Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 10EA

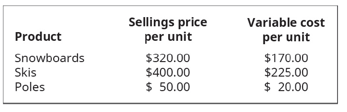

Salvador Manufacturing builds and sells snowboards, skis and poles. The sales price and variable cost for each are shown:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025.

1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business.

2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful.

3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years.

4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029.

5.) Oriole incurred $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…

Reffering to fair value of an asset, division, or organization, What exactly is fair value and how is it assessed?

The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025.

1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business.

2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful.

3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years.

4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred

5.) $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…

Chapter 3 Solutions

Principles of Accounting Volume 2

Ch. 3 - The amount of a units sales price that helps to...Ch. 3 - A companys product sells for $150 and has variable...Ch. 3 - A companys product sells for $150 and has variable...Ch. 3 - A companys contribution margin per unit is $25. It...Ch. 3 - A company sells its products for $80 per unit and...Ch. 3 - If a company has fixed costs of $6.000 per month...Ch. 3 - Company A wants to earn $5,000 profit in the month...Ch. 3 - A company has wants to earn an income of $60,000...Ch. 3 - A company has pre-tax or operating income of...Ch. 3 - When sales price increases and all other variables...

Ch. 3 - When sales price decreases and all other variables...Ch. 3 - When variable costs increase and all other...Ch. 3 - When fixed costs decrease and all other variables...Ch. 3 - When fixed costs increase and all other variables...Ch. 3 - If the sales mix in a multi-product environment...Ch. 3 - Break-even for a multiple product firm. can be...Ch. 3 - Waskowski Company sells three products (A. B. and...Ch. 3 - Beaucheau Farms sells three products (E, F, and G)...Ch. 3 - A company sells two products, Model 101 and Model...Ch. 3 - Wallace Industries has total contribution margin...Ch. 3 - Macom Manufacturing has total contribution margin...Ch. 3 - If a firm has a contribution margin of $59,690 and...Ch. 3 - If a firm has a contribution margin of $78M90 and...Ch. 3 - Define and explain contribution margin on a per...Ch. 3 - Define and explain contribution margin ratio.Ch. 3 - Explain how a contribution margin income statement...Ch. 3 - In a cost-volume-profit analysis, explain what...Ch. 3 - What is meant by a products contribution margin...Ch. 3 - Explain how a manager can use CVP analysis to make...Ch. 3 - After conducting a CVP analysis, most businesses...Ch. 3 - Explain how for is possible for costs to change...Ch. 3 - Explain what a sales mix is and how changes in the...Ch. 3 - Explain how break-even analysis for a...Ch. 3 - Explain margin of safety and why it is an...Ch. 3 - Define operating leverage and explain its...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - A product has a sales price of $150 and a per-unit...Ch. 3 - A product has a sales price of $250 and a per-unit...Ch. 3 - Maple Enterprises sells a single product with a...Ch. 3 - Marlin Motors sells a single product with a...Ch. 3 - Flanders Manufacturing is considering purchasing a...Ch. 3 - Marchete Company produces a single product. They...Ch. 3 - Brahma Industries sells vinyl replacement windows...Ch. 3 - Salvador Manufacturing builds and sells...Ch. 3 - Salvador Manufacturing builds and sells...Ch. 3 - Use the information from the previous exercises...Ch. 3 - Company A has current sales of $10,000,000 and a...Ch. 3 - Marshall s target margin of safety be in units and...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - A product has a sales price of $175 and a per-unit...Ch. 3 - A product has a sales price of $90 and a per-unit...Ch. 3 - Cadre, Inc., sells a single product with a selling...Ch. 3 - Kerr Manufacturing sells a single product with a...Ch. 3 - Delta Co. sells a product for $150 per unit. The...Ch. 3 - Shonda & Shonda is a company that does land...Ch. 3 - Baghdad Company produces a single product. They...Ch. 3 - Keleher Industries manufactures pet doors and...Ch. 3 - Manufacturing builds and sells switch harnesses...Ch. 3 - Manufacturing builds and sells switch harnesses...Ch. 3 - Use the information from the previous exercises...Ch. 3 - Company A has current sales of $4,000,000 and a...Ch. 3 - Best Wholesale recently calculated their...Ch. 3 - A company sells small motors as a component part...Ch. 3 - A company manufactures and sells racing bicycles...Ch. 3 - Fill in the missing amounts for the four...Ch. 3 - Markham Farms reports the following contribution...Ch. 3 - Kylies Cookies is considering the purchase of a...Ch. 3 - Morris Industries manufactures and sells three...Ch. 3 - Manatoah Manufacturing produces 3 models of window...Ch. 3 - Jakarta Company is a service firm with current...Ch. 3 - A company sells mulch by the cubic yard. Grade A...Ch. 3 - A company manufactures and sells blades that are...Ch. 3 - Fill in the missing amounts for the four...Ch. 3 - West Island distributes a single product. The...Ch. 3 - Wellington, Inc., reports the following...Ch. 3 - Karens Quilts is considering the purchase of a new...Ch. 3 - Abilene Industries manufactures and sells three...Ch. 3 - Tim-Buck-Il rents jet skis at a beach resort....Ch. 3 - Fire Company is a service firm with current...Ch. 3 - Mariana Manufacturing and Bellow Brothers compete...Ch. 3 - Roald is the sales manager for a small regional...Ch. 3 - As a manager, you have to choose between two...Ch. 3 - Coutures Creations is considering offering Joe, an...

Additional Business Textbook Solutions

Find more solutions based on key concepts

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

•• 3.14 Kelle Carpet and Trim installs carpet in commercial offices. Peter Kelle has been very concerned with t...

Operations Management

The approach on how Person X (holder) can purchase insurance to protect himself against a fall in the price of ...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

(Record inventory transactions in the periodic system) Wexton Technologies began the year with inventory of 560...

Financial Accounting (12th Edition) (What's New in Accounting)

15-18 Societal moral issue: Although enforcement of worker safety in Bangladesh is clearly lax, government offi...

Fundamentals of Management (10th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Inspection and Quality control in Manufacturing. What is quality inspection?; Author: Educationleaves;https://www.youtube.com/watch?v=Ey4MqC7Kp7g;License: Standard youtube license