Concept explainers

a)

To develop: A gross requirements plan for all the items.

Introduction:

Gross requirements plan:

The gross requirements plan is the plan where the independent and dependent demand for a product or a component before the on-hand inventory and the scheduled receipts are netted with.

a)

Explanation of Solution

Given information:

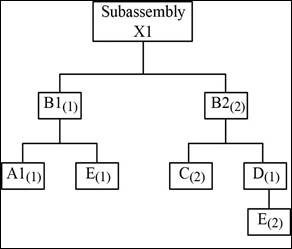

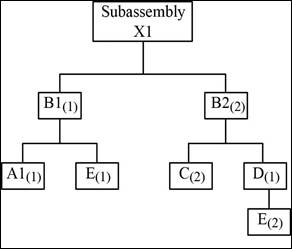

Product structure:

Master production

| MPS for X1 | ||||||

| Period | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 50 | 20 | 100 | |||

Inventory and lead time:

| Item | X1 | B1 | B2 | A1 | C | D | E |

| Lead time | 1 | 2 | 2 | 1 | 1 | 1 | 3 |

| On hand | 50 | 20 | 20 | 5 | 0 | 0 | 10 |

Item X1:

| Week | ||||||||||||

| Item X1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 50 | 20 | 100 | |||||||||

| Order release | 50 | 20 | 100 | |||||||||

The gross requirements are 50, 20 and 100 (1 assembly of X1) in weeks 8, 10 and 12 respectively derived from the master production schedule of X1. The lead time is 1 week. Therefore, the order release will be 50, 20 and 100 in weeks 7, 9 and 11 respectively.

Item B1:

| Week | ||||||||||||

| Item B1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 50 | 20 | 100 | |||||||||

| Order release | 50 | 20 | 100 | |||||||||

The order release of X1 will become the gross requirements of B1. The gross requirements are 50, 20 and 100 (1 assembly of B1) in weeks 7, 9 and 11 respectively. The lead time is 2 weeks. Therefore, the order release will be 50, 20 and 100 in weeks 5, 7 and 9 respectively.

Item B2:

| Week | ||||||||||||

| Item B2 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 100 | 40 | 200 | |||||||||

| Order release | 100 | 40 | 200 | |||||||||

The order release of X1 will become the gross requirements of B2. The gross requirements are 100, 40 and 200 (2 assemblies of B2) in weeks 7, 9 and 11 respectively. The lead time is 2 weeks. Therefore, the order release will be 100, 40 and 200 in weeks 5, 7 and 9 respectively.

Item A1:

| Week | ||||||||||||

| Item A1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 50 | 20 | 100 | |||||||||

| Order release | 50 | 20 | 100 | |||||||||

The order release of B1 will become the gross requirements of A1. The gross requirements are 50, 20 and 100 (1 assembly of A1) in weeks 5, 7 and 9 respectively. The lead time is 1 week. Therefore, the order release will be 50, 20 and 100 in weeks 4, 6 and 8 respectively.

Item C:

| Week | ||||||||||||

| Item C | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 200 | 80 | 400 | |||||||||

| Order release | 200 | 80 | 400 | |||||||||

The order release of B2 will become the gross requirements of C. The gross requirements are 200, 80 and 400 (2 assemblies of C) in weeks 5, 7 and 9 respectively. The lead time is 1 week. Therefore, the order release will be 200, 80 and 400 in weeks 4, 6 and 8 respectively.

Item D:

| Week | ||||||||||||

| Item D | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 100 | 40 | 200 | |||||||||

| Order release | 100 | 40 | 200 | |||||||||

The order release of B2 will become the gross requirements of D. The gross requirements are 100, 40 and 200 (2 assemblies of C) in weeks 5, 7 and 9 respectively. The lead time is 1 week. Therefore, the order release will be 100, 40 and 200 in weeks 4, 6 and 8 respectively.

Item E:

| Week | ||||||||||||

| Item E | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 200 | 50 | 80 | 20 | 400 | 100 | ||||||

| Order release | 200 | 50 | 80 | 20 | 400 | 100 | ||||||

The order release of B1 and D will become the gross requirements of E. The gross requirements are 50, 20 and 100 (1 assembly of E) in weeks 5, 7 and 9 respectively. The lead time is 3 weeks. Therefore, the order release will be 50, 20 and 100 in weeks 2, 4 and 6 respectively.

The gross requirements are 200, 80 and 400 (2 assembly of E) in weeks 4, 6 and 8 respectively. The lead time is 3 weeks. Therefore, the order release will be 200, 80 and 400 in weeks 1, 3 and 5 respectively.

b)

To develop: A net requirements plan for all the items.

Introduction:

Net requirements plan:

The net requirements plan is the plan which is established on the gross requirements plan formed by deducting the stock on and the scheduled receipts. If the total requirement is below the safety stock levels, a planned order is made based on the given lot sizing technique.

b)

Explanation of Solution

Given information:

Product structure:

Master production schedule for X1:

| MPS for X1 | ||||||

| Period | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 50 | 20 | 100 | |||

Inventory and lead time:

| Item | X1 | B1 | B2 | A1 | C | D | E |

| Lead time | 1 | 2 | 2 | 1 | 1 | 1 | 3 |

| On hand | 50 | 20 | 20 | 5 | 0 | 0 | 10 |

Item X1:

| Week | ||||||||||||

| Item X1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 50 | 20 | 100 | |||||||||

| Scheduled receipt | ||||||||||||

| On hand (50) | 50 | 0 | 0 | |||||||||

| Net requirement | 0 | 20 | 100 | |||||||||

| Planned order receipt | 20 | 100 | ||||||||||

| Planned order release | 20 | 100 | ||||||||||

Week 8:

The gross requirement is 50 (1 assembly)derived from the master production schedule of X1. The on hand inventory is 50. Hence, the net requirement is 0. The lead time is 1 week. Therefore, there will be no planned order release.

Week 10:

The gross requirement is 20 (1 assembly) derived from the master production schedule of X1. The on hand inventory is 0. Hence, the net requirement is 20. The lead time is 1 week. Therefore, the planned order release will be 20 in week 9 which will be the planned order receipt in week 10.

Week 12:

The gross requirement is 100 (1 assembly) derived from the master production schedule of X1. The on hand inventory is 0. Hence, the net requirement is 100. The lead time is 1 week. Therefore, the planned order release will be 100 in week 11 which will be the planned order receipt in week 12.

Item B1:

| Week | ||||||||||||

| Item B1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 20 | 100 | ||||||||||

| Scheduled receipt | ||||||||||||

| On hand (20) | 20 | 0 | ||||||||||

| Net requirement | 0 | 100 | ||||||||||

| Planned order receipt | 100 | |||||||||||

| Planned order release | 100 | |||||||||||

Week 9:

The gross requirement is 20 (1 assembly) derived from the planned order release of X1. The on hand inventory is 20. Hence, the net requirement is 0. The lead time is 2 weeks. Therefore, there will be no planned order release.

Week 11:

The gross requirement is 100 (1 assembly) derived from planned order release of X1. The on hand inventory is 0. Hence, the net requirement is 100. The lead time is 2 weeks. Therefore, the planned order release will be 100 in week 9 which will be the planned order receipt in week 11.

Item B2:

| Week | ||||||||||||

| Item B2 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 40 | 200 | ||||||||||

| Scheduled receipt | ||||||||||||

| On hand (20) | 20 | 0 | ||||||||||

| Net requirement | 20 | 200 | ||||||||||

| Planned order receipt | 20 | 200 | ||||||||||

| Planned order release | 20 | 200 | ||||||||||

Week 9:

The gross requirement is 40 (2 assembly) derived from the planned order release of X1. The on hand inventory is 20. Hence, the net requirement is 20. The lead time is 2 weeks. Therefore, the planned order release will be 20 in week 7 which will be the planned order receipt in week 9.

Week 11:

The gross requirement is 200 (2 assembly) derived from planned order release of X1. The on hand inventory is 0. Hence, the net requirement is 200. The lead time is 2 weeks. Therefore, the planned order release will be 200 in week 9 which will be the planned order receipt in week 11.

Item A1:

| Week | ||||||||||||

| Item A1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 100 | |||||||||||

| Scheduled receipt | ||||||||||||

| On hand (5) | 5 | |||||||||||

| Net requirement | 95 | |||||||||||

| Planned order receipt | 95 | |||||||||||

| Planned order release | 95 | |||||||||||

Week 9:

The gross requirement is 100 (1 assembly) derived from the planned order release of B1. The on hand inventory is 5. Hence, the net requirement is 95. The lead time is 1 week. Therefore, the planned order release will be 95 in week 8 which will be the planned order receipt in week 9.

Item C:

| Week | ||||||||||||

| Item C | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 40 | 400 | ||||||||||

| Scheduled receipt | ||||||||||||

| On hand (0) | 0 | 0 | ||||||||||

| Net requirement | 40 | 400 | ||||||||||

| Planned order receipt | 40 | 400 | ||||||||||

| Planned order release | 40 | 400 | ||||||||||

Week 7:

The gross requirement is 40 (2 assembly) derived from the planned order release of B2. The on hand inventory is 0. Hence, the net requirement is 40. The lead time is 1 week. Therefore, the planned order release will be 40 in week 6 which will be the planned order receipt in week 7.

Week 9:

The gross requirement is 400 (2 assembly) derived from planned order release of B2. The on hand inventory is 0. Hence, the net requirement is 400. The lead time is 1 week. Therefore, the planned order release will be 400 in week 8 which will be the planned order receipt in week 9.

Item D:

| Week | ||||||||||||

| Item D | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 20 | 200 | ||||||||||

| Scheduled receipt | ||||||||||||

| On hand (0) | 0 | 0 | ||||||||||

| Net requirement | 20 | 200 | ||||||||||

| Planned order receipt | 20 | 200 | ||||||||||

| Planned order release | 20 | 200 | ||||||||||

Week 7:

The gross requirement is 20 (1 assembly) derived from the planned order release of B2. The on hand inventory is 0. Hence, the net requirement is 20. The lead time is 1 week. Therefore, the planned order release will be 20 in week 6 which will be the planned order receipt in week 7.

Week 9:

The gross requirement is 200 (1 assembly) derived from planned order release of B2. The on hand inventory is 0. Hence, the net requirement is 200. The lead time is 1 week. Therefore, the planned order release will be 200 in week 8 which will be the planned order receipt in week 9.

Item E:

| Week | ||||||||||||

| Item E | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Gross requirements | 40 | 400 | 100 | |||||||||

| Scheduled receipt | ||||||||||||

| On hand (10) | 10 | 0 | 0 | |||||||||

| Net requirement | 30 | 400 | 100 | |||||||||

| Planned order receipt | ||||||||||||

| Planned order release | 30 | 400 | 100 | |||||||||

Week 6:

The gross requirement is 40 (2 assembly) derived from the planned order release of B2. The on hand inventory is 10. Hence, the net requirement is 30. The lead time is 3 weeks. Therefore, the planned order release will be 30 in week 3 which will be the planned order receipt in week 6.

Week 8:

The gross requirement is 400 (2 assembly) derived from the planned order release of B2. The on hand inventory is 0. Hence, the net requirement is 400. The lead time is 3 weeks. Therefore, the planned order release will be 400 in week 5 which will be the planned order receipt in week 8.

Week 9:

The gross requirement is 100 (1 assembly) derived from the master production schedule of B1. The on hand inventory is 0. Hence, the net requirement is 100. The lead time is 3 weeks. Therefore, the planned order release will be 100 in week 6 which will be the planned order receipt in week 9.

Want to see more full solutions like this?

Chapter 14 Solutions

Principles Of Operations Management

- PepsiCo South Africa says the incident where a woman discovered part of a rodent in her loaf of bread, is anisolated occurrence.Durban woman, Nombulelo Mkumla, took to social media last week to share how she discovered the rodent.In a lengthy Facebook post, she said she purchased the loaf of bread from a local shop after work on August 27.For the next days, Mkumla proceeded to use slices of bread from the load to make toast."Then, on the morning of August 31, I took the bread out of the fridge to make toast and noticed something disgusting andscary. I took a picture and sent it to my friends, and one of them said, 'Yi mpuku leyo tshomi' [That's a rat friend]“."I was in denial and suggested it might be something else, but the rat scenario made sense - it's possible the rat got into thebread at the factory, and no one noticed," Mkumla said.She went back to the shop she'd bought the bread from and was told to lay a complaint directly with the supplier.She sent an email with a video and…arrow_forwardThe deaths are included in the discharges; this includes deaths occurring in less than 48 hours and postoperative deaths. Rehabilitation had 362 discharges, 22 deaths, 1<48 hours, 0 Postoperative. what is the gross death rate for the rehabilitation service?arrow_forwardA copy machine is available 24 hours a day. On a typical day, the machine produces 100 jobs. Each job takes about 3 minutes on the machine, 2 minutes of which is processing time and 1 minute is setup time (logging in, defining the job). About 20 percent of the jobs need to be reworked, in which case the setup time and the processing time have to be repeated. The remainder of the time, the equipment is idle. What is the OEE of the equipment?arrow_forward

- How do you think we can keep updating Toyota's ideas as new technologies come out and what customers want keeps changing?arrow_forwardGiven how TPS has helped change things in so many fields, do you think there are parts of it that might be hard to use in areas that aren’t about making things, like in healthcare or services? If so, why do you think that might be?arrow_forwardDo you feel there is anything positive about rework?arrow_forward

- Do you think technology can achieve faster setup times? How would it be implemented in the hospital workforce?arrow_forwardIn your experience or opinion, do you think process changes like organizing workspaces make a bigger difference, or is investing in technology usually the better solution for faster setups?arrow_forwardHave you seen rework done in your business, and what was done to prevent that from occurring again?arrow_forward

- Research a company different than case studies examined and search the internet and find an example of a business that had to rework a process. How was the organization affected to rework a process in order to restore a good flow unit? Did rework hurt a process or improve the organization's operational efficiency? • Note: Include a reference with supportive citations in the discussion reply in your post.arrow_forwardSetup time is very important in affecting a process and the capacity of a process. How do you reduce setup time? Give examples of reducing setup time. Please Provide a referenecearrow_forwardDo you think TPS was successful? If so, how? Are there other companies that have used TPS? If so, give examples. Please provide a referencearrow_forward

- MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning  Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,