Concept explainers

Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for $6 million). Although the existing system will be fully

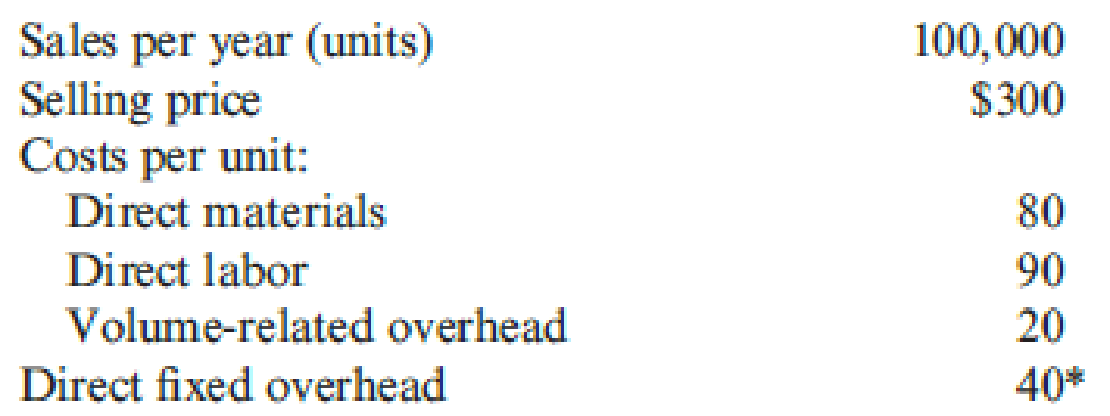

The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department:

*All cash expenses with the exception of depreciation, which is $6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered.

The automated system will cost $34 million to purchase, plus an estimated $20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for $3 million.

The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related

The firm’s cost of capital is 12 percent, but management chooses to use 20 percent as the required

Required:

- 1. Compute the

net present value for the old system and the automated system. Which system would the company choose? - 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate.

- 3. Upon seeing the projected sales for the old system, the marketing manager commented: “Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year.” Repeat the net present value analysis, using this new information and a 12 percent discount rate.

- 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for $4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate.

- 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.

1.

Ascertain the net present value for both the old and automated system, and state the system that the company would choose.

Explanation of Solution

Net present value method (NVP): Net present value method is the method which is used to compare the initial cash outflow of investment with the present value of its cash inflows. In the net present value, the interest rate is desired by the business based on the net income from the investment, and it is also called as the discounted cash flow method.

Ascertain the net present value for both the old and automated system, and state the system that the company would choose:

For Old system (in thousands):

| Year | Revenue | Expenses | Depreciation after tax | Cash flow | Discount factor @ 20% | Present value |

| (1) (a) | (2) (b) | (3) (c) | (e) | |||

| 1 | $18,000 | ($13,440) | $240 | 4,800 | 0.833 | 3,998 |

| 2 | $18,000 | ($13,440) | $240 | 4,800 | 0.694 | 3,331 |

| 3 | $18,000 | ($13,440) | $240 | 4,800 | 0.579 | 2,779 |

| 4 | $18,000 | ($13,440) | $240 | 4,800 | 0.482 | 2,314 |

| 5 | $18,000 | ($13,440) | $240 | 4,800 | 0.402 | 1,930 |

| 6 | $18,000 | ($13,440) | $240 | 4,800 | 0.335 | 1,608 |

| 7 | $18,000 | ($13,440) | $240 | 4,800 | 0.279 | 1,339 |

| 8 | $18,000 | ($13,440) | $240 | 4,800 | 0.233 | 1,118 |

| 9 | $18,000 | ($13,440) | $240 | 4,800 | 0.194 | 931 |

| 10 | $18,000 | ($13,440) | - | 4,560 | 0.162 | 739 |

| 20,088 | ||||||

| Less: Initial investment | 0 | |||||

| Net present value | 20,088 | |||||

Table (1)

Working note (1):

Compute the amount of revenue:

Working note (2):

Compute the amount of expense:

Working note (3):

Compute the amount of after tax depreciation expense:

For New system (in thousands):

| Year | Revenue | Expenses | Depreciation after tax | Cash flow | Discount factor | Present value |

| (1) (a) | (4) (b) | (6) (c) | (e) | |||

| 0 | (50,040) (7) | 1.000 | $(50,040) | |||

| 1 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.833 | 3,998 |

| 2 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.694 | 3,331 |

| 3 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.579 | 2,779 |

| 4 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.482 | 2,314 |

| 5 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.402 | 1,930 |

| 6 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.335 | 1,608 |

| 7 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.279 | 1,339 |

| 8 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.233 | 1,118 |

| 9 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.194 | 931 |

| 10 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.162 | 739 |

| Net present value | 2,025 | |||||

Table (2)

Working note (4):

Step 1: Compute the total cost:

| Particulars | Total cost |

| Direct materials | $60 |

| Direct labor | $36 |

| Volume-related overhead | $16 |

| Direct fixed overhead | $17 |

| Unit cost | $129 |

Table (3)

Step 2: Compute the amount of expense:

Working note (5):

Compute the loss on sale of old machinery:

Working note (6):

Compute the depreciation expense for cash outflow:

Working note (7):

Compute the cash outflow:

Description:

The company should choose the old system because it has the higher net present value.

2.

Ascertain the net present value for both the old and automated system under 12% discount rate, and state the system that the company would choose.

Explanation of Solution

Ascertain the net present value for both the old and automated system under 12% discount rate, and state the system that the company would choose:

For Old system (in thousands):

| Year | Revenue | Expenses | Depreciation after tax | Cash flow | Discount factor | Present value |

| (1) (a) | (2) (b) | (3) (c) | (e) | |||

| 1 | $18,000 | ($13,440) | $240 | 4,800 | 0.893 | 4,286 |

| 2 | $18,000 | ($13,440) | $240 | 4,800 | 0.797 | 3,826 |

| 3 | $18,000 | ($13,440) | $240 | 4,800 | 0.712 | 3,418 |

| 4 | $18,000 | ($13,440) | $240 | 4,800 | 0.636 | 3,053 |

| 5 | $18,000 | ($13,440) | $240 | 4,800 | 0.567 | 2,722 |

| 6 | $18,000 | ($13,440) | $240 | 4,800 | 0.507 | 2,434 |

| 7 | $18,000 | ($13,440) | $240 | 4,800 | 0.452 | 2,170 |

| 8 | $18,000 | ($13,440) | $240 | 4,800 | 0.404 | 1,939 |

| 9 | $18,000 | ($13,440) | $240 | 4,800 | 0.361 | 1,733 |

| 10 | $18,000 | ($13,440) | - | 4,560 | 0.322 | 1,468 |

| 27,048 | ||||||

| Less: Initial investment | 0 | |||||

| Net present value | 27,048 | |||||

Table (4)

For New system (in thousands):

| Year | Revenue | Expenses | Depreciation after tax | Cash flow | Discount factor | Present value |

| (1) (a) | (4) (b) | (6) (c) | (e) | |||

| 0 | (50,040) (7) | 1.000 | $(50,040) | |||

| 1 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.893 | 11,091 |

| 2 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.797 | 9,899 |

| 3 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.712 | 8,843 |

| 4 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.636 | 7,899 |

| 5 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.567 | 7,042 |

| 6 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.507 | 6,297 |

| 7 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.452 | 5,614 |

| 8 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.404 | 5,018 |

| 9 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.361 | 4,484 |

| 10 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.322 | 3,999 |

| Net present value | 20,145 | |||||

Table (5)

Description:

The company should choose the old system because it has the higher net present value. However when using 12% discount rate, the automated system becomes more attractive because under 10% discount rate the NPV was $ 2,025, whereas under 12% discount rate the NPV was $ 20,145.

3.

Ascertain the net present value for the 12% discount rate using this given information.

Explanation of Solution

Ascertain the net present value for the 12% discount rate using this given information.

| Year | Revenue | Expenses | Depreciation after tax | Cash flow | Discount factor | Present value |

| (8) (a) | (9) (b) | (6) (c) | (e) | |||

| 0 | $0 | 1.000 | $0 | |||

| 1 | $18,000 | ($13,440) | $240 | 4,800 | 0.893 | 4,286 |

| 2 | $16,200 | (12,300) | $240 | 4,140 | 0.797 | 3,300 |

| 3 | $14,400 | (11,160) | $240 | 3,480 | 0.712 | 2,478 |

| 4 | $12,600 | (10,020) | $240 | 2,820 | 0.636 | 1,794 |

| 5 | $10,800 | (8,880) | $240 | 2,160 | 0.567 | 1,225 |

| 6 | $9,000 | ($7,740) | $240 | 1,500 | 0.507 | 761 |

| 7 | $7,200 | (6,600) | $240 | 840 | 0.452 | 380 |

| 8 | $5,400 | (5,460) | $240 | 180 | 0.404 | 73 |

| 9 | $3,600 | (4,320) | $240 | (480) | 0.361 | (173) |

| 10 | $1,800 | (3,180) | - | (1,380) | 0.322 | (444) |

| Net present value | $13,680 | |||||

Table (6)

Working Note (8):

Compute the amount of revenue:

| Year | Sales units | Selling price | Revenue | |

| (a) | (b) | (c) | ||

| 1 | $100,000 | $300 | 60% | $18,000 |

| 2 | $90,000 | $300 | 60% | $16,200 |

| 3 | $80,000 | $300 | 60% | $14,400 |

| 4 | $70,000 | $300 | 60% | $12,600 |

| 5 | $60,000 | $300 | 60% | $10,800 |

| 6 | $50,000 | $300 | 60% | $9,000 |

| 7 | $40,000 | $300 | 60% | $7,200 |

| 8 | $30,000 | $300 | 60% | $5,400 |

| 9 | $20,000 | $300 | 60% | $3,600 |

| 10 | $10,000 | $300 | 60% | $1,800 |

Table (7)

Working Note (9):

Compute the amount of expense:

| Year | Sales units | Total cost per unit | Purchase cost | Expense | |

| (a) | (b) | (c) | (c) | ||

| 1 | $100,000 | $190 | $3,400,000 | 60% | $(13,440,000) |

| 2 | $90,000 | $190 | $3,400,000 | 60% | $(12,300,000) |

| 3 | $80,000 | $190 | $3,400,000 | 60% | $(11,160,000) |

| 4 | $70,000 | $190 | $3,400,000 | 60% | $(10,020,000) |

| 5 | $60,000 | $190 | $3,400,000 | 60% | $(8,880,000) |

| 6 | $50,000 | $190 | $3,400,000 | 60% | $(7,740,000) |

| 7 | $40,000 | $190 | $3,400,000 | 60% | $(6,600,000) |

| 8 | $30,000 | $190 | $3,400,000 | 60% | $(5,460,000) |

| 9 | $20,000 | $190 | $3,400,000 | 60% | $(4,320,000) |

| 10 | $10,000 | $190 | $3,400,000 | 60% | $(3,180,000) |

Table (8)

4.

Ascertain the net present value for the given analysis; use the information in Requirement 3,

Explanation of Solution

Compute the salvage value for the new system:

Compute the net present value for the new system:

Thereby, the salvage value of the new system would increase the after-tax cash flows by $2,400,000. On the other hand, the NPV of the new system has been increased by $772,800, whereas, the NPV analysis for the old system remains unchanged. Thus this makes the new investment more attractive.

5.

Interpret the significance of providing accurate inputs for evaluating investments in automated manufacturing systems.

Explanation of Solution

Interpret the significance of providing accurate inputs for evaluating investments in automated manufacturing systems:

The key importance is that the usage of correct discount rate. Under requirement 2, the usage of 20% discount rate made the automated alternative system look entirely unappealing. Thus when using the correct discount rate (12%), the automated system results in a larger NPV, even though it was less than the NPV of the old system. However, the projections of future revenues for the old system were overly optimistic. On the other hand, the old system was not able to produce the same level of quality as the new system could produce. Thus, by considering the correct discount rate, the new system dominated the old. Moreover, the addition of salvage value simply increased this dominance.

Want to see more full solutions like this?

Chapter 19 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning