REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

16th Edition

ISBN: 9780134789705

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 14.24E

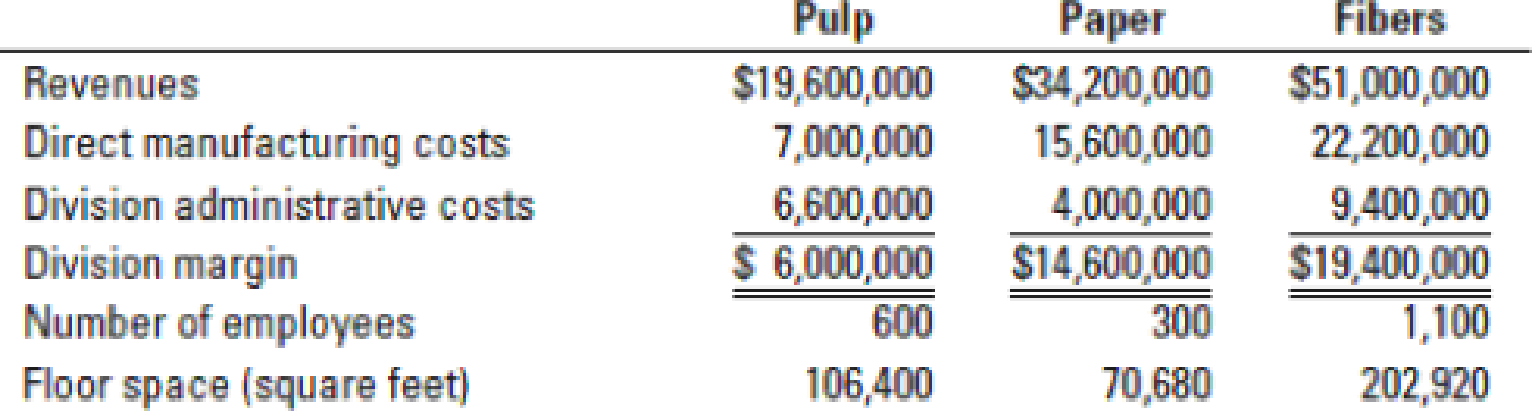

Cost allocation to divisions. Bergen Corporation has three divisions: pulp, paper, and fibers. Bergen’s new controller, David Fisher, is reviewing the allocation of fixed corporate-

Until now, Bergen Corporation has allocated fixed corporate-overhead costs to the divisions on the basis of division margins. Fisher asks for a list of costs that comprise fixed corporate overhead and suggests the following new allocation bases:

| Fixed Corporate-Overhead Costs | Suggested Allocation Bases | |

| Human resource management | $ 4,600,000 | Number of employees |

| Facility | 6,400,000 | Floor space (square feet) |

| Corporate administration | 9,200,000 | Division administrative costs |

| Total | $20,200,000 |

- 1. Allocate 2017 fixed corporate-overhead costs to the three divisions using division margin as the allocation base. What is each division’s operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)?

Required

- 2. Allocate 2017 fixed costs using the allocation bases suggested by Fisher. What is each division’s operating margin percentage under the new allocation scheme?

- 3. Compare and discuss the results of requirements 1 and 2. If division performance incentives are based on operating margin percentage, which division would be most receptive to the new allocation scheme? Which division would be the least receptive? Why?

- 4. Which allocation scheme should Bergen Corporation use? Why? How might Fisher overcome any objections that may arise from the divisions?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation.

Marley's ManufacturingIncome StatementMonth Ending August 31, 2018

Dept. A

Dept. B

Sales

$23,000

$52,000

Cost of goods sold

11,270

27,040

Gross profit

$11,730

$24,960

Expenses:

Utility expenses

$1,380

$3,640

Wages expense

5,980

9,880

Costs allocated from corporate

2,300

14,560

Total expenses

$9,660

$28,080

Operating income/(loss) in dollars

$fill in the blank 1

$fill in the blank 2

Operating income/(loss) in percentage

fill in the blank 3

%

fill in the blank 4

%

Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation.

Marley's ManufacturingIncome StatementMonth Ending August 31, 2018

Dept. A

Dept. B

Sales

$21,000

$52,000

Cost of goods sold

9,870

27,040

Gross profit

$11,130

$24,960

Expenses:

Utility expenses

$840

$3,120

Wages expense

5,040

10,920

Costs allocated from corporate

2,100

14,560

Total expenses

$7,980

$28,600

Operating income/(loss) in dollars

$fill in the blank 1

$fill in the blank 2

Operating income/(loss) in percentage

fill in the blank 3

%

fill in the blank 4

%

Department B had…

Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation.

Marley's ManufacturingIncome StatementMonth Ending August 31, 2018

Chapter 14 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

Ch. 14 - Prob. 14.1QCh. 14 - Why is customer-profitability analysis an...Ch. 14 - Prob. 14.3QCh. 14 - A customer-profitability profile highlights those...Ch. 14 - Give examples of three different levels of costs...Ch. 14 - What information does the whale curve provide?Ch. 14 - A company should not allocate all of its corporate...Ch. 14 - What criteria might managers use to guide...Ch. 14 - Once a company allocates corporate costs to...Ch. 14 - A company should not allocate costs that are fixed...

Ch. 14 - How should a company decide on the number of cost...Ch. 14 - Show how managers can gain insight into the causes...Ch. 14 - How can the concept of a composite unit be used to...Ch. 14 - Explain why a favorable sales-quantity variance...Ch. 14 - How can the sales-quantity variance be decomposed...Ch. 14 - Flexible-budget variance, sales-quantity,...Ch. 14 - Sales-volume, sales-mix, and sales-quantity...Ch. 14 - Cost allocation in hospitals, alternative...Ch. 14 - Customer profitability, customer-cost hierarchy....Ch. 14 - Customer profitability, service company. Instant...Ch. 14 - Customer profitability, distribution. Best Drugs...Ch. 14 - Cost allocation and decision making. Reidland...Ch. 14 - Cost allocation to divisions. Rembrandt Hotel ...Ch. 14 - Cost allocation to divisions. Bergen Corporation...Ch. 14 - Prob. 14.25ECh. 14 - Variance analysis, working backward. The Hiro...Ch. 14 - Variance analysis, multiple products. Emcee Inc....Ch. 14 - Market-share and market-size variances...Ch. 14 - Click here to open your MyFinanceLab Study Plan...Ch. 14 - Customer profitability. Bracelet Delights is a new...Ch. 14 - Customer profitability, distribution. Green Paper...Ch. 14 - Customer profitability in a manufacturing firm....Ch. 14 - Customer-cost hierarchy, customer profitability....Ch. 14 - Allocation of corporate costs to divisions. Cathy...Ch. 14 - Cost allocation to divisions. Forber Bakery makes...Ch. 14 - Prob. 14.36PCh. 14 - Cost-hierarchy income statement and allocation of...Ch. 14 - Variance analysis, sales-mix and sales-quantity...Ch. 14 - Market-share and market-size variances...Ch. 14 - Variance analysis, multiple products. The Robins...Ch. 14 - Customer profitability and ethics. KC Corporation...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardVarney Corporation, a manufacturer of electronics and communications systems, allocates Computing and Communications Services Department (CCS) costs to profit centers. The following table lists the types of services and cost drivers for each service. The table also includes the budgeted cost and quantity for each service for August. One of the profit centers for Varney Corporation is the Communication Systems (COMM) division. Assume the following information for COMM: COMM has 2,500 employees, of whom 20% are office employees. All of the office employees have been issued a smartphone, and 95% of them have a computer on the network. One hundred percent of the employees with a computer also have an email account. The average number of help desk calls for August was 0.6 call per individual with a computer. There are 400 additional printers, servers, and peripherals on the network beyond the personal computers. a. Compute the service allocation rate for each of CCSs services for August. b. Compute the allocation of CCSs services to COMM for August.arrow_forwardAssume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. The cost that needs further investigation is cost allocated from corporate. In Department A the percentage of cost allocated based on sales is 10% where as in Department B this is 29.41% based on sales. This needs further investigation beacuse of this cost there is operating loss in Department B. Marley's Manufacturing Income Statement Month ending August 31, 2018 Dept. A % Dept. B % Sales…arrow_forward

- Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. The cost that needs further investigation is cost allocated from corporate. In Department A the percentage of cost allocated based on sales is 10% where as in Department B this is 29.41% based on sales. This needs further investigation beacuse of this cost there is operating loss in Department B. Income Statement Month ending August 31, 2019 Dept. A % Dept. B % Sales $22,000 100 $51,000 100 Cost of Goods Sold 10,560 48 26,520 52 Gross profit $11,440 52 $24,480 48 Utility expenses 1,000 4.55…arrow_forwardCosts incurred in the main headquarters are as follows: Human resources (HR) costs $2,300,000 Accounting department costs 1,800,000 Rent and depreciation 640,000 Other 660,000 Total costs $5,400,000 The Ford upper management currently allocates this cost to the divisions equally. One of the division managers has done some research on activity-based costing and proposes the use of different allocation bases for the different indirect costs−number of employees for HR costs, total revenues for accounting department costs, square feet of space for rent and depreciation costs, and equal allocation among the divisions of "other" costs. Information about the three divisions follows: Bread Cake Doughnuts Total revenues $21,200,000 $4,700,000 $13,200,000 Direct costs 14,000,000 3,300,000 7,000,000 Segment margin $7,200,000 $1,400,000 $6,200,000 Number of employees 700 200 100 Square feet…arrow_forwardOxmoor Corporation has two service departments (Maintenance and Human Resources) and three production departments (Machining, Assembly, and Finishing). The two service departments service the production departments as well as each other, and studies have shown that Maintenance provides the greater amount of service. On the basis of this information, which of the following cost allocations would likely occur under the step-down method? Maintenance cost would be allocated to Finishing. Machining cost would be allocated to Assembly. Maintenance cost would be allocated to Human Resources. Human Resources cost would be allocated to Maintenance. Both maintenance cost would be allocated to Finishing and maintenance cost would be allocated to Human Resources.arrow_forward

- (Appendix 4B) Direct Method of Support Department Cost Allocation Stevenson Company is divided into two operating divisions: Battery and Small Motors. The company allocates power and general factory costs to each operating division using the direct method. Power costs are allocated on the basis of the number of machine hours and general factory costs on the basis of square footage. Support department cost allocations using the direct method are based on the following data: Operating Divisions Overhead costs Machine hours Square footage Direct labor hours Required: Battery Support Departments Small Motors Power $160,000 2,000 1,000 General Factory Battery $430,000 $163,000 2,000 8,000 Power 1,500 1. Calculate the allocation ratios for Power and General Factory. (Note: Carry these calculations out to four decimal places, if necessary.) General Factory 0.8000 ✓ 0.2727 X 7,500 18,000 Small Motors $84,600 2,000 20,000 60,000 0.2000 X 0.7273 2. Allocate the support service costs to the…arrow_forwardAssume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation.arrow_forward(Appendix 4B) Sequential Method of Support Department Cost Allocation Stevenson Company is divided into two operating divisions: Battery and Small Motors. The company allocates power and general factory costs to each operating division using the sequential method. General Factory is allocated first in the sequential method for the company. Support department cost allocations using the sequential method are based on the following data: Support Departments Operating Divisions Overhead costs Machine hours Square footage Direct labor hours Required: Power Allocation ratios for General Factory Battery Power Small Motors $160,000 Allocation ratios for Power 2,000 1,000 General Factory $430,000 1. Calculate the allocation ratios for Power and General Factory. (Note: Carry these calculations out to four decimal places.) 2,000 1,500 Battery $163,000 7,000 7,500 18,000 Small Motors $84,600 1,500 20,000 60,000arrow_forward

- ssume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). The income statement for Marley's Manufacturing is shown below: Marley's ManufacturingIncome StatementMonth Ending August 31, 2018arrow_forwardThe scenario describes a task undertaken by Adam, the managing partner at Novak Accounting Services (NAS), who is assessing the profitability of the firm’s three operational divisions: Audit, Tax, and Advisory Services. These divisions receive support from three separate departments: Billing, Human Resources (HR), and IT. Each support department incurs specific costs and serves the operating divisions based on distinct cost drivers or allocation bases. Here are the details: •The Billing Department has incurred original costs of $66,000 but does not record any specific billing hours used by the operating divisions. •The Human Resources Department has expenses amounting to $113,000 and houses two employees. •The IT Department shows costs of $98,000 and has its services measured in hours used by various departments, totaling 200 hours for itself and distributing additional hours to the operating divisions—900 hours to Audit, 600 hours to Tax, and 300 hours to Advisory. For the…arrow_forward(Appendix 48) Direct Method of Support Department Cost Allocation Stevenson Company is divided into two operating divisions: Battery and Small Motors. The company allocates power and general factory costs to each operating division using the direct method. Power costs are allocated on the basis of the number of machine hours and general factory costs on the basis of square footage. Support department cost allocations using the direct method are based on the following data: Support Departments Operating Divisions General Small Power Factory Battery Motors Overhead costs $160,000 $430,000 $163,000 $84,600 Machine hours 2,000 2,000 7,500 2,000 Square footage 1,000 1,500 10,000 20,000 Direct labor hours 18,000 60,000 Required: 1. Calculate the allocation ratios for Power and General Factory. (Note: Carry these calculations out to four decimal places, if necessary.) Power General Factory 0.8750 X Battery 0.8750 X Small Motors 2. Allocate the support service costs to the operating divisions.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY