Concept explainers

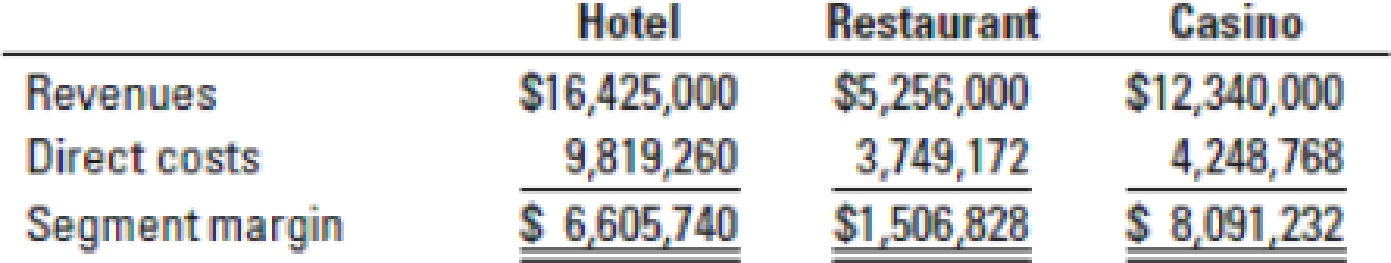

Cost allocation to divisions. Rembrandt Hotel & Casino is situated on beautiful Lake Tahoe in Nevada. The complex includes a 300-room hotel, a casino, and a restaurant. As Rembrandt’s new controller, your manager asks you to recommend the basis the hotel should use for allocating fixed

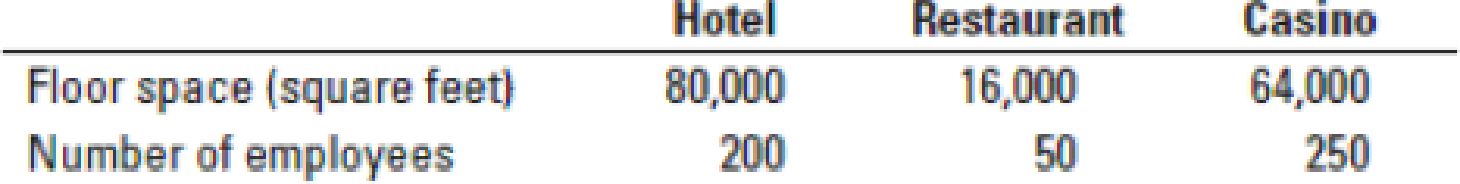

You are also given the following data on the three divisions:

You are told that you may choose to allocate indirect costs based on one of the following: direct costs, floor space, or the number of employees. Total fixed overhead costs for 2016 were $14,550,000

- 1. Calculate division margins in percentage terms prior to allocating fixed overhead costs.

- 2. Allocate indirect costs to the three divisions using each of the three allocation bases suggested. For each allocation base, calculate division operating margins after allocations, in dollars and as a percentage of revenues.

- 3. Discuss the results. How would you decide how to allocate indirect costs to the divisions? Why?

- 4. Would you recommend closing any of the three divisions (and possibly reallocating resources to other divisions) as a result of your analysis? If so, which division would you close and why?

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 14 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

Additional Business Textbook Solutions

Financial Accounting: Tools for Business Decision Making, 8th Edition

Accounting Information Systems (14th Edition)

Macroeconomics

MARKETING:REAL PEOPLE,REAL CHOICES

Engineering Economy (17th Edition)

- Get correct solution for this general accounting questionarrow_forwardFosnight Enterprises prepared the following sales budget: Month Budgeted Sales March April $6,000 $13,000 $12,000 May June $ 14,000 The expected gross profit rate is 30% and the inventory at the end of February was $10,000. Desired inventory levels at the end of the month are 20% of the next month's cost of goods sold. What is the desired ending inventory on May 31?arrow_forwardSub: Accounting 09arrow_forward

- ANSWERarrow_forwardStep by step answerarrow_forwardWhat is the effect of interest received on the accounting equation? a. Equity will increase, and assets will decrease b. Equity will decrease, and assets will increase c. Equity will increase, and assets will increase d. Equity will increase, and liabilities will decrease e. Equity will decrease, and liabilities will increasearrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub