...Ch. 3 - Marshall s target margin of safety be in units and...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - A product has a sales price of $175 and a per-unit...Ch. 3 - A product has a sales price of $90 and a per-unit...Ch. 3 - Cadre, Inc., sells a single product with a selling...Ch. 3 - Kerr Manufacturing sells a single product with a...Ch. 3 - Delta Co. sells a product for $150 per unit. The...Ch. 3 - Shonda & Shonda is a company that does land...Ch. 3 - Baghdad Company produces a single product. They...Ch. 3 - Keleher Industries manufactures pet doors and...Ch. 3 - Manufacturing builds and sells switch harnesses...Ch. 3 - Manufacturing builds and sells switch harnesses...Ch. 3 - Use the information from the previous exercises...Ch. 3 - Company A has current sales of $4,000,000 and a...Ch. 3 - Best Wholesale recently calculated their...Ch. 3 - A company sells small motors as a component part...Ch. 3 - A company manufactures and sells racing bicycles...Ch. 3 - Fill in the missing amounts for the four...Ch. 3 - Markham Farms reports the following contribution...Ch. 3 - Kylies Cookies is considering the purchase of a...Ch. 3 - Morris Industries manufactures and sells three...Ch. 3 - Manatoah Manufacturing produces 3 models of window...Ch. 3 - Jakarta Company is a service firm with current...Ch. 3 - A company sells mulch by the cubic yard. Grade A...Ch. 3 - A company manufactures and sells blades that are...Ch. 3 - Fill in the missing amounts for the four...Ch. 3 - West Island distributes a single product. The...Ch. 3 - Wellington, Inc., reports the following...Ch. 3 - Karens Quilts is considering the purchase of a new...Ch. 3 - Abilene Industries manufactures and sells three...Ch. 3 - Tim-Buck-Il rents jet skis at a beach resort....Ch. 3 - Fire Company is a service firm with current...Ch. 3 - Mariana Manufacturing and Bellow Brothers compete...Ch. 3 - Roald is the sales manager for a small regional...Ch. 3 - As a manager, you have to choose between two...Ch. 3 - Coutures Creations is considering offering Joe, an...

Additional Business Textbook Solutions

Find more solutions based on key concepts

4. JC Manufacturing purchase d inventory for $ 5,300 and al so paid a $260 freight bill. JC Manufacturing retur...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

A company has the opportunity to take over a redevelopment project in an industrial area of a city. No immediat...

Engineering Economy (17th Edition)

The beta of call option and leverage ratio of the option. Introduction: A binomial model portrays the developme...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

S4–12 Identifying accounts included on a post–closing trail balance

Learning Objective 4

Office Supplies

Inte...

Horngren's Accounting (12th Edition)

What is an action plan? Why are action plans such an important part of market planning? Why is it so important ...

MARKETING:REAL PEOPLE,REAL CHOICES

Knowledge Booster

Similar questions

- Selby Industries has a standard requirement of 4 direct labor hours for each unit produced and pays $12 per hour. During the last month, the company produced 1,200 units of its product and paid a total of $60,480 in direct labor wages. The labor efficiency variance was $720 favorable. What was the direct labor rate variance? Helparrow_forwardGiven true answer general accountingarrow_forwardCompute the correct cost of goods sold for 2022arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning