Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 16E

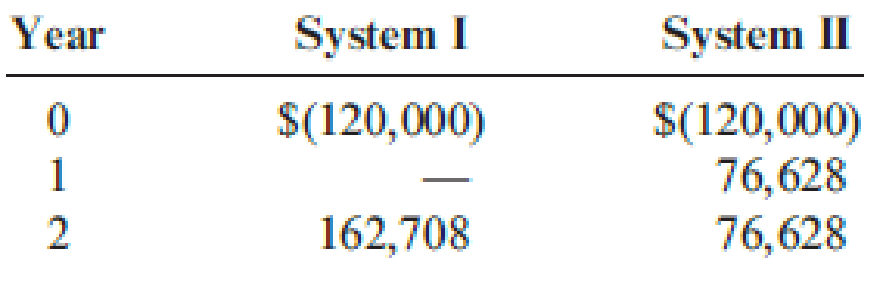

Covington Pharmacies has decided to automate its insurance claims process. Two networked computer systems are being considered. The systems have an expected life of two years. The net

The company’s cost of capital is 10 percent.

Required:

- 1. Compute the

NPV and theIRR for each investment. - 2. Show that the project with the larger NPV is the correct choice for the company.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Lacy is a single taxpayer. In 2024, her taxable income is $56,000. What is her tax liability in each of the following alternative situations.Her $56,000 of taxable income includes $10,000 of qualified dividends. What is her tax liability?

Accounting problem

Please help me this question solution

Chapter 19 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 19 - Explain the difference between independent...Ch. 19 - Explain why the timing and quantity of cash flows...Ch. 19 - Prob. 3DQCh. 19 - Prob. 4DQCh. 19 - What is the accounting rate of return?Ch. 19 - What is the cost of capital? What role does it...Ch. 19 - Prob. 7DQCh. 19 - Explain how the NPV is used to determine whether a...Ch. 19 - Explain why NPV is generally preferred over IRR...Ch. 19 - Prob. 10DQ

Ch. 19 - Prob. 11DQCh. 19 - Prob. 12DQCh. 19 - Prob. 13DQCh. 19 - Prob. 14DQCh. 19 - Prob. 15DQCh. 19 - Jan Booth is considering investing in either a...Ch. 19 - Prob. 2CECh. 19 - Carsen Sorensen, controller of Thayn Company, just...Ch. 19 - Manzer Enterprises is considering two independent...Ch. 19 - Keating Hospital is considering two different...Ch. 19 - Prob. 6CECh. 19 - Prob. 7ECh. 19 - Prob. 8ECh. 19 - Each of the following scenarios is independent....Ch. 19 - Roberts Company is considering an investment in...Ch. 19 - NPV A clinic is considering the possibility of two...Ch. 19 - Refer to Exercise 19.11. 1. Compute the payback...Ch. 19 - Buena Vision Clinic is considering an investment...Ch. 19 - Consider each of the following independent cases....Ch. 19 - Gina Ripley, president of Dearing Company, is...Ch. 19 - Covington Pharmacies has decided to automate its...Ch. 19 - Postman Company is considering two independent...Ch. 19 - Prob. 18ECh. 19 - Prob. 19ECh. 19 - Prob. 20ECh. 19 - Assume there are two competing projects, X and Y....Ch. 19 - Prob. 22ECh. 19 - Assume that an investment of 100,000 produces a...Ch. 19 - Prob. 24PCh. 19 - Prob. 25PCh. 19 - Prob. 26PCh. 19 - Kent Tessman, manager of a Dairy Products...Ch. 19 - Friedman Company is considering installing a new...Ch. 19 - Okmulgee Hospital (a large metropolitan for-profit...Ch. 19 - Mallette Manufacturing, Inc., produces washing...Ch. 19 - Jonfran Company manufactures three different...Ch. 19 - Prob. 32P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Debt equity ratioarrow_forwardPlease help me with part B of this problem. I am having trouble. Fill all necessary cells as shown. I have provided the dropdown that includes the accounts.arrow_forwardWhat is a good response to this post? My chosen product is an ergonomic pet bed similar to a large bean bag called a Pooch Poof. And my proposed markets are the United States, as it currently has the largest share of pet product sales, Europe as the pet population is 324.4 million currently, and South America, as this country is expected to be one of the fastest growing markets for pet accessories and food (Shahbandeh, 2024). With my product in two stable markets, and one emerging market, financial risks will be minimized as much as possible when expanding into the emerging market of South America by the stability of the American and European markets that are established. My slogan will be “Pamper your pooch with softness and watch your worries about your pup’s good night sleep go “Poof”. A “poofed” pet is a proper pet!” This slogan works as in the United States and Europe, dogs are generally considered family members, and allowed in public spaces, and socialization, training, health…arrow_forward

- What is its debt to equity ratio for WACC purposes?arrow_forwardWhat is its debt to equity ratio for WACC purposes? Accountingarrow_forwardWhat is a good response to this post? In this week’s discussion, we will consider product slogans and expansion into other countries. For my post, I will be focusing on make-up brand Merit Beauty. It is a vegan beauty brand that focuses on minimalist beauty and offers kits that have all five pieces for ease of application and enhances the natural beauty of the wearer (Fallon, 2024). My slogan: “Where less is more and looking good is easy” The countries I would like to expand marketing to are: Singapore: The country focuses on health and beauty with emphasis on wellbeing and the country has a comprehensive offering of insurance, both private and national insurance, along with initiatives to promote wellbeing (GCPIT, n.d.). Additionally, the makeup market had total revenues of $221.4 million in 2023 which was an annual growth rate of 3.7% between 2018 and 2023 (Marketline, 2024). France: France too has a commitment to offering clean products to their citizens and have been know as one…arrow_forward

- Please find the interest revenue HELParrow_forwardAns plzarrow_forwardToodles Inc. had sales of $1,840,000. Cost of goods sold,administrative and selling expenses, and depreciation expenses were $1,180,000, $185,000 and $365,000 respectively. In addition, the company had an interest expense of $280,000 and a tax rate of 35 percent. (Ignore any tax loss carry-back or carry-forward provisions.)Arrange the financial information for Toodles Inc. in an income statement and compute its OCF?arrow_forward

- Anti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000; Costs = $2,173,000; Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes = $76,000; Dividends = $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed. a) Compute the cash flow from assets b) Compute the net change in working capitalarrow_forwardAnswer the questions in the attached imagearrow_forwardAuditor should assess the likelihood of --------- when identifying potential criteria for the audit. material misstatement wrong answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License