Comparative Income Statements and Management Analysis

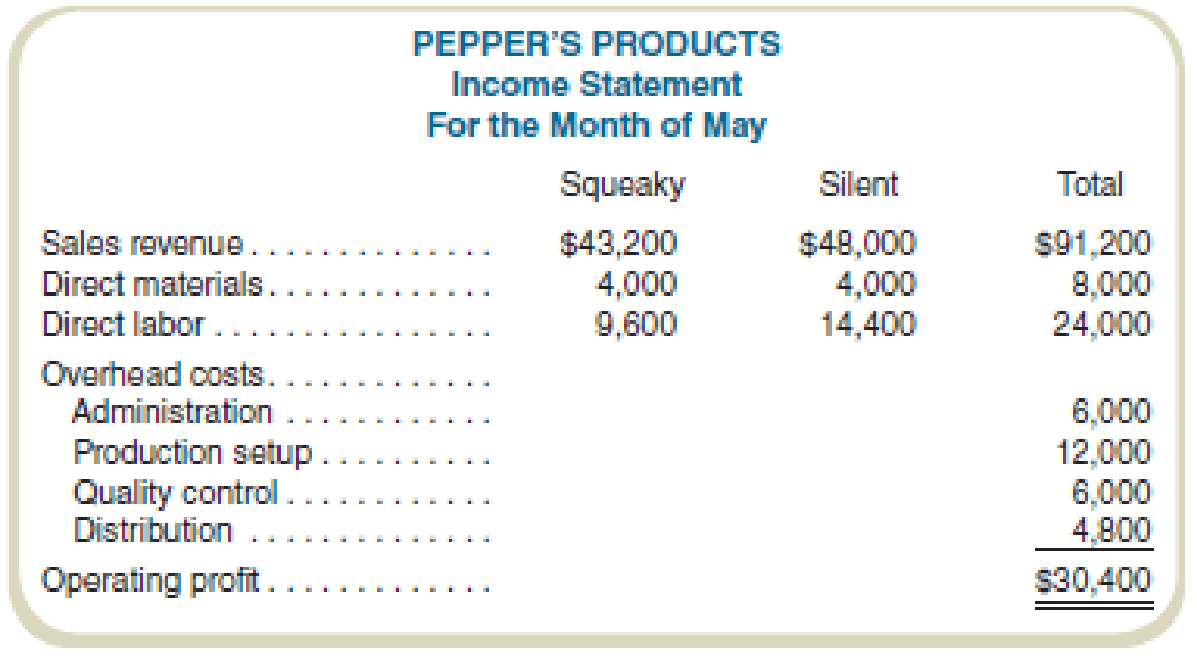

Pepper’s Products manufactures and sells two types of chew toys for pets, Squeaky and Silent. In May, Pepper’s Products had the following costs and revenues:

Pepper’s Products currently uses labor costs to allocate all

Required

- a. Complete the income statement using the preceding activity bases.

- b. Write a report indicating how management might use activity-based costing to reduce costs.

- c. Restate the income statement for Pepper’s Products using direct labor costs as the only overhead allocation base.

- d. Write a report to management stating why product line profits differ-using activity based costing compared to the traditional approach. Indicate whether activity-based costing provides more accurate information and why (if you believe it does provide more accurate information). Indicate in your report how the use of labor-based overhead allocation could cause management at Pepper’s Products to make suboptimal decisions.

a.

Complete the income statement using preceding activity bases.

Explanation of Solution

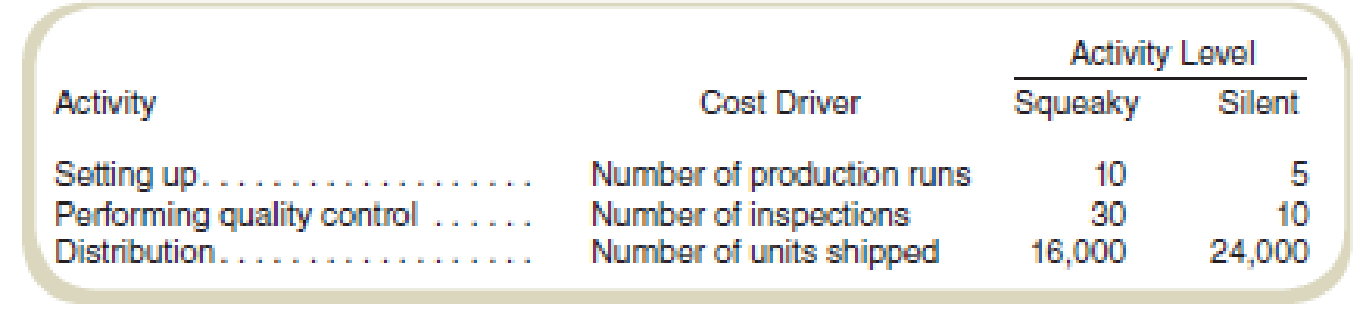

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Complete the income statement using preceding activity bases:

| Particulars | Squeaky | Silent | Total |

| Sales revenue | $43,200 | $48,000 | $91,200 |

| Direct materials | $4,000 | $4,000 | $8,000 |

| Direct labor | $9,600 | $14,400 | $24,000 |

| Overhead costs: | |||

|

Add: Administration | $2,400 | $3,600 | $6,000 |

|

Add: Production setup | $8,000 | $4,000 | $12,000 |

|

Add: Quality control | $4,500 | $1,500 | $6,000 |

|

Add: Distribution | $1,920 | $2,880 | $4,800 |

| Total overhead costs | $16,820 | $11,980 | $28,800 |

|

Operating profit | $12,780 | $17,620 | $30,400 |

Table: (1)

Working note 1:

Compute the percentage of direct labor applicable:

Working note 2:

Compute the rate per setup:

Working note 3:

Compute the rate per inspection:

Working note 4:

Compute the shipping cost per unit:

b.

Write a brief report indicating how management could use activity-based costing to reduce costs

Explanation of Solution

Activity-based costing:

Activity-based costing (ABC) refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

ABC method for reducing the cost:

Reduction in the cost of activities may not be the direct result of implementing the ABC method of costing, but it can highlight the activities where the cost reduction can be made. Reducing the setup costs or other overhead costs specifically from the perspective of cost reduction can be identified using the ABC method of costing.

c.

Restate the income statement according to the information given in the question.

Explanation of Solution

Recompute the income statement according to the information given in the question:

| Particulars | Squeaky | Silent | Total |

| Sales revenue | $43,200 | $48,000 | $91,200 |

| Direct materials | $4,000 | $4,000 | $8,000 |

| Direct labor | $9,600 | $14,400 | $24,000 |

|

Overhead costs | $11,520 | $17,280 | $28,800 |

| Operating profit | $18,080 | $12,320 | $30,400 |

Table: (2)

Working note 5:

d.

Write a report to management stating why product line profits differ using activity-based costing compared to the traditional approach. Indicate whether activity-based costing provides more accurate information and provide a reason for the same.

Explanation of Solution

Purpose of the report:

To explain the difference between the implementation of ABC costing and traditional labor-based costing method for the computation of the product line profits.

The implication of both the methods:

Direct costs do not differ in both the methods implemented. While using the labor-based method, all the overhead costs are computed under one single head and while using ABC the bifurcation of cost drivers is relevant to their respective cost of allocation

Result using the traditional labor-based method of costing:

The result shows that the product Squeaky has made a profit of $18,080 which is 41% percent of the sales revenue. And the product Silent has attained a profit of $12,320 which is 25% of sales revenue.

Result using the ABC method of costing:

The result shows that the product Squeaky has attained a profit of $12,780 which is 30% percent of the sales revenue. And the product Silent has incurred the loss of $17,620 which is 36% of sales revenue.

Conclusion:

The choice of a method adapted should be ABC costing as the results computed from the traditional labor-based method are fluctuating.

Want to see more full solutions like this?

Chapter 9 Solutions

COST ACCOUNTING W/CONNECT

- How much gross profit was realized from this sale on this general accounting question?arrow_forwardMartinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its unit costs are as follows: Amount Per Unit Direct materials $ 6 Direct labor $ 3.50 Variable manufacturing overhead $ 1.50 Fixed manufacturing overhead $ 4 Fixed selling expense $ 3 Fixed administrative expense $2 Sales commissions $ 1 $ 0.50 Variable administrative expense Required: 1. For financial accounting purposes, what is the total amount of product costs incurred to make 10,000 units? 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 10,000 units? 3. If 8,000 units are sold, what is the variable cost per unit sold? 4. If 12,500 units are sold, what is the variable cost per unit sold?arrow_forwardWhich of the following is included in inventory costs? A. Period costs. B. Product and period costs. C. Product costs. D. Neither product or period costs.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning