Multiple Products. Materials, and Processes

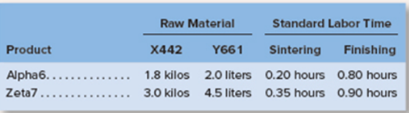

Mickley Corporation produces two products. Alpha’s and Zeta’s, which pass through two operations. Sintering and

Finishing. Each of the products uses two raw materials−X442 and Y661. The company uses a

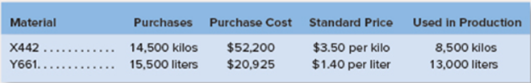

Information relating to materials purchased and materials used in production during May follows:

The following additional information is available:

a. The company recognizes price variances when materials are purchased.

b. The standard labor rate is $19.80 per hour in Sintering and $19.20 per hour in Finishing.

c. During May, 1,200 direct labor-hours were worked in Sintering at a total labor cost of $27,000, and 2,850 direct labor-hours were worked in Finishing at a total labor cost of $59.850.

d. Production during May was 1,500 Alpha6s and 2.000 Zeta7s.

Required:

1. Prepare a standard cost card for each product, showing the standard cost of direct materials and direct labor.

2. Compute the materials price and quantity variances for each material.

3. Compute the labor rate and efficiency variances for each operation.

.

1

Standard cost card

A standard cost card contains all the information regarding standard quantities, rates, hours etc. It shows total cost of producing one unit.

To prepare: Standard cost card for both the given products, showing cost of direct materials and labor.

Answer to Problem 21P

Total standard cost of alpha6s is determined as $28.42 and of zeta7s is $41.01.

Explanation of Solution

Standard cost card of Alpha6s:

| Particulars | Standard Quantity or standard hours | Standard price or standard rate | Standard cost (in $) | ||

| Direct material (X442) | 1.8 | Kilos | $3.5 | Per kilo | 6.3 |

| Direct material (Y661) | 2.0 | Liters | $1.4 | Per liter | 2.8 |

| Direct labor (Sintering) | 0.2 | Hours | $19.8 | Per hour | 3.96 |

| Direct labor (Finishing) | 0.8 | Hours | $19.2 | Per hour | 15.36 |

| Total | 28.42 | ||||

Standard cost card of zeta7s:

| Particulars | Standard Quantity or standard hours | Standard price or standard rate | Standard cost (in $) | ||

| Direct material (X442) | 3.0 | Kilos | $3.5 | Per kilo | 10.5 |

| Direct material (Y661) | 4.5 | Liters | $1.4 | Per liter | 6.3 |

| Direct labor (Sintering) | 0.35 | Hours | $19.8 | Per hour | 6.93 |

| Direct labor (Finishing) | 0.9 | Hours | $19.2 | Per hour | 17.28 |

| Total | 41.01 | ||||

So, total standard cost of Alpha6s is $28.42 and of zeta7s is $41.01.

2

Variances

A variance shows difference between actual amount of cost incurred and the budgeted cost. Variances can either be favorable or unfavorable.

To calculate: Amount of material price variance and quantity variance.

Answer to Problem 21P

Material price variance for material X442 is $1,450 unfavorable and for material Y661 is $775 favorable.

material quantity variance for material X442 is $700 favorable and for material Y661 is $1,400 unfavorable.

Explanation of Solution

Formula to calculate material price variance is:

For material X442, actual price will be:

Standard price is given as $3.5 per kilo and actual quantity purchased is 14,500. So, material price variance will be:

For material Y661, actual price will be:

Standard price is given as $1.4 per liter and actual quantity purchased is 15,500. So, material price will be:

Formula to calculate material quantity variance is:

For material X442, actual quantity is given as 8,500 kilos and standard price is $3.5 per kilo. Standard quantity will be calculated as:

So, Material quantity variance will be:

For material Y661, actual quantity is given as 13,000 liters and standard price is $1.4 per liter. Standard quantity will be calculated as:

So, material quantity variance will be:

3

Variances

Variances related to labor show difference among actual cost incurred on labor and the standard cost. Variances are considered favorable when standard cost is more than that of actual cost.

Amount of labor rate and efficiency variances.

Answer to Problem 21P

Labor rate variance for sintering is $3,240 unfavorable and for finishing is $5,130 unfavorable.

Labor efficiency variance for sintering is $3,960 unfavorable and for finishing is $2,880 favorable.

Explanation of Solution

Formula to calculate labor rate variance is:

For sintering, standard rate is $19.80 per hour, actual hours worked are 1,200 and actual rate will be $22.5 per hour ($27,000/1,200). Labor rate variance will be:

For finishing, standard rate is $19.20 per hour, actual hours worked are 2,850 and actual rate will be $21 per hour ($59,850/2,850). So, labor rate variance will be:

Formula to calculate labor efficiency variance is:

For sintering, actual hours are 1,200, standard rate is $19.8 and standard hours will be 1,000 ((0.2*1,500)+(0.35*2,000)). So, the labor efficiency variance will be:

For finishing, actual hours are 2,850, standard rate is $19.2 and standard hours will be 3,000 ((0.8*1,500 + 0.9*2,000))

Want to see more full solutions like this?

Chapter 9 Solutions

Introduction To Managerial Accounting

- Can you help me solve this general accounting problem using the correct accounting process?arrow_forwardApplying the Accounting Equation and Assessing Financial Statement LinkagesThe following information is available for Advanced Micro Devices (AMD) and Intel for a recent fiscal year.• AMD’s assets increased by $1,004 million and its liabilities increased by $334 million.• Intel’s assets increased by $4,714 million and its liabilities decreased by $830 million.a. Complete the following table. Assets, beginning Assets, end Liabilities, Liabilities, Stockholders’ Equity, (in $ millions) of year of year beginning of year end of year end of year AMD Answer 1 $4,556 $2,956 Answer 2 Answer 3 Intel $123,249 Answer 4 Answer 5 $53,400 Answer 6 b. Calculate average assets for each company. (in $ millions) Average Assets AMD Answer 7 Intel Answer 8 c. Which company has the larger proportion of its assets financed by the company’s owners at year-end? Answer 9arrow_forwardApplying the Accounting Equation and Assessing Financial Statement LinkagesThe following information is available for Advanced Micro Devices (AMD) and Intel for a recent fiscal year.• AMD’s assets increased by $1,004 million and its liabilities increased by $334 million.• Intel’s assets increased by $4,714 million and its liabilities decreased by $830 million.a. Complete the following table. Assets, beginning Assets, end Liabilities, Liabilities, Stockholders’ Equity, (in $ millions) of year of year beginning of year end of year end of year AMD Answer 1 $4,556 $2,956 Answer 2 Answer 3 Intel $123,249 Answer 4 Answer 5 $53,400 Answer 6 b. Calculate average assets for each company. (in $ millions) Average Assets AMD Answer 7 Intel Answer 8 c. Which company has the larger proportion of its assets financed by the company’s owners at year-end? Answer 9arrow_forward

- Formulating Financial Statements from Raw Data and Calculating RatiosFollowing is selected financial information from JM Smucker Co. for a recent fiscal year ($ millions). Current assets, end of year $2,010.1 Noncurrent liabilities, end of year $5,962.1 Cash, end of year 169.9 Stockholders' equity, end of year 8,140.1 Cash for investing activities (355.5) Cash from operating activities 1,136.3 Cost of product sold 5,298.2 Total assets, beginning of year 16,284.2 Total liabilities, end of year 7,914.9 Revenue 7,998.9 Cash for financing activities (945.2) Total expenses, other than cost of product sold 2,069.0 Stockholders' equity, beginning of year 8,124.8 Dividends paid (418.1) Requireda. Prepare the income statement for the year. J.M. Smucker Company, Inc. Income Statement ($ millions) Answer 1 Answer 2 Answer 3 Answer 4 Answer 5 Answer 6 Answer 7 Answer 8 Answer 9 Answer 10 b. Prepare the balance sheet at the end of the year. J.M.…arrow_forwardCalculate Total Fixed Cost With General Accounting Methodarrow_forwardIm Waiting for Solution of this General Accounting Questionarrow_forward

- Provide Solutions Pleasearrow_forwardFinancial Accounting Question Solution with Correct Methodarrow_forwardComputing Return on Assets and Applying the Accounting Equation Nordstrom Inc. reports net income of $564 million for a recent fiscal year. At the beginning of that fiscal year, Nordstrom had $8,115 million in total assets. By fiscal year end, total assets had decreased to $7,886 million. What is Nordstrom’s ROA? Note: Enter answer as a percentage rounded to the nearest 2 decimal places (ex: 24.58%). ROA Answer 1arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning