Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1.11E

Statement of

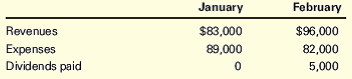

Ace Corporation has been in business for many years. Retained earnings on January 1, 2016, is $235,800. The following information is available for the first two months of 2016:

Required

Prepare a statement of retained earnings for the month ended February 29, 2016.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What would a 5-year projection for a startup Accounting Firm business look like?

Include units, dollars, and assumptions in the projection.

How would a startup Accounting Firm present the sales projection in a narrative that includes the description of the units you plan to sell, the services (amount of them) you plan to provide, and your growth projections of these numbers?

When will a startup Accounting Firm start making a profit and have the break-even point?

None

Kindly help me with general accounting question

Chapter 1 Solutions

Financial Accounting: The Impact on Decision Makers

Ch. 1 - Prob. 1.1KTQCh. 1 - Prob. 1.1ECh. 1 - Prob. 1.2ECh. 1 - The Accounting Equation For each of the following...Ch. 1 - The Accounting Equation Ginger Enterprises began...Ch. 1 - The Accounting Equation Using the accounting...Ch. 1 - Changes in Owners Equity The following amounts are...Ch. 1 - The Accounting Equation For each of the following...Ch. 1 - Classification of Financial Statement Items...Ch. 1 - Classification of Financial Statement Items Regal...

Ch. 1 - Net Income (or Loss) and Retained Earnings The...Ch. 1 - Statement of Retained Earnings Ace Corporation has...Ch. 1 - Accounting Principles and Assumptions The...Ch. 1 - Prob. 1.13ECh. 1 - Prob. 1.14ECh. 1 - Prob. 1.15MCECh. 1 - Prob. 1.16MCECh. 1 - Prob. 1.1PCh. 1 - Users of Accounting Information and Their Needs...Ch. 1 - Prob. 1.3PCh. 1 - Prob. 1.4PCh. 1 - Income Statement, Statement of Retained Earnings,...Ch. 1 - Income Statement and Balance Sheet Green Bay...Ch. 1 - Prob. 1.7PCh. 1 - Statement of Retained Earnings for The Coca-Cola...Ch. 1 - Prob. 1.9PCh. 1 - Prob. 1.10MCPCh. 1 - Prob. 1.1APCh. 1 - Users of Accounting Information and Their Needs...Ch. 1 - Prob. 1.3APCh. 1 - Prob. 1.4APCh. 1 - Income Statement, Statement of Retained Earnings,...Ch. 1 - Income Statement and Balance Sheet Fort Worth...Ch. 1 - Corrected Financial Statements Heidis Bakery Inc....Ch. 1 - Statement of Retained Earnings for Brunswick...Ch. 1 - Prob. 1.9APCh. 1 - Prob. 1.10AMCPCh. 1 - Prob. 1.1DCCh. 1 - Reading and Interpreting Chipotles Financial...Ch. 1 - Comparing Two Companies in the Same Industry:...Ch. 1 - Prob. 1.5DCCh. 1 - Prob. 1.6DCCh. 1 - Prob. 1.7DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company has beginning inventory of 2,300 units at a cost of $4.4 per unit. During the month, it purchases an additional 3,200 units at $5.8 per unit. If the company uses the weighted average cost method, what is the average cost per unit? A. $4.20 B. $4.60 C. $4.40 D. $5.00 E. $5.21arrow_forwardProvide correct answer general Accountingarrow_forwardNeed help with this accounting questionsarrow_forward

- If a company's net income for the year is $115,000 and its total assets at the beginning of the year were $525,000, while its total assets at the end of the year were $710,000, what is the company's return on assets (ROA)? Help me with this financial accounting Queryarrow_forwardThe green tree company manufacturers woodenarrow_forwardIf a company's net income for the year is $115,000 and its total assets at the beginning of the year were $525,000, while its total assets at the end of the year were $710,000, what is the company's return on assets (ROA)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License