Concept explainers

Prepare a statement of

• LO21–3, LO21–8

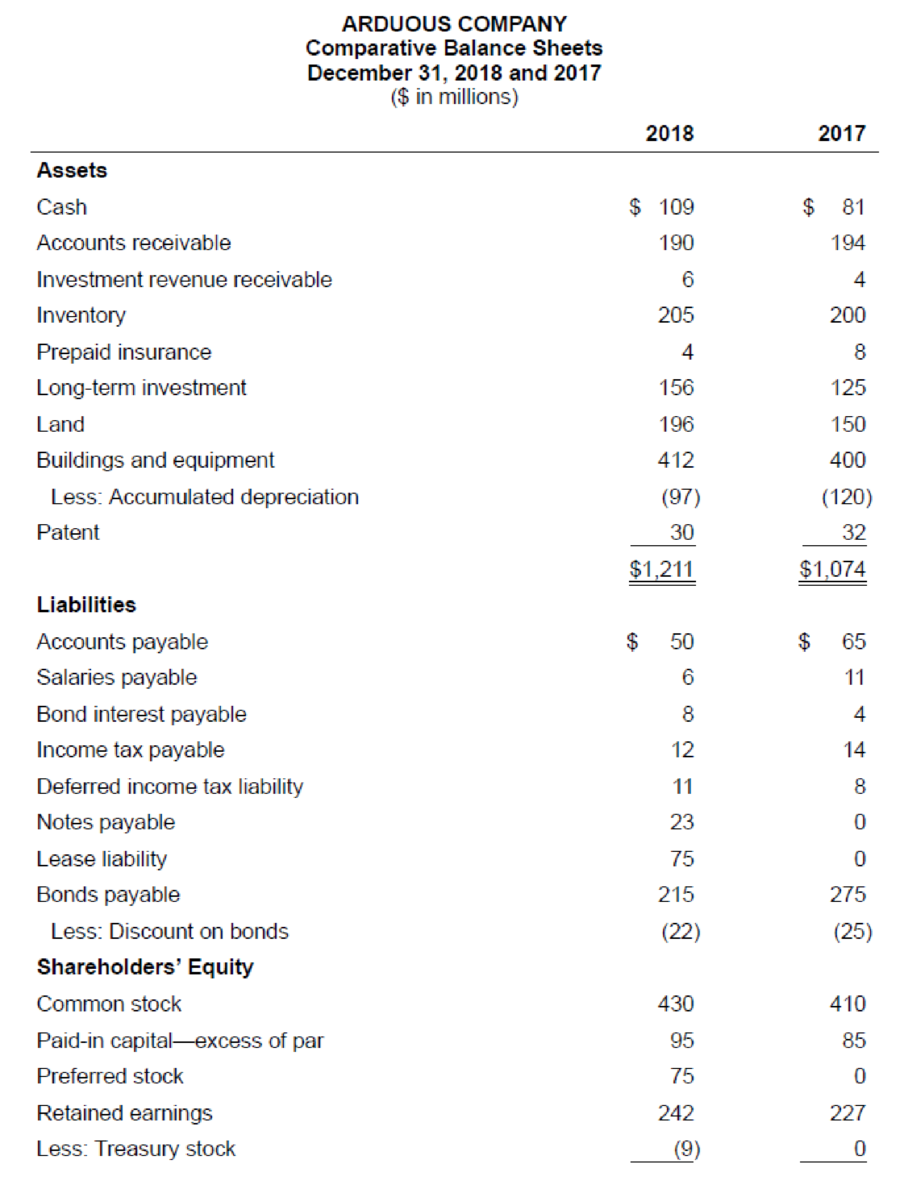

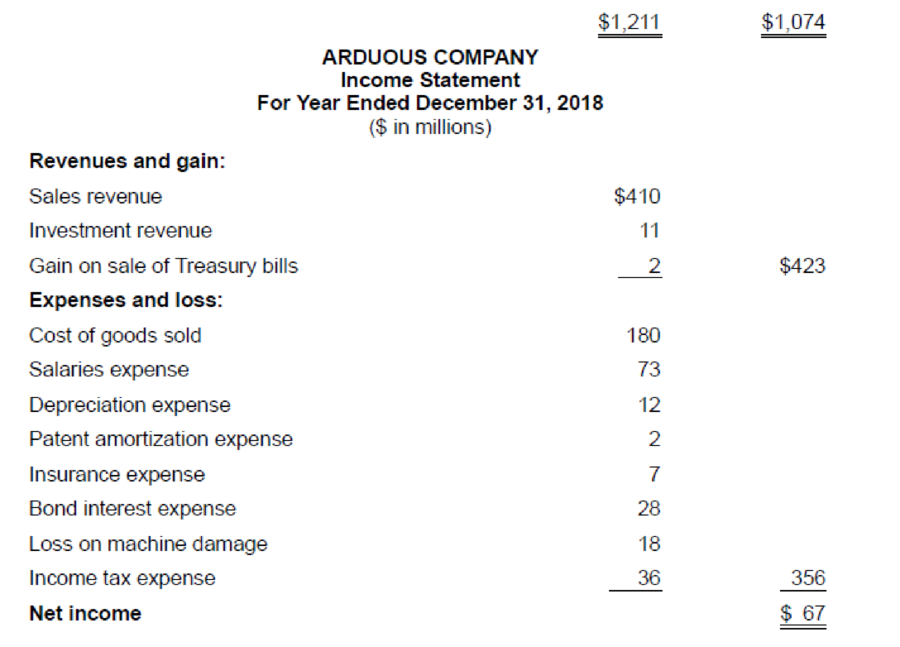

The comparative balance sheets for 2018 and 2017 and the income statement for 2018 are given below for Arduous Company. Additional information from Arduous’s accounting records is provided also.

Additional information from the accounting records:

a. Investment revenue includes Arduous Company’s $6 million share of the net income of Demur Company, an equity method investee.

b. Treasury bills were sold during 2018 at a gain of $2 million. Arduous Company classifies its investments in Treasury bills as cash equivalents.

c. A machine originally costing $70 million that was one-half

d. Temporary differences between pretax accounting income and taxable income caused the

e. The

f. Land costing $46 million was acquired by issuing $23 million cash and a 15%, four-year, $23 million note payable to the seller.

g. The right to use a building was acquired with a 15-year lease agreement; present value of lease payments, $82 million. Annual lease payments of $7 million are paid at the beginning of each year starting January 1, 2018.

h. $60 million of bonds were retired at maturity.

i. In February, Arduous issued a 4% stock dividend (4 million shares). The market price of the $5 par value common stock was $7.50 per share at that time.

j. In April, 1 million shares of common stock were repurchased as

Required:

Prepare the statement of cash flows of Arduous Company for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (A reconciliation schedule is not required.)

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash and result of these transactions is reported as ending balance of cash at the end of reported period.

To Prepare: The statement of cash flows of Company A.

Explanation of Solution

Spreadsheet: The spreadsheet is a supplementary device which helps to prepare the adjusting entries and the statement of cash flows easier. The spreadsheet is a working tool of the accountant but it is not a permanent accounting record.

The spreadsheet, for the statement of cash flow analysis, is shown below.

| Company A | ||||

| Spreadsheet for the Statement of Cash Flows | ||||

| Amount in Millions | ||||

| Particulars | December 31,2017 Amount ($) | Changes | December 31,2018 Amount ($) | |

| Debit ($) | Credit ($) | |||

| Assets | ||||

| Current Assets | ||||

| Cash | $81 | (21) $28 | $109 | |

| Accounts receivable | $194 | (1) $4 | $190 | |

| Investment revenue receivable | $4 | (2) $2 | $6 | |

| Inventory | $200 | (4) $5 | $205 | |

| Prepaid insurance | $8 | (8) $4 | $4 | |

| Long-term investment | $125 | (2) $6 (13) $25 | $156 | |

| Land | $150 | (14) $46* | $196 | |

| Buildings and equipment | $400 | (15) $82* | (10) $70 | $412 |

| Less: Depreciation | ($120) | (10) $35 | (6) $12 | ($97) |

| Patent | $32 | (7) $2 | $30 | |

| Total current assets | $1,074 | $1,211 | ||

| Liabilities and Stockholders’ Equity | ||||

| Liabilities | ||||

| Accounts payable | $65 | (4) $15 | $50 | |

| Salaries payable | $11 | (5) $5 | $6 | |

| Bond interest payable | $4 | (9) $4 | $8 | |

| Income tax payable | $14 | (11) $2 | $12 | |

| Deferred tax liability | $8 | (11) $3 | $11 | |

| Notes payable | $0 | (14) $23* | $23 | |

| Lease liability | $0 | (15) $7 | (15) $82* | $75 |

| Bonds payable | $275 | (16) $60 | $215 | |

| Less: Discount | ($25) | (9) $3 | ($22) | |

| Stockholders’ equity | ||||

| Common Stock | $410 | (17) $20 | $430 | |

| Paid-in capital—excess of par | $85 | (17) $10 | $95 | |

| Preferred stock | $0 | (18) $75 | $75 | |

| Retained Earnings | $227 | (17) $30/ (19) $22 | (12) $67 | $242 |

| Less: Treasury Stock | $0 | (20) $9 | ($9) | |

| Total liabilities and stockholders’ equity | $1,074 | $1,211 | ||

| Income Statement | ||||

| Revenues | ||||

| Sales revenue | (1) $410 | $410 | ||

| Investment revenue | (2) $11 | $11 | ||

| Gain on sale of treasury bills | (3) $2 | $2 | ||

| Expenses | ||||

| Cost of goods sold | (4) $180 | ($180) | ||

| Salaries expense | (5) $73 | ($73) | ||

| Depreciation expense | (6) $12 | ($12) | ||

| Patent amortization expense | (7) $2 | ($2) | ||

| Insurance expense | (8) $7 | ($7) | ||

| Bond interest expense | (9) $28 | ($28) | ||

| Loss on machine damage | (10) $18 | ($18) | ||

| Income tax expense | (11) $36 | ($36) | ||

| Net income | (12) $67 | $67 | ||

| Statement of Cash Flows | ||||

| Operating activities: | ||||

| Cash Inflows: | ||||

| From customers | (1) $414 | |||

| From investment revenue | (2) $3 | |||

| From sale of cash equivalents | (3) $2 | |||

| Cash Outflows: | ||||

| To suppliers of goods | (4) $200 | |||

| To employees | (5) $78 | |||

| For insurance | (8) $3 | |||

| For bond interest | (9) $21 | |||

| For income taxes | (11) $35 | |||

| Net cash flows | $82 | |||

| Investing activities: | ||||

| Sale of machine components | (10) $17 | |||

| Purchase of Long Term investment | (13) $25 | |||

| Purchase of land | (14) $23 | |||

| Net cash flows | ($31) | |||

| Financing activities: | ||||

| Payment on lease liability | (15) $7 | |||

| Retirement of bonds payable | (16) $60 | |||

| Sale of preferred stock | (18) $75 | |||

| Payment of cash dividends | (19) $22 | |||

| Purchase of treasury stock | (20) $9 | |||

| Net cash flows | ($23) | |||

| Net decrease in cash | (21) $28 | $28 | ||

| Total | $1,313 | $1,313 | ||

Table (1)

Operating activities: Operating activities refer to the normal activities of a company to carry out the business. The examples for operating activities are purchase of inventory, payment of salary, sales, and others.

Investing activities: Investing activities refer to the activities carried out by a company for acquisition of long term assets. The examples for investing activities are purchase of equipment, long term investment, sale of land, and others.

Financing activities: Financing activities refer to the activities carried out by a company to mobilize funds to carry out the business activities. The examples for financing activities are purchase of bonds, issuance of common shares, and others.

The spreadsheet of Company A shows the analysis of cash flows in the reporting year 2018.

| Company A | ||

| Statement of Cash Flows | ||

| For year ended December 31, 2018 | ||

| Amount in Millions | ||

| Particulars | Amount ($) | Amount ($) |

| Operating activities: | ||

| Cash Inflows: | ||

| From customers | $414 | |

| From investment revenue | $3 | |

| From sale of cash equivalents | $2 | |

| Cash Outflows: | ||

| To suppliers of goods | ($200) | |

| To employees | ($78) | |

| For insurance | ($3) | |

| For bond interest | ($21) | |

| For income taxes | ($35) | |

| Net cash flows from operating activities | $82 | |

| Investing activities: | ||

| Sale of machine components | $17 | |

| Purchase of Long Term investment | ($25) | |

| Purchase of land | ($23) | |

| Net cash flows from investing activities | ($31) | |

| Financing activities: | ||

| Payment on lease liability | ($7) | |

| Retirement of bonds payable | ($60) | |

| Sale of preferred stock | $75 | |

| Payment of cash dividends | ($22) | |

| Purchase of treasury stock | ($9) | |

| Net cash flows from financing activities | ($23) | |

| Net decrease in cash | $28 | |

| Cash balance, January 1, 2018 | $81 | |

| Cash balance, December 31, 2018 | $109 | |

Table (2)

The statement of cash flows of Company A, shows opening balance of cash flows for the reporting year 2018 as $81 million and the closing balance of cash as $109 million.

Note:

*Non Cash investing activity and financing activity:

- Company A acquired a building on 15 year lease for $82 million.

- Company A acquired a land for $46 million, by:

- Paying Cash of $23 million;

- Issuing 4-year note for $23 million.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Accounting

- Can you help me solve this general accounting problem using the correct accounting process?arrow_forwardNet Income Calculation A company has the following financial information for the year: Revenue: $100,000 Cost of Goods Sold: $60,000 Operating Expenses: $20,000What is the company's net income?arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniquesarrow_forward

- If a company has current assets of $80,000 and current liabilities of $50,000, what is its working capital? Needarrow_forwardIf a company has current assets of $80,000 and current liabilities of $50,000, what is its working capital?arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forward

- On January 1, XYZ Corp. purchases inventory for $5,000 on credit. What is the journal entry for this transaction?arrow_forwardWhat is general accounting? give correct answer . need help in thisarrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanationarrow_forward

- Please provide the answer to this general accounting question with proper steps.arrow_forwardI am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forwardGive correct answer Global Fitness LLC reported a debt-to-equity ratio of 1.5 times at the end of 2024. If the firm's total assets at year-end were $36.8 million, how much of their assets are financed with equity?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning