Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1.6E

Changes in Owners’ Equity

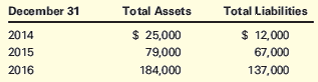

The following amounts are available from the records of Coaches and Carriages Inc. at the end of the years indicated:

Required

- Compute the changes in Coaches and Carriages owners’ equity during 2015 and 2016.

- Compute the amount of Coaches and Carriages’ net income (or loss) for 2015 assuming that no dividends were paid and the owners made no additional contributions during the year.

- Compute the amount of Coaches and Carriages’ net income (or loss) for 2016 assuming that dividends paid during the year amounted to $10,000 and no additional contributions were made by the owners.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Liability?

Solve this question financial accounting

Production Efficiency

Chapter 1 Solutions

Financial Accounting: The Impact on Decision Makers

Ch. 1 - Prob. 1.1KTQCh. 1 - Prob. 1.1ECh. 1 - Prob. 1.2ECh. 1 - The Accounting Equation For each of the following...Ch. 1 - The Accounting Equation Ginger Enterprises began...Ch. 1 - The Accounting Equation Using the accounting...Ch. 1 - Changes in Owners Equity The following amounts are...Ch. 1 - The Accounting Equation For each of the following...Ch. 1 - Classification of Financial Statement Items...Ch. 1 - Classification of Financial Statement Items Regal...

Ch. 1 - Net Income (or Loss) and Retained Earnings The...Ch. 1 - Statement of Retained Earnings Ace Corporation has...Ch. 1 - Accounting Principles and Assumptions The...Ch. 1 - Prob. 1.13ECh. 1 - Prob. 1.14ECh. 1 - Prob. 1.15MCECh. 1 - Prob. 1.16MCECh. 1 - Prob. 1.1PCh. 1 - Users of Accounting Information and Their Needs...Ch. 1 - Prob. 1.3PCh. 1 - Prob. 1.4PCh. 1 - Income Statement, Statement of Retained Earnings,...Ch. 1 - Income Statement and Balance Sheet Green Bay...Ch. 1 - Prob. 1.7PCh. 1 - Statement of Retained Earnings for The Coca-Cola...Ch. 1 - Prob. 1.9PCh. 1 - Prob. 1.10MCPCh. 1 - Prob. 1.1APCh. 1 - Users of Accounting Information and Their Needs...Ch. 1 - Prob. 1.3APCh. 1 - Prob. 1.4APCh. 1 - Income Statement, Statement of Retained Earnings,...Ch. 1 - Income Statement and Balance Sheet Fort Worth...Ch. 1 - Corrected Financial Statements Heidis Bakery Inc....Ch. 1 - Statement of Retained Earnings for Brunswick...Ch. 1 - Prob. 1.9APCh. 1 - Prob. 1.10AMCPCh. 1 - Prob. 1.1DCCh. 1 - Reading and Interpreting Chipotles Financial...Ch. 1 - Comparing Two Companies in the Same Industry:...Ch. 1 - Prob. 1.5DCCh. 1 - Prob. 1.6DCCh. 1 - Prob. 1.7DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License