Concept explainers

Statement of

• LO21–3, LO21–8

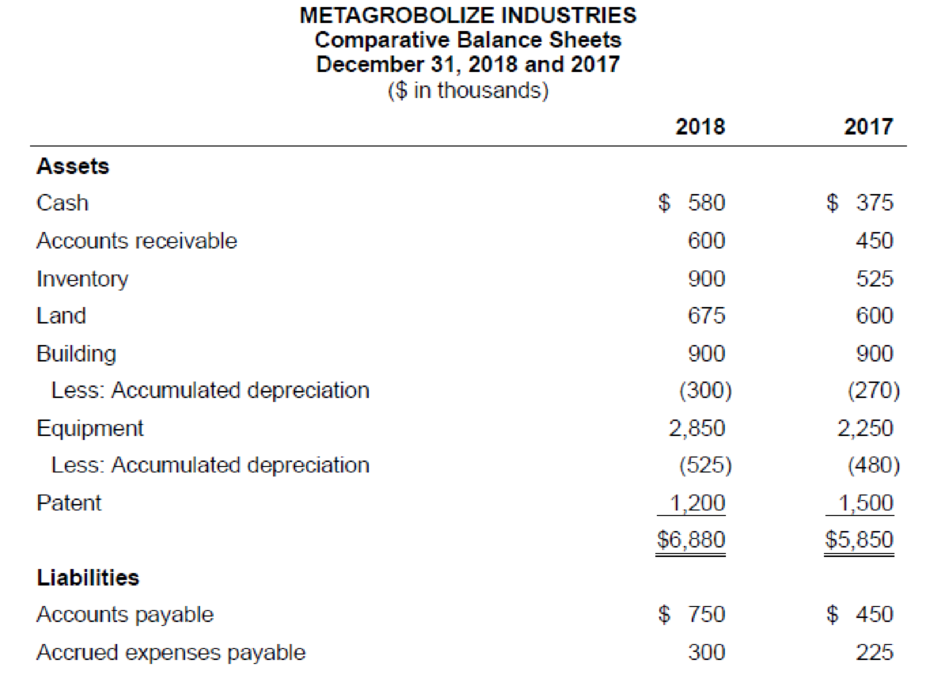

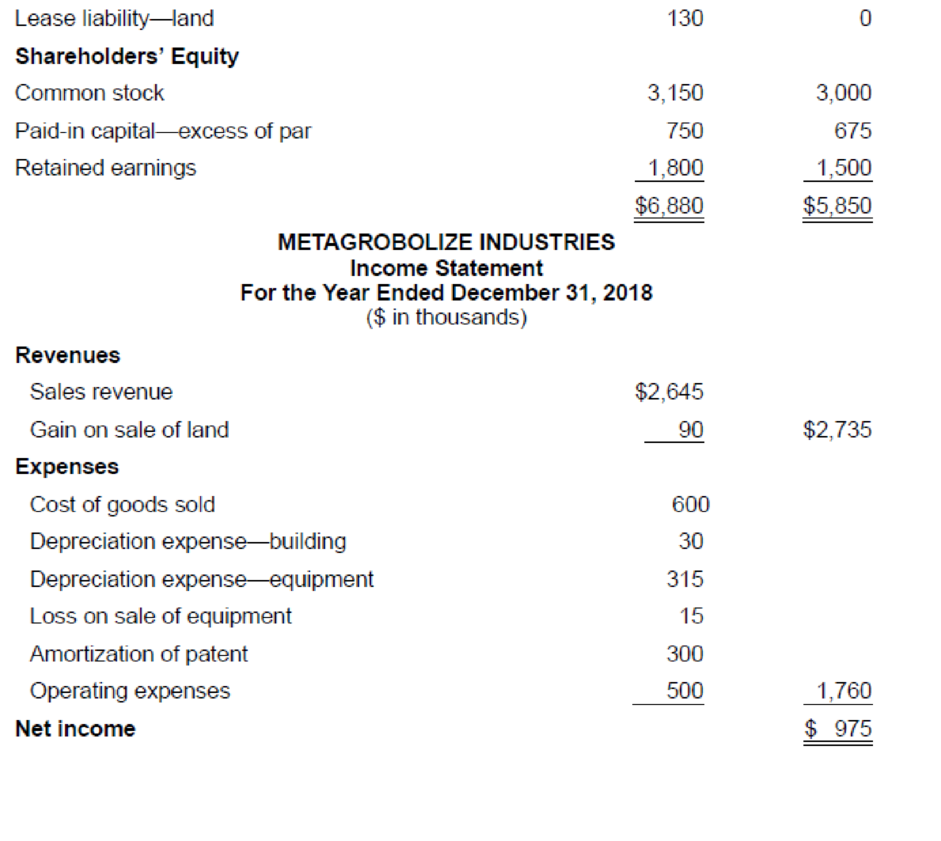

Comparative balance sheets for 2018 and 2017 and a statement of income for 2018 are given below for Metagrobolize Industries. Additional information from the accounting records of Metagrobolize also is provided.

Additional information from the accounting records:

a. Annual payments of $20,000 on the finance lease liability are paid each January 1, beginning in 2018.

b. During 2018, equipment with a cost of $300,000 (90%

c. The statement of shareholders’ equity reveals reductions of $225,000 and $450,000 for stock dividends and cash dividends, respectively.

Required:

Prepare the statement of cash flows of Metagrobolize for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (You may omit the schedule to reconcile net income to cash flows from operating activities.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

Intermediate Accounting

- 9. In a bank reconciliation, a bank service charge would be:A. Deducted from the book balanceB. Added to the bank balanceC. Deducted from the bank balanceD. Ignoredarrow_forwardWhich statement is prepared first in the accounting cycle?A. Balance SheetB. Statement of Retained EarningsC. Income StatementD. Cash Flow Statement need helparrow_forward10. Which statement is prepared first in the accounting cycle?A. Balance SheetB. Statement of Retained EarningsC. Income StatementD. Cash Flow Statementhelp mearrow_forward

- I need help The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardNo use chatgpt 1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forward1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forward

- Don't use chatgpt The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardThe normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetneed help in this .arrow_forwardThe normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the asset Help!arrow_forward

- No AI The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardWhich item would appear on the statement of retained earnings?A. DividendsB. InventoryC. Prepaid RentD. Notes Payablearrow_forwardWhat does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning