Concept explainers

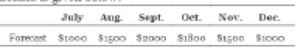

eXcel 10. The Ban go Toy Company produces several types of toys to seasonal demand. The

A regular employee can produce $10,000 worth of toys per month, and the company has so regular employees at the end of June. Regular-time employees are paid $3800 per month, including benefits. An employee on overtime produces at the same rate as on regular time but is paid at 150 percent of the regular pay. Up to 20 percent overtime can be used in anyone month. A worker can be hired for $1000, and it costs $2000 to layoff an employee. Inventory carrying costs are 30 percent per year. The company wishes to end the year with so employees. Beginning inventory of toys is $900,000.

- a. Calculate the cost of a chase strategy.

- b. Calculate the cost of a level strategy.

- c. Using the Excel template, simulate several other strategies.

- d. Determine the effect on the chase strategy, in part a, of changing the hiring cost to $ 1500, $2000, and $2500. What do these changes suggest the relationship is between hiring cost and total cost?

- e. Use the Excel template to study the effect of demand changes on the total cost of the chase strategy. Assume various percentage increases and decreases in demand (110 percent, 120 percent, 210 percent, 220 percent, etc.).

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

OPERATIONS MANAGEMENT IN THE SUPPLY CHAIN: DECISIONS & CASES (Mcgraw-hill Series Operations and Decision Sciences)

- Dyson, a high-tech home appliance maker, has cut ties with Malaysian supplier ATA IMS Bhd following an audit of the company's labour practices and allegations by a whistleblower. ATA is already under US investigation over forced labour allegations. Dyson has terminated its contracts and is in talks with its customer over the audit findings. ATA, which produces parts for Dyson's vacuum cleaners and air purifiers, tumbled 30% to its lowest since April 2020. The termination is a significant blow for Malaysia, a major electronics manufacturing hub, which has faced scrutiny this year over claims of abusive working and living conditions. Dyson terminated the relationship with six months' contractual notice, hoping it would give ATA the impetus to improve and enable an orderly withdrawal in the interests of the workers they employ. Former ATA worker Dhan Kumar Limbu was beaten by police in Malaysia after sharing information about conditions at the factory with activists. ATA denied all…arrow_forwardQuestion 4 (25 Marks) Discuss how developing internal performance measures to track the performance of supplier development, can create efficiency for Pick n Pay.arrow_forwardLeadership and people Earlier this year, Pick n Pay actioned the first priority of the plan: the introduction of a new, simplified and seasoned leadership team with proven track records. The team has already implemented strengthened structures, including establishing regional trading areas with local decision-making, with clear sight of strong long-term succession Each operating region now has a regional buying team and store management team in place to meet specific customer needs particular to that region, while also increasing staff training and productivity for an overall improved store experience. Reset the store estate To create a more sustainable supermarket business, the Group is resetting its store estate to minimise losses by creating a smaller but more profitable Pick n Pay store estate. The plan is to leverage the strength of its multi-format model with strategic conversions to lift store profitability: selected Pick n Pay stores will be converted to Boxer, where customer…arrow_forward

- Question 3 (25 Marks) Elaborate on how Pick n Pay could use information technology and ERP systems across the company and their suppliers to improve their operating model? Question 4 (25 Marks)arrow_forwardQuestion 2 (25 Marks) Discuss how you would "reset the store estate" to remain competitive and relevant in the market? Question 3 (25 Marks)arrow_forwardWhat should leaders do after conducting an employee survey? take immediate action on results take at least 6 months to review the results to make sure the leader understands them review them immediately, but do not take action right away keep results confidential from employeesarrow_forward

- One of the best ways to encourage teamwork is to: continually promote from outside of the department recognize employees who focus on their personal performance goals only reward employees who complete their own tasks and also assist with problems outside of their department discuss individual performance issues at staff meetingsarrow_forwardWhat can happen if a leader doesn't encourage teamwork? team members will support each other more the environment can become overly competitive and hostile turnover will descrease team members become more motivatedarrow_forwardunderstand 4 Classwork LSC Drag the name of the figure of speech to its example. 12 February 2025 personification Onomatopoeia Simile Metaphor Hyperbole Onomatopoeia metaphor 1. He tried to help but his legs were wax. Metaphor 2. The man flights like a lion on the soccer field. Simile 3. The books fell on the table with a loud thump. Onomatopoeia 4. Rita heard the last piece of pie calling her name. Personification 5. The rustling leaves kept me away. Personification 6. Kisses are the flowers of affection. 7. He's running faster than the windarrow_forward

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,- MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Management, Loose-Leaf VersionManagementISBN:9781305969308Author:Richard L. DaftPublisher:South-Western College Pub

Management, Loose-Leaf VersionManagementISBN:9781305969308Author:Richard L. DaftPublisher:South-Western College Pub