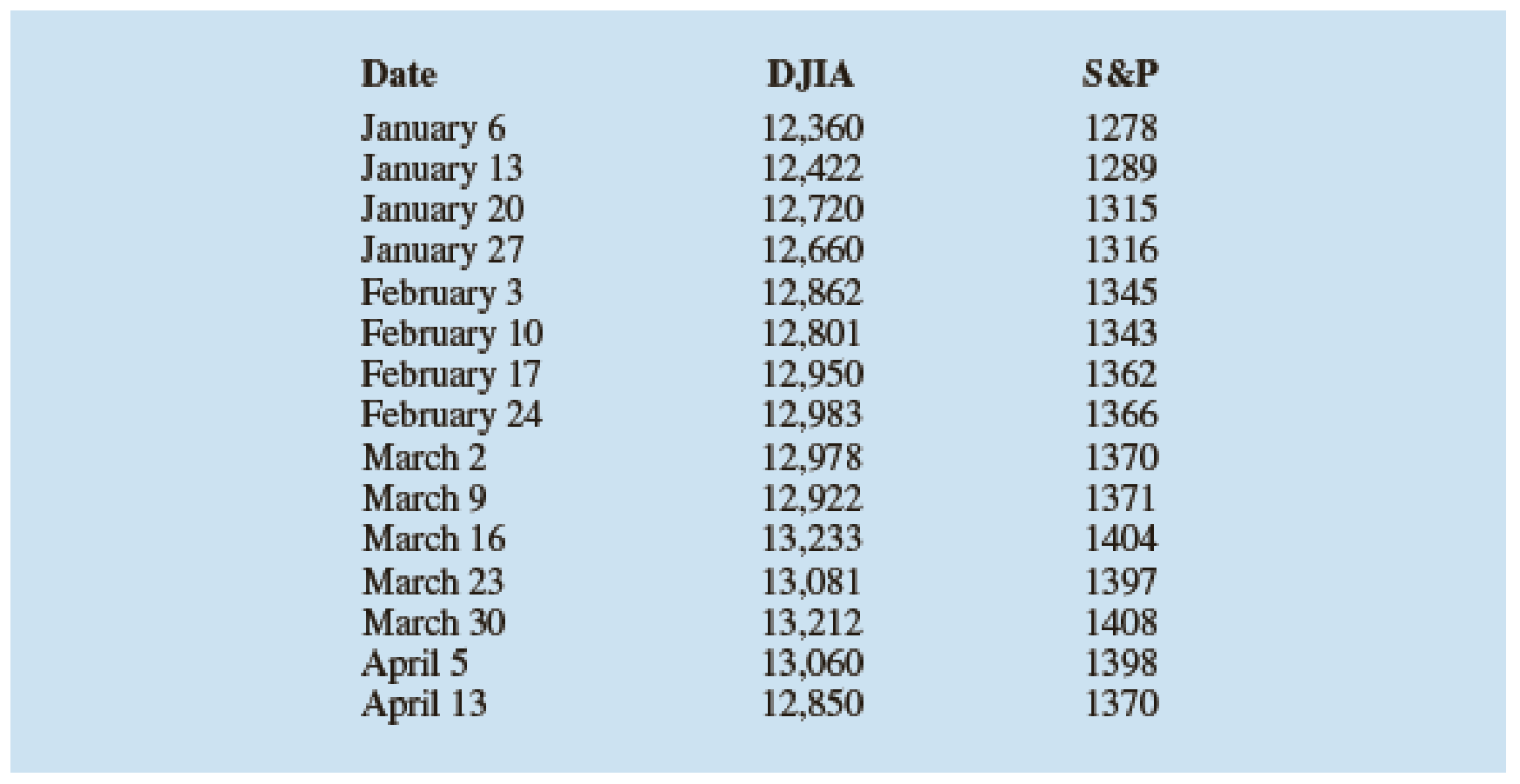

The Dow Jones Industrial Average (DJIA) and the Standard & Poor’s 500 (S&P 500) indexes are used as measures of overall movement in the stock market. The DJIA is based on the price movements of 30 large companies; the S&P 500 is an index composed of 500 stocks. Some say the S&P 500 is a better measure of stock market performance because it is broader based. The closing price for the DJIA and the S&P 500 for 15 weeks, beginning with January 6, 2012, follow (Barron’s website, April 17, 2012).

- a. Develop a

scatter diagram with DJIA as the independent variable. - b. Develop the estimated regression equation.

- c. Test for a significant relationship. Use α = .05.

- d. Did the estimated regression equation provide a good fit? Explain.

- e. Suppose that the closing price for the DJIA is 13,500. Predict the closing price for the S&P 500.

- f. Should we be concerned that the DJIA value of 13,500 used to predict the S&P 500 value in part (e) is beyond the

range of the data used to develop the estimated regression equation?

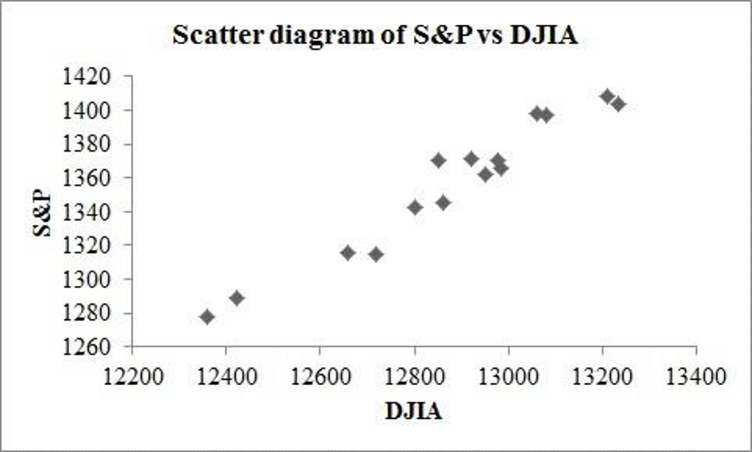

a.

Draw a scatter diagram with DIJA as the independent variable.

Answer to Problem 55SE

The scatter diagram is obtained as follows:

Explanation of Solution

Calculation:

The data shows the closing price for the DIJA and S&P 500 for 15 weeks, beginning with Jan 6, 2012.

Software procedure:

Step-by-step software procedure to draw the scatter diagram using EXCEL:

- Open an EXCEL file.

- In column A enter the data of DJIA and in column B enter the corresponding values of S&P.

- Select the data that is to be displayed.

- Click on the Insert Tab > select Scatter icon.

- Choose a Scatter with only Markers.

- Click on the chart > select Layout from the Chart Tools.

- Select Axis Title > Primary Horizontal Axis Title > Title Below Axis.

- Enter DJIA in the dialog box

- Select Axis Title > Primary Vertical Axis Title > Rotated Title.

- Enter S&P in the dialog box.

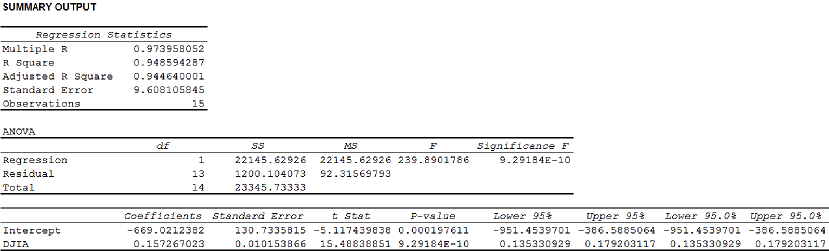

b.

Find the estimated regression equation.

Answer to Problem 55SE

The estimated regression equation is

Explanation of Solution

Calculation:

The estimated regression equation is to be obtained.

Software procedure:

Step-by-step procedure to obtain the estimated regression equation using Excel:

- In Excel sheet, enter S&P and DJIA in different columns.

- In Data, select Data Analysis and choose Regression.

- In Input Y Range, select S&P.

- In Input X Range, select DJIA.

- Select Labels.

- Click OK.

Output obtained using Excel is given below:

Thus, the estimated regression equation is

c.

Test for a significant relationship at

Answer to Problem 55SE

There is a significant relationship between S&P and DJIA.

Explanation of Solution

Calculation:

Consider that

State the test hypotheses.

Null hypothesis:

That is, there is no significant relationship between S&P and DJIA.

Alternative hypothesis:

That is, there is a significant relationship between S&P and DJIA.

From the output in pat (b) it is found that the F-test statistic is 239.89.

Level of significance:

The given level of significance is

p-value:

From the output in Pat (b), it is found that the p-value is 0.

Rejection rule:

If

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provides sufficient evidence to conclude that there is a significant relationship between S&P and DJIA.

Thus, S&P and DJIA are related.

d.

Explain whether the estimated regression provides a good fit.

Answer to Problem 55SE

The model provides a good fit.

Explanation of Solution

Calculation:

The coefficient of determination (

In the given output in Part (b),

Thus, the percentage of variation in the observed values of S&P 500 is explained by the regression is 94.86%, which indicates that 94.86% of the variability in S&P 500 is explained by the variability in DJIP using linear regression model.

Thus, the model provides a good fit.

e.

Predict the closing price for the S&P 500.

Answer to Problem 55SE

The predicted closing price for the S&P 500 is 1,454.

Explanation of Solution

Calculation:

The closing price for the DJIA is 13,500.

Using the estimated regression equation

Thus, the predicted closing price for the S&P 500 is 1,454.

f.

Explain whether it is concerned that the DJIA is 13,500 used to predict the S&P 500 value in Part (e) is beyond the range of the data used to develop the estimated regression equation.

Explanation of Solution

From Part (e), it is found that the predicted closing price for the S&P 500 is 1,454.

According to the scatter diagram or given data, it can be said that the predicted DJIA is not far beyond the range of the data. Thus, there should not be too concern about using the estimated regression equation to predict S&P 500.

Want to see more full solutions like this?

Chapter 14 Solutions

Modern Business Statistics with Microsoft Office Excel (with XLSTAT Education Edition Printed Access Card) (MindTap Course List)

- An electronics company manufactures batches of n circuit boards. Before a batch is approved for shipment, m boards are randomly selected from the batch and tested. The batch is rejected if more than d boards in the sample are found to be faulty. a) A batch actually contains six faulty circuit boards. Find the probability that the batch is rejected when n = 20, m = 5, and d = 1. b) A batch actually contains nine faulty circuit boards. Find the probability that the batch is rejected when n = 30, m = 10, and d = 1.arrow_forwardTwenty-eight applicants interested in working for the Food Stamp program took an examination designed to measure their aptitude for social work. A stem-and-leaf plot of the 28 scores appears below, where the first column is the count per branch, the second column is the stem value, and the remaining digits are the leaves. a) List all the values. Count 1 Stems Leaves 4 6 1 4 6 567 9 3688 026799 9 8 145667788 7 9 1234788 b) Calculate the first quartile (Q1) and the third Quartile (Q3). c) Calculate the interquartile range. d) Construct a boxplot for this data.arrow_forwardPam, Rob and Sam get a cake that is one-third chocolate, one-third vanilla, and one-third strawberry as shown below. They wish to fairly divide the cake using the lone chooser method. Pam likes strawberry twice as much as chocolate or vanilla. Rob only likes chocolate. Sam, the chooser, likes vanilla and strawberry twice as much as chocolate. In the first division, Pam cuts the strawberry piece off and lets Rob choose his favorite piece. Based on that, Rob chooses the chocolate and vanilla parts. Note: All cuts made to the cake shown below are vertical.Which is a second division that Rob would make of his share of the cake?arrow_forward

- Three players (one divider and two choosers) are going to divide a cake fairly using the lone divider method. The divider cuts the cake into three slices (s1, s2, and s3). If the choosers' declarations are Chooser 1: {s1 , s2} and Chooser 2: {s2 , s3}. Using the lone-divider method, how many different fair divisions of this cake are possible?arrow_forwardTheorem 2.6 (The Minkowski inequality) Let p≥1. Suppose that X and Y are random variables, such that E|X|P <∞ and E|Y P <00. Then X+YpX+Yparrow_forwardTheorem 1.2 (1) Suppose that P(|X|≤b) = 1 for some b > 0, that EX = 0, and set Var X = 0². Then, for 0 0, P(X > x) ≤e-x+1²² P(|X|>x) ≤2e-1x+1²² (ii) Let X1, X2...., Xn be independent random variables with mean 0, suppose that P(X ≤b) = 1 for all k, and set oσ = Var X. Then, for x > 0. and 0x) ≤2 exp Σ k=1 (iii) If, in addition, X1, X2, X, are identically distributed, then P(S|x) ≤2 expl-tx+nt²o).arrow_forward

- Theorem 5.1 (Jensen's inequality) state without proof the Jensen's Ineg. Let X be a random variable, g a convex function, and suppose that X and g(X) are integrable. Then g(EX) < Eg(X).arrow_forwardCan social media mistakes hurt your chances of finding a job? According to a survey of 1,000 hiring managers across many different industries, 76% claim that they use social media sites to research prospective candidates for any job. Calculate the probabilities of the following events. (Round your answers to three decimal places.) answer parts a-c. a) Out of 30 job listings, at least 19 will conduct social media screening. b) Out of 30 job listings, fewer than 17 will conduct social media screening. c) Out of 30 job listings, exactly between 19 and 22 (including 19 and 22) will conduct social media screening. show all steps for probabilities please. answer parts a-c.arrow_forwardQuestion: we know that for rt. (x+ys s ا. 13. rs. and my so using this, show that it vye and EIXI, EIYO This : E (IX + Y) ≤2" (EIX (" + Ely!")arrow_forward

- Theorem 2.4 (The Hölder inequality) Let p+q=1. If E|X|P < ∞ and E|Y| < ∞, then . |EXY ≤ E|XY|||X|| ||||qarrow_forwardTheorem 7.6 (Etemadi's inequality) Let X1, X2, X, be independent random variables. Then, for all x > 0, P(max |S|>3x) ≤3 max P(S| > x). Isk≤narrow_forwardTheorem 7.2 Suppose that E X = 0 for all k, that Var X = 0} x) ≤ 2P(S>x 1≤k≤n S√2), -S√2). P(max Sk>x) ≤ 2P(|S|>x- 1arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning