Concept explainers

Prepare a Flexible Budget with More Than One Cost Driver

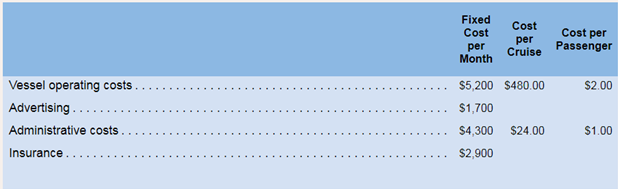

Alyeski Tours operates day tours of coastal glaciers in Alaska on its tow boat the Blue Glacer. Management has identified two cost drivers−the number of cruises and the number of passengers−that it uses in its budgeting and performance reports. The company publishes a schedule of day cruises that it may supplement with special sailings if there is sufficient demand. Up to 80 passengers can be accommodated on the tour boat. Data concerning the companys cost formulas appear below:

For example, vessel operating costs should be Ss.200 per month plus $480 per cruise plus $2 per passenger. The company’s sales should average S2S per passenger. In July. the company provided 24 cruises for a total of 1,400 passengers.

Required: Using Exhibit 9−7 as your guide, prepare the company’s flexible budget for July.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Introduction To Managerial Accounting

- 5 PTSarrow_forwardKaran Financial Services has total sales of $890,000, costs of $365,000, depreciation expense of $57,000, and an interest expense of $42,000. The company has a tax rate of 30%. What is Karan Financial Services' net income?arrow_forwardDon't use ai given answer accounting questionsarrow_forward

- Financial Accounting: At an output level of 53,000 units, you calculate that the degree of operating leverage is 1.75. If output rises to 82,420 units, what will the percentage change in operating cash flow be? Help me with thisarrow_forwardGnomes R Us just paid a dividend of $3.22 per share. The company has a dividend payout ratio of 64 percent. If the PE ratio is 18.2 times, what is the stock price?arrow_forwardGnomes R Us just paid a dividend of $3.22 per share. The company has a dividend payout ratio of 64 percent. If the PE ratio is 18.2 times, what is the stock price? Ansarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College