Concept explainers

Activity-Based versus Traditional Costing

Maglie Company manufactures two video game consoles: handheld and home. The handheld consoles are smaller and less expensive than the home consoles. The company only recently began producing the home model. Since the introduction of the new product, profits have been steadily declining. Management believes that the accounting system is not accurately allocating costs to products, particularly because sales of the new product have been increasing.

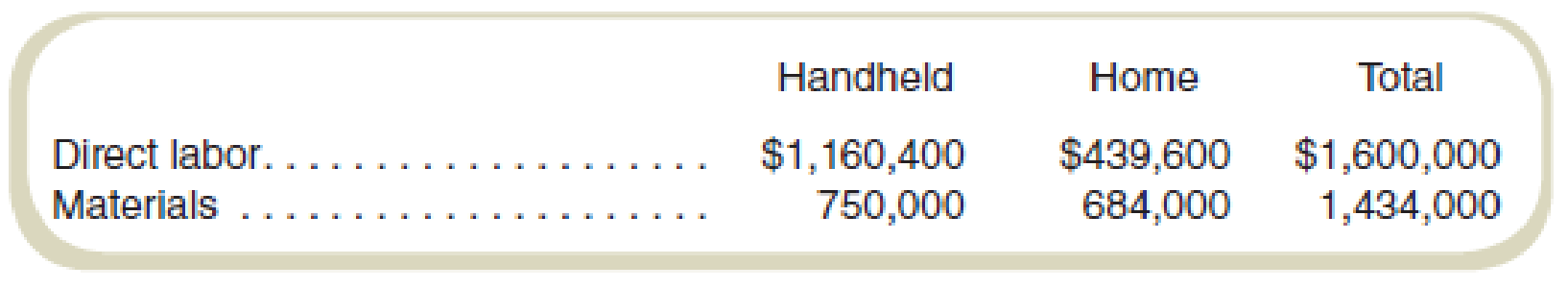

Management has asked you to investigate the cost allocation problem. You find that manufacturing

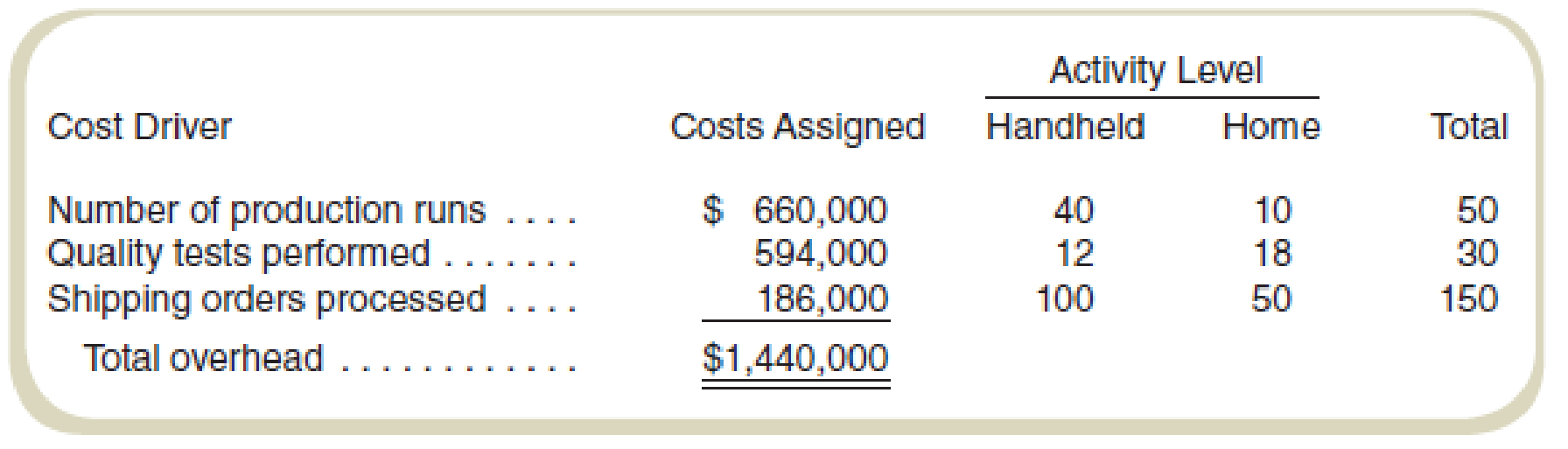

Management has determined that overhead costs are caused by three cost drivers. These drivers and their costs for last year are as follows:

Required

- a. How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total cost per unit produced for each product?

- b. How much overhead will be assigned to each product if direct labor cost is used to allocate overhead? What is the total cost per unit produced for each product?

- c. How might the results from using activity-based costing in requirement (a) help management understand Maglie’s declining profits?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

COST ACCOUNTING W/CONNECT

- What is the stockholder's equity at the end of the year on general Accounting question?arrow_forwardI don't need ai answer accounting questionsarrow_forwardLaws can be classified into several categories: criminal law versus civil law, substantive law versus procedural law, public versus private law, and law versus equity. Discuss one of these categories and the distinctions between the two types of laws.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning