Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 7EA

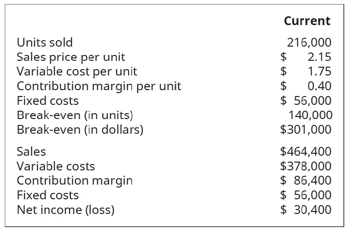

Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. The information they will use to consider these changes is shown here.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Which account is closed at the end of the period?

A) Accounts ReceivableB) EquipmentC) Wages ExpenseD) Common Stock need

Which account is closed at the end of the period?

A) Accounts ReceivableB) EquipmentC) Wages ExpenseD) Common Stock

How is net income calculated?

A) Revenues - ExpensesB) Assets - LiabilitiesC) Revenues + LiabilitiesD) Assets + Expensesneed

Chapter 3 Solutions

Principles of Accounting Volume 2

Ch. 3 - The amount of a units sales price that helps to...Ch. 3 - A companys product sells for $150 and has variable...Ch. 3 - A companys product sells for $150 and has variable...Ch. 3 - A companys contribution margin per unit is $25. It...Ch. 3 - A company sells its products for $80 per unit and...Ch. 3 - If a company has fixed costs of $6.000 per month...Ch. 3 - Company A wants to earn $5,000 profit in the month...Ch. 3 - A company has wants to earn an income of $60,000...Ch. 3 - A company has pre-tax or operating income of...Ch. 3 - When sales price increases and all other variables...

Ch. 3 - When sales price decreases and all other variables...Ch. 3 - When variable costs increase and all other...Ch. 3 - When fixed costs decrease and all other variables...Ch. 3 - When fixed costs increase and all other variables...Ch. 3 - If the sales mix in a multi-product environment...Ch. 3 - Break-even for a multiple product firm. can be...Ch. 3 - Waskowski Company sells three products (A. B. and...Ch. 3 - Beaucheau Farms sells three products (E, F, and G)...Ch. 3 - A company sells two products, Model 101 and Model...Ch. 3 - Wallace Industries has total contribution margin...Ch. 3 - Macom Manufacturing has total contribution margin...Ch. 3 - If a firm has a contribution margin of $59,690 and...Ch. 3 - If a firm has a contribution margin of $78M90 and...Ch. 3 - Define and explain contribution margin on a per...Ch. 3 - Define and explain contribution margin ratio.Ch. 3 - Explain how a contribution margin income statement...Ch. 3 - In a cost-volume-profit analysis, explain what...Ch. 3 - What is meant by a products contribution margin...Ch. 3 - Explain how a manager can use CVP analysis to make...Ch. 3 - After conducting a CVP analysis, most businesses...Ch. 3 - Explain how for is possible for costs to change...Ch. 3 - Explain what a sales mix is and how changes in the...Ch. 3 - Explain how break-even analysis for a...Ch. 3 - Explain margin of safety and why it is an...Ch. 3 - Define operating leverage and explain its...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - A product has a sales price of $150 and a per-unit...Ch. 3 - A product has a sales price of $250 and a per-unit...Ch. 3 - Maple Enterprises sells a single product with a...Ch. 3 - Marlin Motors sells a single product with a...Ch. 3 - Flanders Manufacturing is considering purchasing a...Ch. 3 - Marchete Company produces a single product. They...Ch. 3 - Brahma Industries sells vinyl replacement windows...Ch. 3 - Salvador Manufacturing builds and sells...Ch. 3 - Salvador Manufacturing builds and sells...Ch. 3 - Use the information from the previous exercises...Ch. 3 - Company A has current sales of $10,000,000 and a...Ch. 3 - Marshall s target margin of safety be in units and...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - A product has a sales price of $175 and a per-unit...Ch. 3 - A product has a sales price of $90 and a per-unit...Ch. 3 - Cadre, Inc., sells a single product with a selling...Ch. 3 - Kerr Manufacturing sells a single product with a...Ch. 3 - Delta Co. sells a product for $150 per unit. The...Ch. 3 - Shonda & Shonda is a company that does land...Ch. 3 - Baghdad Company produces a single product. They...Ch. 3 - Keleher Industries manufactures pet doors and...Ch. 3 - Manufacturing builds and sells switch harnesses...Ch. 3 - Manufacturing builds and sells switch harnesses...Ch. 3 - Use the information from the previous exercises...Ch. 3 - Company A has current sales of $4,000,000 and a...Ch. 3 - Best Wholesale recently calculated their...Ch. 3 - A company sells small motors as a component part...Ch. 3 - A company manufactures and sells racing bicycles...Ch. 3 - Fill in the missing amounts for the four...Ch. 3 - Markham Farms reports the following contribution...Ch. 3 - Kylies Cookies is considering the purchase of a...Ch. 3 - Morris Industries manufactures and sells three...Ch. 3 - Manatoah Manufacturing produces 3 models of window...Ch. 3 - Jakarta Company is a service firm with current...Ch. 3 - A company sells mulch by the cubic yard. Grade A...Ch. 3 - A company manufactures and sells blades that are...Ch. 3 - Fill in the missing amounts for the four...Ch. 3 - West Island distributes a single product. The...Ch. 3 - Wellington, Inc., reports the following...Ch. 3 - Karens Quilts is considering the purchase of a new...Ch. 3 - Abilene Industries manufactures and sells three...Ch. 3 - Tim-Buck-Il rents jet skis at a beach resort....Ch. 3 - Fire Company is a service firm with current...Ch. 3 - Mariana Manufacturing and Bellow Brothers compete...Ch. 3 - Roald is the sales manager for a small regional...Ch. 3 - As a manager, you have to choose between two...Ch. 3 - Coutures Creations is considering offering Joe, an...

Additional Business Textbook Solutions

Find more solutions based on key concepts

(Record inventory transactions in the periodic system) Wexton Technologies began the year with inventory of 560...

Financial Accounting (12th Edition) (What's New in Accounting)

The exchange rate, potential risk, transfer pricing, tax law differences and strategies are the items affects t...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

6. Explain why such forecasting devices as moving averages, weighted moving averages, and exponential smoothing...

Operations Management

The meaning of straddle. Introduction: Option is a contract to purchase a financial asset from one party and se...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How is net income calculated? A) Revenues - ExpensesB) Assets - LiabilitiesC) Revenues + LiabilitiesD) Assets + Expensesarrow_forwardWhat does a trial balance check for? A) Net incomeB) Tax amountsC) That total debits equal total creditsD) Cash balances onlyneedarrow_forwardWhat does a trial balance check for? A) Net incomeB) Tax amountsC) That total debits equal total creditsD) Cash balances onlyNo aiarrow_forward

- What does a trial balance check for? A) Net incomeB) Tax amountsC) That total debits equal total creditsD) Cash balances onlyarrow_forwardWhich of the following is a permanent account? A) Utilities ExpenseB) Salaries ExpenseC) Interest RevenueD) Accounts Receivableneedarrow_forwardWhich financial statement shows changes in owner’s equity? A) Income StatementB) Balance SheetC) Statement of Retained EarningsD) Cash Flow Statementarrow_forward

- Which of the following is a permanent account? A) Utilities ExpenseB) Salaries ExpenseC) Interest RevenueD) Accounts Receivableno aiarrow_forwardWhich of the following is a permanent account? A) Utilities ExpenseB) Salaries ExpenseC) Interest RevenueD) Accounts Receivableneedarrow_forwardWhich of the following is a permanent account? A) Utilities ExpenseB) Salaries ExpenseC) Interest RevenueD) Accounts Receivablearrow_forward

- A company receives a utility bill but doesn’t pay it immediately. What is the correct journal entry? A) Debit Utilities Payable, Credit CashB) Debit Utilities Expense, Credit Utilities PayableC) Debit Utilities Expense, Credit Accounts ReceivableD) Debit Cash, Credit Utilities Expensearrow_forwardWhich financial statement shows revenues and expenses? A) Balance SheetB) Statement of Cash FlowsC) Income StatementD) Statement of Financial Positionarrow_forwardWhat is the main purpose of adjusting entries? A) To record transactions after the period endsB) To correct errorsC) To match revenues and expenses in the correct periodD) To close accountscorrectarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License