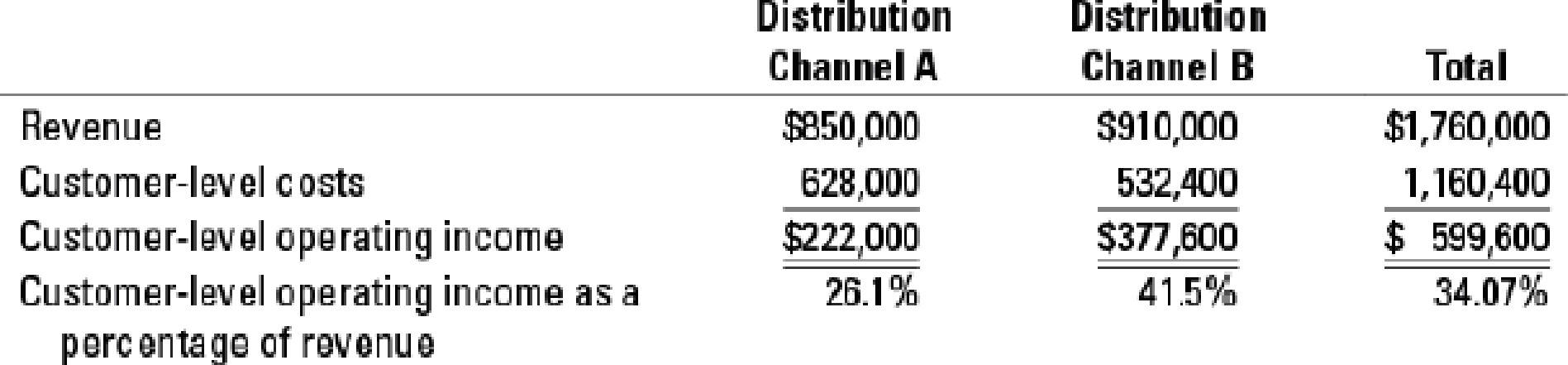

Cost-hierarchy income statement and allocation of corporate, division, and channel costs to customers. Vocal Speakers makes wireless speakers that are sold to different customers in two main distribution channels. Recently, the company’s profitability has decreased. Management would like to analyze the profitability of each channel based on the following information:

The company allocates distribution channel costs of marketing and administration as follows:

| Total | Allocation basis | |

| Distribution-channel costs | ||

| Marketing costs | $260,000 | Channel revenue |

| Administration costs | $200,000 | Customer-level costs |

Based on a special study, the company allocates corporate costs to the two channels based on the corporate resources demanded by the channels as follows: Distribution Channel A, $45,000, and Distribution Channel B, $55,000. If the company were to close a distribution channel, none of the corporate costs would be saved.

- 1. Calculate the operating income for each distribution channel as a percentage of revenue after assigning customer-level costs, distribution-channel costs, and corporate costs.

Required

- 2. Should Vocal Speakers close down any distribution channel? Explain briefly including any assumptions that you made.

- 3. Would you allocate corporate costs to divisions? Why is allocating these costs helpful? What actions would it help you take?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

- Assume you are the department B manager for Marleys Manufacturing. Marleys operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only o department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. (Hint: It may be helpful to perform a vertical analysis.)arrow_forwardAnstell Corporation operates a Manufacturing Division and a Marketing Division. Both divisions are evaluated as profit centers. Marketing buys products from Manufacturing and packages them for sale. Manufacturing sells many components to third parties in addition to Marketing. Selected data from the two operations follow: Capacity (units) Sales price* Variable costst Fixed costs Manufacturing 250,000 $ 310 $ 142 $ 107,500 a. Transfer price b. Transfer price Marketing 125,000 $940 * For Manufacturing, this is the price to third parties. For Marketing, this does not include the transfer price paid to Manufacturing. Required: a. Current output in Manufacturing is 180,000 units. Marketing requests an additional 55,000 units to produce a special order. What transfer price would you recommend? b. Suppose Manufacturing is operating at full capacity. What transfer price would you recommend? per unit per unit $366 $ 727,500arrow_forwardAnstell Corporation operates a Manufacturing Division and a Marketing Division. Both divisions are evaluated as profit centers. Marketing buys products from Manufacturing and packages them for sale. Manufacturing sells many components to third parties in addition to Marketing. Selected data from the two operations follow: Capacity (units) Sales price* Variable costs + Fixed costs Manufacturing 250,000 $ 280 $ 112 $ 100,000 a. Transfer price b. Transfer price Marketing 125,000 $910 For Manufacturing, this is the price to third parties. t For Marketing, this does not include the transfer price paid to Manufacturing. per unit per unit $ 336 $ 720,000 Required: a. Current output in Manufacturing is 150,000 units. Marketing requests an additional 25,000 units to produce a special order. What transfer price would you recommend? b. Suppose Manufacturing is operating at full capacity. What transfer price would you recommend?arrow_forward

- Anstell Corporation operates a Manufacturing Division and a Marketing Division. Both divisions are evaluated as profit centers. Marketing buys products from Manufacturing and packages them for sale. Manufacturing sells many components to third parties in addition to Marketing. Selected data from the two operations follow: Capacity (units) Sales price* Variable costs + Fixed costs Manufacturing 250,000 $ 280 $ 112 $ 100,000 a. Transfer price b. Transfer price Marketing 125,000 $910 For Manufacturing, this is the price to third parties. t For Marketing, this does not include the transfer price paid to Manufacturing. per unit per unit $ 336 $ 720,000 Required: a. Current output in Manufacturing is 125,000 units. Marketing requests an additional 25,000 units to produce a special order. What transfer price would you recommend? b. Suppose Manufacturing is operating at full capacity. What transfer price would you recommend? c. Suppose Manufacturing is operating at 230,000 units. What transfer…arrow_forwardPlease help mearrow_forwardCarol Components operates a Production Division and a Packaging Division. Both divisions are evaluated as profit centers. Packaging buys components from Production and assembles them for sale. Production sells many components to third parties in addition to Packaging. Selected data from the two operations follow: Capacity (units) Sales pricea Variable costs b Fixed costs Production 50,600 $ 252 $ 108 $ 30,000,000 a For Production, this is the price to third parties. b For Packaging, this does not include the transfer price paid to Production. Packaging 25,300 $ 792 $ 300 $ 18,000,000 Suppose Production is located in Country A with a tax rate of 30 percent and Distribution in Country B with a tax rate of 10 percent. All other facts remain the same. a. Optimal transfer price b. Transfer price c. Transfer price Required: a. Current output in Production is 25,300 units. Packaging requests an additional 5,960 units to produce a special order. What transfer price would you recommend? b.…arrow_forward

- Carol Components operates a Production Division and a Packaging Division. Both divisions are evaluated as profit centers. Packaging buys components from Production and assembles them for sale. Production sells many components to third parties in addition to Packaging. Selected data from the two operations follow: Capacity (units) Sales pricea Variable costs b Fixed costs Production 51,000 $ 260 $116 $ 30,000,000 a For Production, this is the price to third parties. b For Packaging, this does not include the transfer price paid to Production. a. Optimal transfer price b. Transfer price c. Transfer price Packaging 25,500 $ 800 $ 308 $ 18,000,000 Required: a. Current output in Production is 25,500 units. Packaging requests an additional 6,600 units to produce a special order. What transfer price would you recommend? b. Suppose Production is operating at full capacity. What transfer price would you recommend? c. Suppose Production is operating at 47,700 units. What transfer price would you…arrow_forwardVaibhavarrow_forwardsarrow_forward

- Atascadero Industries operates a Manufacturing Division and a Marketing Division. Both divisions are evaluated as profit centers. Marketing buys products from Manufacturing and packages them for sale. Manufacturing sells many components to third parties in addition to Marketing. Selected data from the two operations follow. Manufacturing Marketing 1,020,000 %24 Capacity (units) sales price variable costs Fixed costs 502,000 1,500 4,650 $4 580 1,720 $10,200, 000 $7,220, 000 a. For Manufacturing, this is the price to third partles. For Marketing, this does not include the transfer price paid to Manufacturing. Suppose Manufacturing is located in Country X with a tax rate of 70 percent and Marketing in Country Y with a tax rate of 30 percent. All other facts remain the same, Requlred: a. Current production levels in Manufacturing are 520,000 units. Marketing requests an additional 120.000 units to produce a speclal order. What transfer price would youu recommend? b. Suppose Manufacturing…arrow_forwardCompute the ROI ratio (operating income to total assets) of each division using historical-cost measures. Comment on the results.arrow_forwardProfit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales Cost of goods sold Gross profit Administrative expenses Income from operations The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,950,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin Investment turnover Rate of return on investment Profit margin Investment turnover $1,170,000 526,500 $643,500 409,500 $234,000 b. If expenses could be reduced by $58,500 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,