Concept explainers

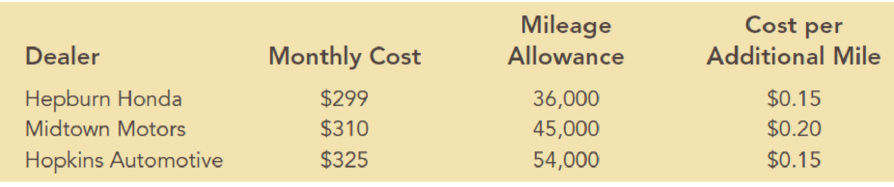

Amy Lloyd is interested in leasing a new Honda and has contacted three automobile dealers for pricing information. Each dealer offered Amy a closed-end 36-month lease with no down payment due at the time of signing. Each lease includes a monthly charge and a mileage allowance. Additional miles receive a surcharge on a per-mile basis. The monthly lease cost, the mileage allowance, and the cost for additional miles follow:

Amy decided to choose the lease option that will minimize her total 36-month cost. The difficulty is that Amy is not sure how many miles she will drive over the next three years. For purposes of this decision, she believes it is reasonable to assume that she will drive 12,000 miles per year, 15,000 miles per year, or 18,000 miles per year. With this assumption Amy estimated her total costs for the three lease options. For example, she figures that the Hepburn Honda lease will cost her 36($299) + $0.15(36,000 – 36,000) = $10,764 if she drives 12,000 miles per year, 36($299) + $0.15(45,000 – 36,000) = $12,114 if she drives 15,000 miles per year, or 36($299) + $0.15(54.000 – 36,000) = $13,464 if she drives 18,000 miles per year.

- a. What is the decision, and what is the chance

event ? - b. Construct a payoff table for Amy’s problem.

- c. If Amy has no idea which of the three mileage assumptions is most appropriate, what is the recommended decision (leasing option) using the optimistic, conservative, and minimax regret approaches?

- d. Suppose that the probabilities that Amy drives 12,000, 15,000, and 18,000 miles per year are 0.5, 0.4, and 0.1, respectively. What option should Amy choose using the

expected value approach? - e. Develop a risk profile for the decision selected in part (d). What is the most likely cost, and what is its

probability ? - f. Suppose that, after further consideration, Amy concludes that the probabilities that she will drive 12,000, 15,000, and 18,000 miles per year are 0.3, 0.4, and 0.3, respectively. What decision should Amy make using the expected value approach?

a.

Find the decision and the chance event faced by Amy.

Explanation of Solution

Here, the decision is based on selecting the best lease option. Thus the least option has three alternatives that are Hepburn Honda, Midtown Motors and Hopkins Automotive.

Here, the chance event is the number of miles Amy will drive.

b.

Find the payoff table for Amy’s problem.

Answer to Problem 3P

Thus, the payoff table for Amy’s problem is given as:

| Actual Miles Driven Annually | |||

| Decision | 12000 | 15000 | 18000 |

| Hepburn Honda | $10,764 | $12,114 | $13,464 |

| Midtown Motors | $11,160 | $11,160 | $12,960 |

| Hopkins Automotive | $11,700 | $11,700 | $11,700 |

Explanation of Solution

The payoff for any combination of alternative and the chance event is the sum of the total monthly charges and total additional mileage cost that is given as follows:

For the Hepburn Honda lease option:

For the Midtown Motors lease option:

For the Hopkins Automotive lease option:

Thus, the payoff table for Amy’s problem is given as:

| Actual Miles Driven Annually | |||

| Decision | 12000 | 15000 | 18000 |

| Hepburn Honda | $10,764 | $12,114 | $13,464 |

| Midtown Motors | $11,160 | $11,160 | $12,960 |

| Hopkins Automotive | $11,700 | $11,700 | $11,700 |

c.

Find the decision using the optimistic, conservative and minimax regret approaches.

Answer to Problem 3P

The Hepburn Honda lease option gives the optimistic approach because it has the smallest minimum profit.

The Hopkins Automotive lease option gives the conservative approach because it has the smallest maximum profit.

The minimax regret is the Hopkins Automotive lease option because it minimizes the maximum regret.

Explanation of Solution

By using the decision tree in Part (a), the maximum and minimum profit based on the decisions Hepburn Honda, Midtown Motors and Hopkins Automotive.

| Decision | Maximum Profit | Minimum Profit |

| Hepburn Honda | $10,764 | $13,464 |

| Midtown Motors | $11,160 | $12,960 |

| Hopkins Automotive | $11,700 | $11,700 |

Optimistic approach:

The optimistic approach evaluates each decision alternative in terms of best payoff that can occur.

The Hepburn Honda lease option gives the optimistic approach because it has the smallest minimum profit (from the above table).

Conservative approach:

The conservative approach evaluates each decision alternative in terms of worst payoff that can occur.

The Hopkins Automotive lease option gives the conservative approach because it has the smallest maximum profit (from the above table).

Minimax Regret approach:

The minimax regret approach is the difference between the payoff associated with a particular alternative and payoff associated with the most decision that would yield the most desirable payoff for a given state of nature.

Regret or opportunity loss table:

| Decision | 12000 | 15000 | 18000 | Maximum Regret |

| Hepburn Honda | $0 | $954 | $1,764 | $1,764 |

| Midtown Motors | $396 | $0 | $1,260 | $1,260 |

| Hopkins Automotive | $936 | $540 | $0 | $936 |

The maximum regret for the decision Hepburn Honda is $1,764, Midtown Motors is $1,260 and Hopkins Automotive is $936.

Here, the Hopkins Automotive lease option has been selected because it minimizes the maximum regret.

d.

Find the expected value approach for the probabilities of 0.5, 0.4 and 0.1.

Answer to Problem 3P

The expected value approach results in Midtown Motors lease option.

Explanation of Solution

The formula to find expected value (EV) of decision alternative di is given as follows:

Here, the expected value for the payoffs associated with each of Amy’s three alternatives:

The expected value approach results in Midtown Motors lease option because it has the minimum expected value of the three alternatives.

e.

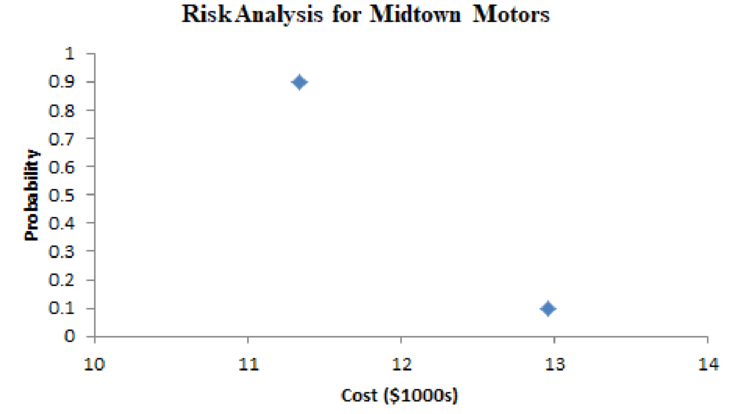

Find the most likely cost and its probability using risk analysis.

Answer to Problem 3P

The risk analysis for midtown motors, the most likely cost is $11,160 with the probability of 0.9.

Explanation of Solution

From the data in part (d).

The risk profile for the decision to lease from Midtown Motors is:

From the above risk analysis for midtown motors, the most likely cost is $11,160 with the probability of 0.9.

Here, there are only two unique costs on this graph because for the decision alternative (midtown motors) have two unique payoffs. The payoffs are associated with the three chance outcomes- the payoff (cost) associated with midtown motors lease is same for the two of the chance outcomes.

f.

Find the expected value approach for the probabilities of 0.3, 0.4 and 0.3.

Answer to Problem 3P

The expected value approach results in either Midtown Motors lease option or Hopkins Automotive lease option.

Explanation of Solution

The formula to find expected value (EV) of decision alternative di is given as follows:

Here, the expected value for the payoffs associated with each of Amy’s three alternatives:

The expected value approach results in either Midtown Motors lease option or Hopkins Automotive lease option because both have the same minimum expected value of the three alternatives.

Want to see more full solutions like this?

Chapter 12 Solutions

Essentials Of Business Analytics

- Suppose we wish to test the hypothesis that women with a sister’s history of breast cancer are at higher risk of developing breast cancer themselves. Suppose we assume that the prevalence rate of breast cancer is 3% among 60- to 64-year-old U.S. women, whereas it is 5% among women with a sister history. We propose to interview 400 women 40 to 64 years of age with a sister history of the disease. What is the power of such a study assuming that the level of significance is 10%? I only need help writing the null and alternative hypotheses.arrow_forward4.96 The breaking strengths for 1-foot-square samples of a particular synthetic fabric are approximately normally distributed with a mean of 2,250 pounds per square inch (psi) and a standard deviation of 10.2 psi. Find the probability of selecting a 1-foot-square sample of material at random that on testing would have a breaking strength in excess of 2,265 psi.4.97 Refer to Exercise 4.96. Suppose that a new synthetic fabric has been developed that may have a different mean breaking strength. A random sample of 15 1-foot sections is obtained, and each section is tested for breaking strength. If we assume that the population standard deviation for the new fabric is identical to that for the old fabric, describe the sampling distribution forybased on random samples of 15 1-foot sections of new fabricarrow_forwardUne Entreprise œuvrant dans le domaine du multividéo donne l'opportunité à ses programmeurs-analystes d'évaluer la performance des cadres supérieurs. Voici les résultats obtenues (sur une échelle de 10 à 50) où 50 représentent une excellente performance. 10 programmeurs furent sélectionnés au hazard pour évaluer deux cadres. Un rapport Excel est également fourni. Programmeurs Cadre A Cadre B 1 34 36 2 32 34 3 18 19 33 38 19 21 21 23 7 35 34 8 20 20 9 34 34 10 36 34 Test d'égalité des espérances: observations pairéesarrow_forward

- A television news channel samples 25 gas stations from its local area and uses the results to estimate the average gas price for the state. What’s wrong with its margin of error?arrow_forwardYou’re fed up with keeping Fido locked inside, so you conduct a mail survey to find out people’s opinions on the new dog barking ordinance in a certain city. Of the 10,000 people who receive surveys, 1,000 respond, and only 80 are in favor of it. You calculate the margin of error to be 1.2 percent. Explain why this reported margin of error is misleading.arrow_forwardYou find out that the dietary scale you use each day is off by a factor of 2 ounces (over — at least that’s what you say!). The margin of error for your scale was plus or minus 0.5 ounces before you found this out. What’s the margin of error now?arrow_forward

- Suppose that Sue and Bill each make a confidence interval out of the same data set, but Sue wants a confidence level of 80 percent compared to Bill’s 90 percent. How do their margins of error compare?arrow_forwardSuppose that you conduct a study twice, and the second time you use four times as many people as you did the first time. How does the change affect your margin of error? (Assume the other components remain constant.)arrow_forwardOut of a sample of 200 babysitters, 70 percent are girls, and 30 percent are guys. What’s the margin of error for the percentage of female babysitters? Assume 95 percent confidence.What’s the margin of error for the percentage of male babysitters? Assume 95 percent confidence.arrow_forward

- You sample 100 fish in Pond A at the fish hatchery and find that they average 5.5 inches with a standard deviation of 1 inch. Your sample of 100 fish from Pond B has the same mean, but the standard deviation is 2 inches. How do the margins of error compare? (Assume the confidence levels are the same.)arrow_forwardA survey of 1,000 dental patients produces 450 people who floss their teeth adequately. What’s the margin of error for this result? Assume 90 percent confidence.arrow_forwardThe annual aggregate claim amount of an insurer follows a compound Poisson distribution with parameter 1,000. Individual claim amounts follow a Gamma distribution with shape parameter a = 750 and rate parameter λ = 0.25. 1. Generate 20,000 simulated aggregate claim values for the insurer, using a random number generator seed of 955.Display the first five simulated claim values in your answer script using the R function head(). 2. Plot the empirical density function of the simulated aggregate claim values from Question 1, setting the x-axis range from 2,600,000 to 3,300,000 and the y-axis range from 0 to 0.0000045. 3. Suggest a suitable distribution, including its parameters, that approximates the simulated aggregate claim values from Question 1. 4. Generate 20,000 values from your suggested distribution in Question 3 using a random number generator seed of 955. Use the R function head() to display the first five generated values in your answer script. 5. Plot the empirical density…arrow_forward

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Elementary AlgebraAlgebraISBN:9780998625713Author:Lynn Marecek, MaryAnne Anthony-SmithPublisher:OpenStax - Rice University

Elementary AlgebraAlgebraISBN:9780998625713Author:Lynn Marecek, MaryAnne Anthony-SmithPublisher:OpenStax - Rice University Algebra: Structure And Method, Book 1AlgebraISBN:9780395977224Author:Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. ColePublisher:McDougal Littell

Algebra: Structure And Method, Book 1AlgebraISBN:9780395977224Author:Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. ColePublisher:McDougal Littell Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning, Intermediate AlgebraAlgebraISBN:9781285195728Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning

Intermediate AlgebraAlgebraISBN:9781285195728Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning Algebra for College StudentsAlgebraISBN:9781285195780Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning

Algebra for College StudentsAlgebraISBN:9781285195780Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning