Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1.5AP

Income Statement, Statement of

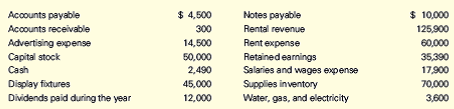

The following list, in alphabetical order, shows the various items that regularly appear on the financial statements of Sterns Audio Book Rental Corp. The amounts shown for balance sheet items are balances as of December 31, 2016 (with the exception of retained earnings, which is the balance on January 1, 2016), and the amounts shown for income statement items are balances for the year ended December 31, 2016.

Required

- Prepare an income statement for the year ended December 31, 2016.

- Prepare a statement of retained earnings for the year ended December 31, 2016.

- Prepare a balance sheet at December 31, 2016.

- You have $1,000 to invest. On the basis of the statements you prepared, would you use it to buy stock in this company? Explain. What other information would you want before deciding?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Tanishk Manufacturing has gross sales of $45,000 for the year. Its cost for the goods sold is $28,000. Returns and allowances amounted to $3,500. It purchased equipment normally selling for $12,000 at a 25% discount. Based on these facts, what is its total gross income for the year? tutor please provide answer

Majestic Collectibles can produce keepsakes that will be sold for $75 each. Non-depreciation fixed costs are $1,200 per year, and variable costs are $55 per unit. What is the degree of operating leverage of Majestic Collectibles when sales are $8,250? Accurate answer

General Accounting

Chapter 1 Solutions

Financial Accounting: The Impact on Decision Makers

Ch. 1 - Prob. 1.1KTQCh. 1 - Prob. 1.1ECh. 1 - Prob. 1.2ECh. 1 - The Accounting Equation For each of the following...Ch. 1 - The Accounting Equation Ginger Enterprises began...Ch. 1 - The Accounting Equation Using the accounting...Ch. 1 - Changes in Owners Equity The following amounts are...Ch. 1 - The Accounting Equation For each of the following...Ch. 1 - Classification of Financial Statement Items...Ch. 1 - Classification of Financial Statement Items Regal...

Ch. 1 - Net Income (or Loss) and Retained Earnings The...Ch. 1 - Statement of Retained Earnings Ace Corporation has...Ch. 1 - Accounting Principles and Assumptions The...Ch. 1 - Prob. 1.13ECh. 1 - Prob. 1.14ECh. 1 - Prob. 1.15MCECh. 1 - Prob. 1.16MCECh. 1 - Prob. 1.1PCh. 1 - Users of Accounting Information and Their Needs...Ch. 1 - Prob. 1.3PCh. 1 - Prob. 1.4PCh. 1 - Income Statement, Statement of Retained Earnings,...Ch. 1 - Income Statement and Balance Sheet Green Bay...Ch. 1 - Prob. 1.7PCh. 1 - Statement of Retained Earnings for The Coca-Cola...Ch. 1 - Prob. 1.9PCh. 1 - Prob. 1.10MCPCh. 1 - Prob. 1.1APCh. 1 - Users of Accounting Information and Their Needs...Ch. 1 - Prob. 1.3APCh. 1 - Prob. 1.4APCh. 1 - Income Statement, Statement of Retained Earnings,...Ch. 1 - Income Statement and Balance Sheet Fort Worth...Ch. 1 - Corrected Financial Statements Heidis Bakery Inc....Ch. 1 - Statement of Retained Earnings for Brunswick...Ch. 1 - Prob. 1.9APCh. 1 - Prob. 1.10AMCPCh. 1 - Prob. 1.1DCCh. 1 - Reading and Interpreting Chipotles Financial...Ch. 1 - Comparing Two Companies in the Same Industry:...Ch. 1 - Prob. 1.5DCCh. 1 - Prob. 1.6DCCh. 1 - Prob. 1.7DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License