Concept explainers

Statement of

• LO21–4, LO21–8

Refer to the data provided in the P 21–4 for Dux Company.

Required:

Prepare the statement of cash flows for Dux Company using the indirect method.

P 21–4

Statement of cash flows; direct method

• LO21–3, LO21–8

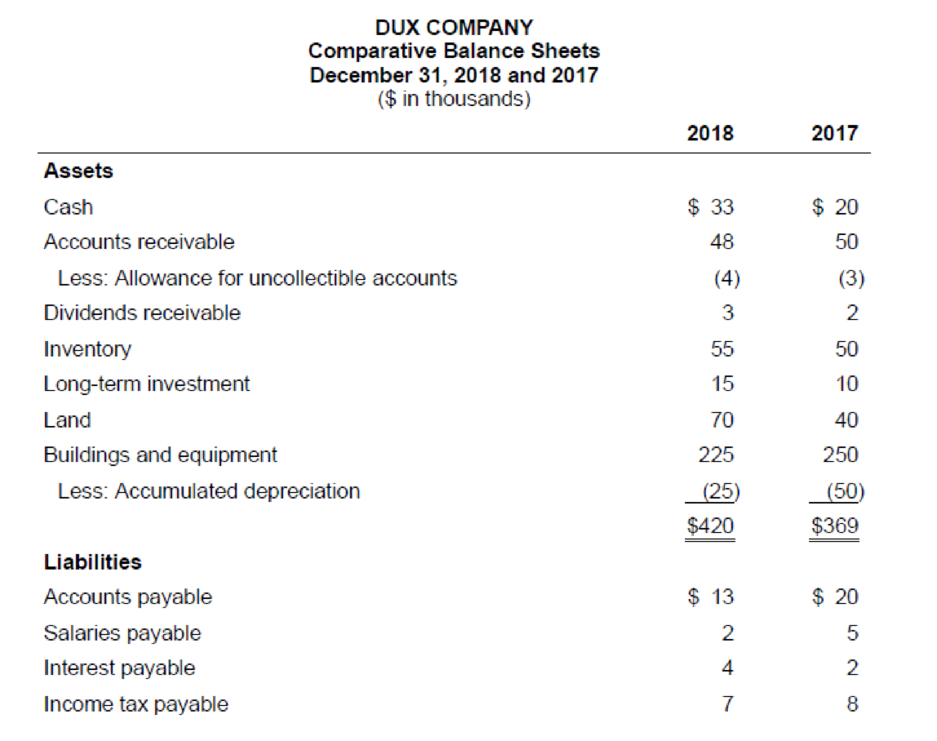

The comparative

Additional information from the accounting records:

- a. A building that originally cost $40,000, and which was three-fourths

depreciated , was sold for $7,000. - b. The common stock of Byrd Corporation was purchased for $5,000 as a long-term investment.

- c. Property was acquired by issuing a 13%, seven-year, $30,000 note payable to the seller.

- d. New equipment was purchased for $15,000 cash.

- e. On January 1, 2018, bonds were sold at their $25,000 face value.

- f. On January 19, Dux issued a 5% stock dividend (1,000 shares). The market price of the $10 par value common stock was $14 per share at that time.

- g. Cash dividends of $13,000 were paid to shareholders.

- h. On November 12, 500 shares of common stock were repurchased as

treasury stock at a cost of $8,000.

Required:

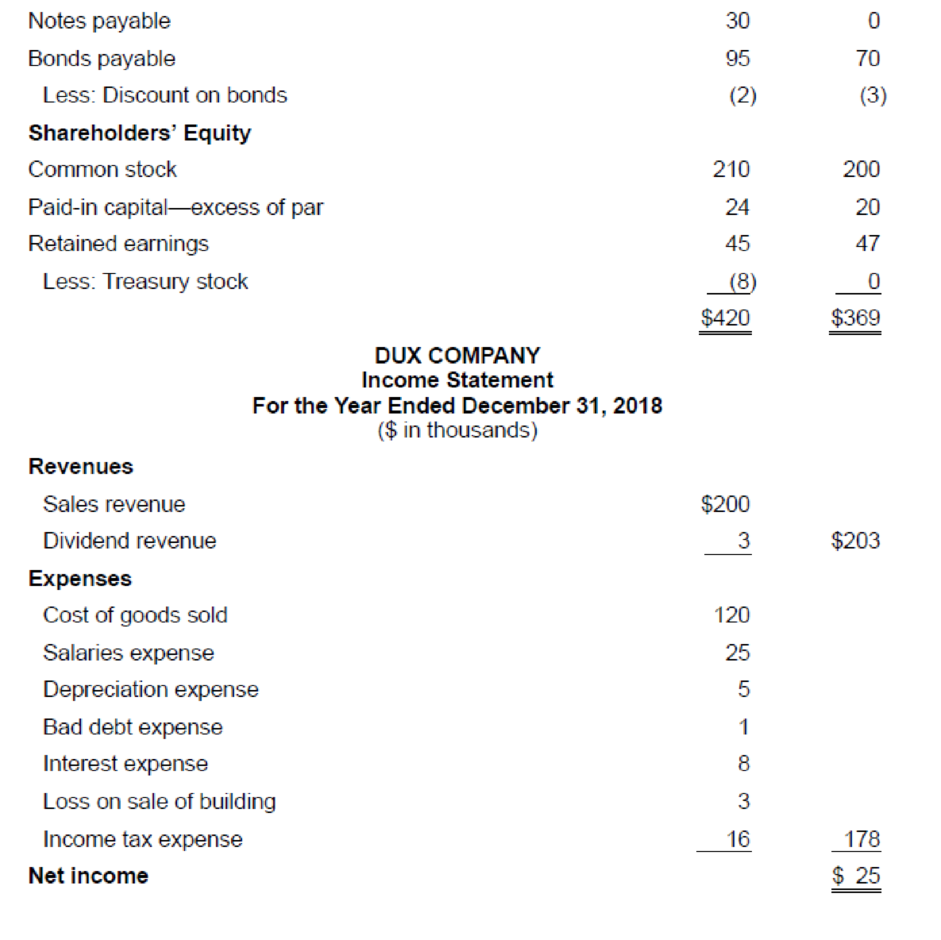

Prepare the statement of cash flows of Dux Company for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (You may omit the schedule to reconcile net income to cash flows from operating activities.)

Statement of cash flows:

Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Cash flows from operating activities:

These refer to the cash received or cash paid in day-to-day operating activities of a company.

Indirect method:

Under this method, the following amounts are to be adjusted from the Net Income to calculate the net cash provided from operating activities.

- Deduct increase in current assets.

- Deduct decrease in current liabilities.

- Add decrease in current assets.

- Add the increase in current liability.

- Add depreciation expense and amortization expense.

- Add loss on sale of plant assets.

- Less gain on sale of plant assets.

Cash flow from investing activities:

This section of cash flows statement provides information concerning about the purchase and sale of capital assets by the company.

- Deduct the amount of cash used to purchase any fixed assets.

- Add the amount of cash received from sale of any fixed asset.

Cash flow from financing activities:

This section of cash flows statement provides information about the cash inflow and outflow as a result of issuance and financing of debt, issue of new stock and payment of dividends.

- Add the amount of cash received from any sources of finance.

- Deduct the amount of cash used for payment for dividend and interest from financing activities.

- Deduct the amount of cash used for payment of treasury stock from financing activities.

To prepare: Statement of cash flow of DUX Company indirect method.

Explanation of Solution

Spreadsheet:

The spreadsheet is a supplementary device which helps to prepare the adjusting entries and the statement of cash flows easier. The spreadsheet is a working tool of the accountant but it is not a permanent accounting record.

Spreadsheet for the Statement of cash flows of DUX Company:

| DUX Company | ||||

| Spreadsheet for the Statement of Cash Flows | ||||

| Amount in Millions | ||||

| Particulars | December 31,2017 Amount ($) | Changes | December 31,2018 Amount ($) | |

| Debit ($) | Credit ($) | |||

| Assets | ||||

| Assets | ||||

| Cash | 20 | (20) 13 | 33 | |

| Accounts receivable | 50 | (5) 2 | 48 | |

| Less: Allowance | (3) | (6) 1 | (4) | |

| Dividends receivable | 2 | (7) 1 | 3 | |

| Inventory | 50 | (8) 5 | 55 | |

| Long term investment | 10 | (13) 5 | 15 | |

| Land | 40 | (14) 30 X | 70 | |

| Buildings and equipment | 250 | (15) 15 | (4) 40 | 225 |

| Less: Acc. depreciation | (50) | (4) 30 | (2) 5 | (25) |

| Total assets | 369 | 420 | ||

| Liabilities and Stockholders’ Equity | ||||

| Liabilities | ||||

| Accounts payable | 20 | (9) 7 | 13 | |

| salaries payable | 5 | (10) 3 | 2 | |

| Interest payable | 2 | (11) 2 | 4 | |

| Income tax payable | 8 | (12) 1 | 7 | |

| Notes payable | 0 | X (14) 30 | 30 | |

| Bonds payable | 70 | (16) 25 | 95 | |

| Less: Discount on bonds | (3) | (3) 1 | (2) | |

| Stockholders’ equity | ||||

| Common Stock | 200 | (17) 10 | 210 | |

| Paid in capital –ex of par | 20 | (17) 4 | 24 | |

| Retained Earnings | 47 | (17) 14 | ||

| (18) 13 | (1) 25 | 45 | ||

| Less: Treasury stock | 0 | (19) 8 | (8) | |

| Total liabilities and stockholders’ equity | 369 | 420 | ||

| Statement of Cash Flows | ||||

| Statement of cash flows | ||||

| Net income | (1) 25 | |||

| Adjustments for noncash effects: | ||||

| Depreciation expense | (2) 5 | |||

| Amortization of discount | (3) 1 | |||

| Loss on sale of building | (4) 3 | |||

| Decrease in accounts receivable | (5) 2 | |||

| Increase in allowance | (6) 1 | |||

| Increase in dividends receivable | (7) 1 | |||

| Increase in inventory | (8) 5 | |||

| Decrease in accounts payable | (9) 7 | |||

| Decrease in salaries payable | (10) 3 | |||

| Increase in interest payable | (11) 2 | |||

| Decrease in income tax payable | (12) 1 | |||

| Net cash flows | 22 | |||

| Investing activities: | ||||

| Sale of building | (4) 7 | |||

| Purchase of long term investment | (13) 5 | |||

| Purchase of equipment | (15) 15 | |||

| Net cash flows | (13) | |||

| Financing activities: | ||||

| Sale of bonds payable | (16) 25 | |||

| Payment of cash dividends | (18) 13 | |||

| Purchase of treasury stock | (19) 8 | |||

| Net cash flows | 4 | |||

| Net increase in cash | (20) 13 | 13 | ||

| Total | 216 | 216 | ||

Table (1)

The spreadsheet of DUX Company shows the analysis of cash flows in the reporting year 2018:

| DUX Company | ||

| Statement of Cash Flows - Indirect Method | ||

| For the year ended December 31, 2018 | ||

| Details | Amount ($ in millions) | Amount ($ in millions) |

| Cash flows from operating activities: | ||

| Net income | 25 | |

| Adjustments to reconcile net income to net cash from operating activities: | ||

| Add: Depreciation expense | 5 | |

| Amortization of discount | 1 | |

| Loss on sale of building | 3 | |

| Changes in operating assets and liabilities: | ||

| Less: Decrease in accounts receivable | 2 | |

| Increase in allowance for uncollectible | 1 | |

| Increase in dividends receivable | (1) | |

| Increase in inventory | (5) | |

| Decrease in accounts payable | (7) | |

| Decrease in salaries payable | (3) | |

| Increase in interest payable | 2 | |

| Decrease in income tax payable | (1) | |

| Net cash provided from operating activities | $22 | |

| Cash flows from investing activities: | ||

| Sale of building | 7 | |

| Purchase of long-term investment | (5) | |

| Purchase of equipment | (15) | |

| Net cash used from investing activities | (13) | |

| Cash flows from financing activities: | ||

| Sale of bonds payable | 25 | |

| Payment of cash dividends | (13) | |

| Purchase of treasury stock | (8) | |

| Net cash provided from financing activities | 4 | |

| Net increase in cash | $13 | |

| Cash balance, January 1 | 20 | |

| Cash balance, December 31 | $33 | |

Table (2)

Note (X):

| Schedule of Non Cash Investing and Financing Activities: | ||

| Purchase of land issuing notes payable | $30 |

Table (3)

Hence, the opening cash balance is $20 million and the closing cash balance is $33 million.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Accounting

- Provide answerarrow_forwardWhat is dora industries actual manufacturing overhead for February?arrow_forwardThe following is a December 31, 2024, post-closing trial balance for Almway Corporation. Account Title Cash Investment in equity securities Accounts receivable Inventory Debits $ 49,000 Credits 114,000 62,000 202,000 Prepaid insurance (for the next 9 months) 5,000 Land 94,000 Buildings 422,000 Accumulated depreciation-buildings $ 102,000 Equipment Accumulated depreciation-equipment 112,000 62,000 Patent (net) Accounts payable Notes payable Interest payable Bonds Payable Common stock Retained earnings 12,000 79,000 136,000 22,000 242,000 306,000 123,000 Totals Additional information: $ 1,072,000 $ 1,072,000 1. The investment in equity securities account includes an investment in common stock of another corporation of $32,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year. 2. The land account includes land which cost $27,000 that the company has not used and is currently listed for sale. 3. The cash…arrow_forward

- 1: Julia Jacobsen files as single on her tax return and earned weekly gross pay of $500. For each period she makes a 401(k) contribution of 2% of gross pay. Julia checked box 2c on Form W-4, entered $40 on line 4c of the form, and did not enter any information in step 3 of the form. Federal income tax withholding = $ 2: Alejandro Wright files as single on his tax return and earned weekly gross pay of $1,300. He does not make any retirement plan contributions. Alejandro entered $500 in step 3 of the form and did not enter any information in steps 2 and 4 of the form. Federal income tax withholding = $ Tentative Federal Income Tax Withholding = $ 3: Beatrice Nen files as married filing jointly on her tax return and earned weekly gross pay of $1,130. For each period she makes a flexible spending account contribution of 5% of gross pay. Beatrice did not enter any information in steps 2-4 of the form. Federal income tax withholding = $arrow_forwardAccounting questionarrow_forwardIn higher education settings, students might encounter fellow classmates with backgrounds, nationalities, and culture-based expectations for conduct that impact the way communication happens. In this scenarioLinks to an external site. about Christine’s experience during class group work, what could the instructor do to better facilitate a good discussion after the classroom incident? How can the instructor ensure that students learn from conflicts that happen and are still willing to engage in real talk about issues that stem from aspects of America’s race-based society?arrow_forward

- Financial accountingarrow_forwardHow many direct labor hours did regal creations havearrow_forward1: Blaine Philips files as married filing jointly on his tax return and earned weekly gross pay of $385. He does not make any retirement plan contributions. Blaine checked box 2c on Form W-4 and did not enter any information in steps 3-4 of the form. Federal income tax withholding = $ 2: Chloe Fineman files as single on her tax return and earned weekly gross pay of $920. For each period she makes a 401(k) contribution of 6% of gross pay. Chloe entered $12,000 on line 4a of Form W-4 and did not enter any information in steps 2 and 3 of the form. Federal income tax withholding = $ 3: Maria Moore files as married filing jointly on her tax return and earned weekly gross pay of $790. For each period she makes a flexible spending account contribution of 3% of gross pay. Maria checked box 2c on Form W-4, entered $500 in step 3 of the form, and did not enter any information in step 4 of the form. Federal income tax withholding = $ Tentative Federal Income Tax Withholding = $arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning