Corrected Financial Statements

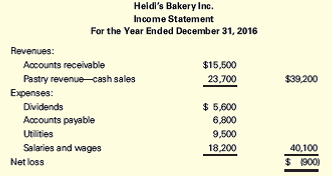

Heidi’s Bakery Inc. operates a small pastry business. The company has always maintained a complete and accurate set of records. Unfortunately, the company’s accountant left in a dispute with the president and took the 2016 financial statements with her. The following

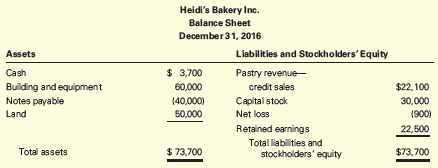

The president is very disappointed with the net loss for the year because net income has averaged $21,000 over the last ten years. He has asked for your help in determining whether the reported net loss accurately reflects the profitability of the company and whether the balance sheet is prepared correctly.

Required

- Prepare a corrected income statement for the year ended December 31, 2016.

- Prepare a statement of

retained earnings for the year ended December 31, 2016. (The actual amount of retained earnings on January 1, 2016, was $39,900. The December 31, 2016, Retained Earnings balance shown is incorrect. The president simply “plugged in” this amount to make the balance sheet balance.) - Prepare a corrected balance sheet at December 31, 2016.

- Draft a memo to the president explaining the major differences between the income statement he prepared and the one you prepared.

Trending nowThis is a popular solution!

Chapter 1 Solutions

Financial Accounting: The Impact on Decision Makers

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning