Analysis Case 21–5

Smudged ink; find missing amounts

• LO21–3, LO21–4

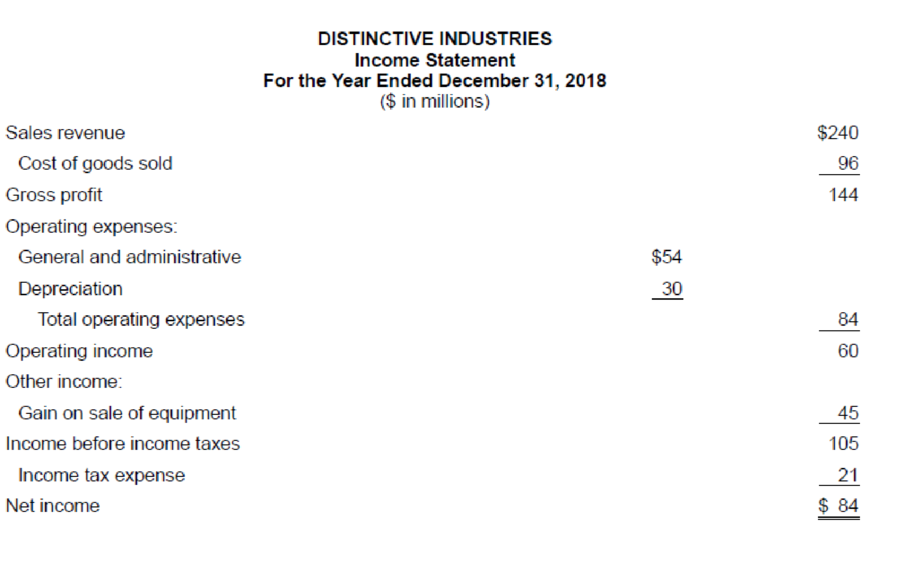

“Be careful with that coffee!” Your roommate is staring in disbelief at the papers in front of her. “This was my contribution to our team project,” she moaned. “When you spilled your coffee, it splashed on this page. Now I can’t recognize some of these numbers, and Craig has my source documents.”

Knowing how important this afternoon’s presentation is to your roommate, you’re eager to see what can be done. “Let me see that,” you offer. “I think we can figure this out.” The statement of

Required:

1. Determine the missing amounts.

2. Reconstruct the reconciliation of net income to cash flows from operating activities (operating cash flows using the indirect method).

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

Intermediate Accounting

- The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the asset Help!arrow_forwardNo AI The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardWhich item would appear on the statement of retained earnings?A. DividendsB. InventoryC. Prepaid RentD. Notes Payablearrow_forward

- What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetno aiarrow_forward4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetneed helparrow_forward

- 4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardA contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s importantDont use AIarrow_forwardA contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s important need helparrow_forward

- A contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s importantarrow_forwardNo chatgpt 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forwardNeed help hi 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forward

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning