REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

16th Edition

ISBN: 9780134789705

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 14.31P

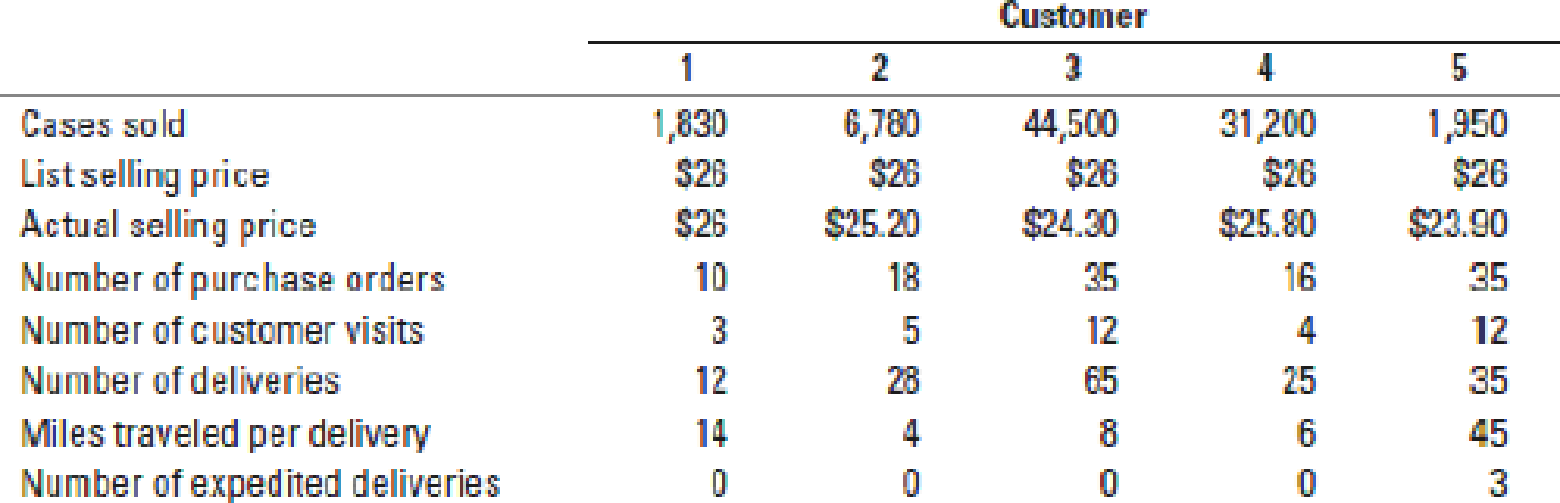

Customer profitability, distribution. Green Paper Delivery has decided to analyze the profitability of five new customers. It buys recycled paper at $20 per case and sells to retail customers at a list price of $26 per case. Data pertaining to the five customers are:

Green Paper Delivery’s five activities and their cost drivers are:

| Activity | Cost-Driver Rate |

| Order taking | $90 per purchase order |

| Customer visits | $75 per customer visit |

| Deliveries | $3 per delivery mile traveled |

| Product handling | $1.20 per case sold |

| Expedited deliveries | $250 per expedited delivery |

- 1. Compute the customer-level operating income of each of the five retail customers now being examined (1, 2, 3, 4, and 5). Comment on the results.

Required

- 2. What insights do managers gain by reporting both the list selling price and the actual selling price for each customer?

- 3. What factors should managers consider in deciding whether to drop one or more of the five customers?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Stable Paper Delivery has decided to analyze the profitability of five new customers. It buys recycled paper at $12 per case and sells to retail customers at a list price of $14.80 per case. Data

pertaining to the five customers are:

E (Click the icon to view the data.)

Stable Paper Delivery's five activities and their cost drivers are as follows:

E (Click the icon to view the activities and cost drivers.)

Read the requirements.

Requirement 1. Compute the customer-level operating income of each of the five retail

Begin by calculating each customer's gross margin. Then calculate the operating incom

minus sign for operating losses.)

Requirements

1

2

1.

Compute the customer-level operating income of each of the five retail

customers now being examined (1, 2, 3, 4, and 5). Comment on the results.

2.

What insights do managers gain by reporting both the list selling price and

the actual selling price for each customer?

3.

What factors should managers consider in deciding whether to drop one…

Fresh

Paper Delivery has decided to analyze the profitability of five new customers. It buys recycled paper at

$ 11

per case and sells to retail customers at a list price of

$14.70

per case. Data pertaining to the five customers are:

Customer

1

2

3

4

5

Cases sold

2,050

8,840

61,800

34,100

2,700

List selling price

$14.70

$14.70

$14.70

$14.70

$14.70

Actual selling price

$14.70

$14.50

$12.80

$14.18

$13.20

Number of purchase orders

16

22

39

31

34

Number of customer visits

3

2

7

4

4

Number of deliveries

18

32

69

40

34

Miles traveled per delivery

17

7

10

11

44

Number of expedited deliveries

0

0

0

0

3

pop-up content ends

ctivity

Cost Driver Rate

Order taking

$200 per purchase order

Customer visits

$50 per customer visit

Deliveries

$2 per delivery mile traveled

Product handling

$0.50 per case sold

Expedited deliveries

$310 per expedited…

Customer profitability, distribution. Best Drugs is a distributor of pharmaceutical products. Its ABC system has five activities:

Chapter 14 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

Ch. 14 - Prob. 14.1QCh. 14 - Why is customer-profitability analysis an...Ch. 14 - Prob. 14.3QCh. 14 - A customer-profitability profile highlights those...Ch. 14 - Give examples of three different levels of costs...Ch. 14 - What information does the whale curve provide?Ch. 14 - A company should not allocate all of its corporate...Ch. 14 - What criteria might managers use to guide...Ch. 14 - Once a company allocates corporate costs to...Ch. 14 - A company should not allocate costs that are fixed...

Ch. 14 - How should a company decide on the number of cost...Ch. 14 - Show how managers can gain insight into the causes...Ch. 14 - How can the concept of a composite unit be used to...Ch. 14 - Explain why a favorable sales-quantity variance...Ch. 14 - How can the sales-quantity variance be decomposed...Ch. 14 - Flexible-budget variance, sales-quantity,...Ch. 14 - Sales-volume, sales-mix, and sales-quantity...Ch. 14 - Cost allocation in hospitals, alternative...Ch. 14 - Customer profitability, customer-cost hierarchy....Ch. 14 - Customer profitability, service company. Instant...Ch. 14 - Customer profitability, distribution. Best Drugs...Ch. 14 - Cost allocation and decision making. Reidland...Ch. 14 - Cost allocation to divisions. Rembrandt Hotel ...Ch. 14 - Cost allocation to divisions. Bergen Corporation...Ch. 14 - Prob. 14.25ECh. 14 - Variance analysis, working backward. The Hiro...Ch. 14 - Variance analysis, multiple products. Emcee Inc....Ch. 14 - Market-share and market-size variances...Ch. 14 - Click here to open your MyFinanceLab Study Plan...Ch. 14 - Customer profitability. Bracelet Delights is a new...Ch. 14 - Customer profitability, distribution. Green Paper...Ch. 14 - Customer profitability in a manufacturing firm....Ch. 14 - Customer-cost hierarchy, customer profitability....Ch. 14 - Allocation of corporate costs to divisions. Cathy...Ch. 14 - Cost allocation to divisions. Forber Bakery makes...Ch. 14 - Prob. 14.36PCh. 14 - Cost-hierarchy income statement and allocation of...Ch. 14 - Variance analysis, sales-mix and sales-quantity...Ch. 14 - Market-share and market-size variances...Ch. 14 - Variance analysis, multiple products. The Robins...Ch. 14 - Customer profitability and ethics. KC Corporation...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Analyzing profitability Father Furniture Company manufactures and sells oak tables and chairs. Price and cost data for the furniture follow: Father Furniture has three sales representatives: Adam, Ben, and Caleb. Adam sold 100 tables With 6 chairs each. Ben sold 110 tables With 4 chairs each. Caleb sold 80 tables with 8 chairs each. Requirements Calculate the total contribution margin and the contribution margin ratio for each sales representative (round to two decimal places). Which sales representative has the highest contribution margin ratio? Explain Whyarrow_forwardUsing the chart, I need assistance in answering the following questions w/ explanations: (The cost of the bags, which must be ordered in batches of 100) a) If this was a profit-making activity, at the entry fee of $20, what would be the profit-maximizing quantity of participants/bags? (I got 300 participants/bags) b) Use the information in the table to determine the exact breakeven quantity of participants/bags for the entry fee of $20. Use the formula Qb = F/(P – AVC). (I am not sure what to do or if I did this right. I got 113.)arrow_forwardCal’s Sporting Goods has three product lines and has decided to apply ABC analysis to these three product lines: Running, Golfing and Kayaking. He identifies four activities and their activity cost rates as follows: Ordering $95 per purchase order Delivery and receipt of merchandise $76 per delivery Shelf stocking $19 per hour Customer support and assistance $0.15 per item sold. The revenues, cost of goods sold and activity usage are listed below: Running Golfing Kayaking Financial Data Revenues $60,000 $66,500 $50,500 Cost of goods sold $41,000 $51,000 $32,000 Store support costs (overhead) Activity Area Usage Ordering (purchase orders 44 24 14 Delivery (deliveries) 120 60 36 Shelf stocking (hours) 170 150 20 Customer support (items sold) 15,400 20,200 7,960 Under the simple costing system. Cal’s Sporting Goods…arrow_forward

- Customer protability, distribution. Best Drugs is a distributor of pharmaceutical products. Its ABC system has five activities:arrow_forwardA tree provider to plant nurseries is trying to use customer lifetime value to determine the value of its customers. Two customers are shown below. Use customer lifetime value to determine the importance of each customer. Use a 7 percent discount rate. Avg. Annual Sales Avg. Profit Margin Customer A: Customer B: $26,500 $14,000 Do not round intermediate calculans. Round your answers to the nearest dollar. NPV (Customer A): $ 25% 15% Expected Lifetime 11 years 7 years NPV (Customer B): $ What do you recommend? -Select- is more important.arrow_forwardA clothing retailer is going to mail out 10,000 catalogues. It costs $2 to mail out each catalogue. When a customer places an order from a catalogue assume a profit of $50 per order is earned. It is assumed that 5% of those who receive a catalogue will place an order however, this number can vary. Use the file below to help you with your tables. Assume that: [total profit = total profit made from the orders – the amount spent on mailing out the catalogues]. a) Use a one-variable data table to determine how the total profit earned from the mailing will vary depending on a response rate between 4% and 10% (with increments of 2%). b) Create a two-variable data table to show how the total profit changes with a varying response rate and number of catalogues mailed. Vary the response rate between 4% and 10% with increments of 2% and vary the number of catalogues mailed from 10,000 to 30,000 at increments of 5000.arrow_forward

- Recalculate the customer-level operating income if salespeople had not broken up actual orders into multiple smaller orders. Don’t forget to also adjust sales commissions.arrow_forwardplease help me and solve this problem with all working and please answer in text thanksarrow_forwardKarera Bicycle shop sells 21-speed bicycles. For purposes of a cost-volume profit analysis, the shop owner divided sales into two-models: Model Sales Price Invoice Cost Sales Commission High-quality P10,000 P5,500 P500 Medium-quality 6,000 2,700 300 Seventy percent of the shop’s sales are medium quality bikes. The shop’s annual fixed expenses are P1,485,000. a. Compute the weighted average unit contribution margin assuming a constant sales mix. b. What is the shop’s break-even sales volume? c. How many bicycles of each model must be sold to earn a target net income of P990,000?arrow_forward

- Please answer all threearrow_forwardAfter studying the costs incurred over the past two years for one of its products, skeins of knitting yarn, Jackson has selected four categories of selling costs and chosen cost drivers for each of these costs. The selling costs actually incurred during the past year and the cost drivers are as follows: Cost Category Sales commissions Pay-per-click/Search engine optimization Cost of online sales Credit and collection Total selling costs The knitting yarn is sold to retail outlets in boxes, each containing 12 skeins of yarn. The sale of partial boxes is not permitted. Commissions are paid on sales to retail outlets but not on online sales. The cost of online sales includes technology infrastructure costs and the wages of personnel who process the online orders. Jackson believes that the selling costs vary significantly with the size of the order. Order sizes are divided into three categories as follows: Order Size Small Medium Large Online Sales 1 to 10 skeins 11 to 20 skeins Over 20…arrow_forwardPlease help me. Thankyou.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Inventory management; Author: The Finance Storyteller;https://www.youtube.com/watch?v=DZhHSR4_9B4;License: Standard Youtube License