Concept explainers

a)

To determine: The suitable outsourcing provider using factor- rating method.

Introduction:

Factor-rating method:

The factor-rating method is a quantitative approach to make a decision from various alternatives such that the decision is beneficial to the firm involved. This method is utilized to decide on new layout, new locations, best supplier, outsourcing providers etc.

a)

Answer

The suitable outsourcing provider is Canada.

Explanation of Solution

Given information:

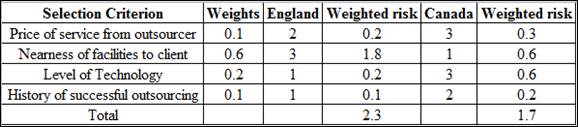

| Selection criterion | Weight | England | Canada |

| Price of service from outsourcer | 0.1 | 2 | 3 |

| Nearness of facilities to client | 0.6 | 3 | 1 |

| Level of technology | 0.2 | 1 | 3 |

| History of successful outsourcing | 0.1 | 1 | 2 |

Low Risk = 1

High Risk = 3

Formula to calculate weighted risk:

Formula to calculate Total weighted risk:

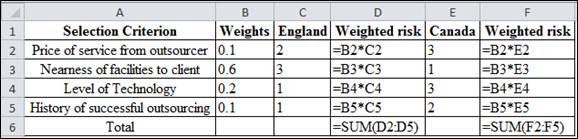

Excel Formula:

Calculation of weighted risk for England:

The weighted risk is calculated my multiplying the weights with risk rating of each criteria.

The weighted risk is calculated as follows:

Service from outsourcer:

The weighted risk for price of service from outsourcer is 0.2.

Nearness of facilities to client:

The weighted risk for Nearness of facilities to client is 1.8.

Level of Technology:

The weighted risk for Level of Technology is 0.2.

History of successful outsourcing:

The weighted risk for History of successful outsourcing is 0.1.

Calculation of Total weighted risk:

The total weighted risk is calculated be summing all the weighted risk values.

The total weighted risk for England is 2.3.

Calculation of weighted risk for Canada:

The weighted risk is calculated my multiplying the weights with risk rating of each criteria.

The weighted risk is calculated as follows:

Price of service from outsourcer:

The weighted risk for price of service from outsourcer is 0.3.

Nearness of facilities to client:

The weighted risk for nearness of facilities to client is 0.6.

Level of Technology:

The weighted risk for Level of Technology is 0.6.

History of successful outsourcing:

The weighted risk for History of successful outsourcing is 0.2.

Calculation of Total weighted risk:

The total weighted risk is calculated be summing all the weighted risk values.

The total weighted risk for Canada is 1.7.

The weighted risk value for England is 2.3. The weighted risk value for Canada is 1.7. Since, the risk value for Canada is less for England (1.7 < 2.3), Canada is selected.

The suitable outsourcing provider is Canada.

b)

To determine: The impact of doubling the weights used in part (a).

Introduction:

Factor-rating method:

The factor-rating method is a quantitative approach to make a decision from various alternatives such that the decision is beneficial to the firm involved. This method is utilized to decide on new layout, new locations, best supplier, outsourcing providers etc.

b)

Answer

The Doubling of weights will have No Change.

Explanation of Solution

Given information:

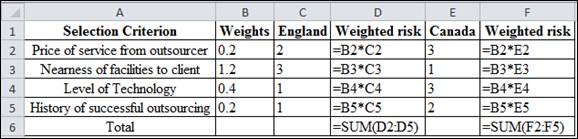

| Selection criterion | Weight | England | Canada |

| Price of service from outsourcer | 0.2 | 2 | 3 |

| Nearness of facilities to client | 1.2 | 3 | 1 |

| Level of technology | 0.4 | 1 | 3 |

| History of successful outsourcing | 0.2 | 1 | 2 |

Low Risk = 1

High Risk = 3

Formula to calculate weighted risk:

Formula to calculate Total weighted risk:

Excel Formula:

Calculation of weighted risk for England:

The weighted risk is calculated my multiplying the weights with risk rating of each criteria.

The weighted risk is calculated as follows:

Price of service from outsourcer:

The weighted risk for price of service from outsourcer is 0.4.

Nearness of facilities to client:

The weighted risk for nearness of facilities to client is 3.6.

Level of Technology:

The weighted risk for Level of Technology is 0.4.

History of successful outsourcing:

The weighted risk for History of successful outsourcing is 0.2.

Calculation of Total weighted risk:

The total weighted risk is calculated be summing all the weighted risk values.

The total weighted risk for England is 4.6.

Calculation of weighted risk for Canada:

The weighted risk is calculated my multiplying the weights with risk rating of each criteria.

The weighted risk is calculated as follows:

Price of service from outsourcer:

The weighted risk for price of service from outsourcer is 0.6.

Nearness of facilities to client:

The weighted risk for nearness of facilities to client is 1.2.

Level of Technology:

The weighted risk for Level of Technology is 1.2.

History of successful outsourcing:

The weighted risk for History of successful outsourcing is 0.4.

Calculation of Total weighted risk:

The total weighted risk is calculated be summing all the weighted risk values.

The total weighted risk for Canada is 3.4.

The weighted risk value for England is 4.6. The weighted risk value for Canada is 3.4. Since, the risk value for Canada is less for England (3.4 < 4.6), Canada is selected.

The doubling of weights of the risk avoidance criteria does not alter the result arrived at in part (a). The weighted risk value is doubled for England and Canada. But, the risk value of Canada is still lower than England. The result will not change irrespective of doubling the weights because the risk avoidance criterion value is unaltered.

Hence, the Doubling of weights will have No Change.

Want to see more full solutions like this?

Chapter 2 Solutions

Pearson eText Principles of Operations Management: Sustainability and Supply Chain Management -- Instant Access (Pearson+)

- Please help me expand upon my research even more in detail please. Need help added more to mine from the photos please. Not sure what more I can add.arrow_forwardHow can HR proactively help ensure that other departments are operating in a legally acceptable manner? Answers Deliver interdepartmental training on legal compliance and requirements. Discuss potential sources of risk with an attorney and create a plan to respond to lawsuits. Ensure that all HR members are watching the conduct of other departments and report infractions to the head of HR. Record improper conduct from various employees throughout the organization and pursue disciplinary measures.arrow_forwardCan you guys help me with this? Thank you! Project is Terminal 1 at JFK International Airport Question: Risk management content: Discuss a major risk management event that affected the project (Keep this content about 2 minute talking and please provide actual sources that you have the information to go over this)arrow_forward

- use the screenshot to find the anwser to this If the project finishes within 27 weeks of its start, the project manager receives a $500 bonus. What is the probability of a $500 bonus? Note: Round z-value to 2 decimal places, and probability to 4 decimal places.arrow_forwardScan To Pay Log into your own Lightning UPI account of supporting app and scan QR code below to pay! ✰ BINANCEarrow_forwardTo help with preparations, a couple has devised a project network to describe the activities that must be completed by their wedding date. Start A Ꭰ F B E The following table lists the activity time estimates (in weeks) for each activity. Optimistic Most Probable Activity Pessimistic A 4 5 6 B 2.5 3 3.5 C 5 6 7 D 5 5.5 9 E 5 7 9 F 2 3 4 G 7 9 11 H 5 6 13 H Finish Based only on the critical path, what is the estimated probability that the project will be completed within the given time frame? (Round your answers to four decimal places.) (a) Within 19 weeks? (b) Within 21 weeks? (c) Within 25 weeks?arrow_forward

- You may need to use the appropriate technology to answer this question. Mueller Associates is a urban planning firm that is designing a new public park in an Omaha suburb. Coordination of the architect and subcontractors will require a major effort to meet the 46-week completion date requested by the owner. The Mueller project manager prepared the following project network. B H Start A C G Finish E Estimates of the optimistic, most probable, and pessimistic times (in weeks) for the activities are as follows. Activity Optimistic Most Probable Pessimistic A 4 12 B 6 7 8 C 6 18 D 3 5 7 E 6 9 18 F 5 8 17 G 10 15 20 H 5 13 (a) Find the critical path. (Enter your answers as a comma-separated list.) (b) What is the expected project completion time (in weeks)? weeks i (c) Based only on the critical path, what is the estimated probability the project can be completed in 46 weeks as requested by the owner? (Round your answer to four decimal places.) (d) Based only on the critical path, what is…arrow_forwardBridge City Developers is coordinating the construction of an office complex. As part of the planning process, the company generated the following activity list. Draw a project network that can be used to assist in the scheduling of the project activities. Activity Immediate Predecessor ABC E FGH ] A, B A, B D E с с F, G, H, I A E Start B D A E Start B D H H E A E Finish Start D F J Finish Start B D F Finish Finish C H I Harrow_forwardHow can mindfulness be combined with cognitive reframing to build emotional regulation and mental flexibility? What is the strategy for maintaining mental well-being to improve through deliberate practice? How to engage in practices that help regulate emotions and build resilience?arrow_forward

- • We Are HIRING Salesforce Developer (2 - 4 Years) @ Cloudodyssey It Solutions Requirement : Appropriate knowledge on Salesforce standard objects Leads, Account, Contacts, Opportunity, Products, Lead process, Sales process, is required. • Hands-on experience in Salesforce Experience Cloud, Sales Cloud and Lightning. • • Hands experience with Salesforce development, administration, system integrations, Lightning Design System, and bug fixes. Experience in configuration, integration, APIs creation, testing and deployment of Salesforce.com functionality. Eloquent verbal and written communication skills. • Familiar with Agile framework. Work Location: Bangalore SUBMIT YOUR CV hello@cloudodyssey.coarrow_forwardAgree or disagree with post On the surface, the numbers in financial statements do present a snapshot of a company's financial position and performance. However, just looking at the raw numbers often doesn't tell the whole story or reveal underlying trends and relationships that are crucial for making informed decisions. Think of it like looking at individual pieces of a puzzle. Each number is a piece, providing some information. But to see the complete picture – the company's overall financial health, its performance over time, how it compares to its peers, and its potential future – you need to assemble those pieces using different analytical tools. For example: Horizontal analysis helps us understand how specific financial statement items have changed over multiple periods. Is revenue growing? Are expenses increasing at a faster rate than sales? This reveals trends that a single year's numbers wouldn't show. Vertical analysis allows us to see the relative size of each item within…arrow_forwardWhat can you do in response to an insulting offer?arrow_forward

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing