Concept explainers

Transaction Analysis; Income Statement Preparation

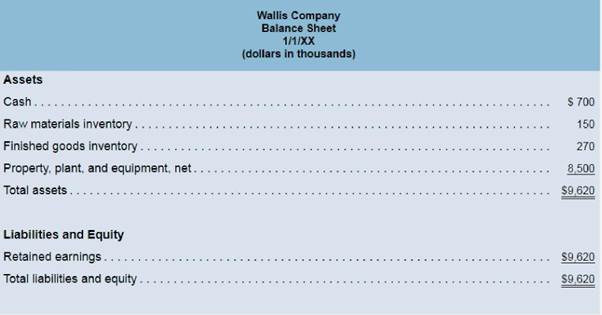

Wallis Company" manufactures only one product and uses a

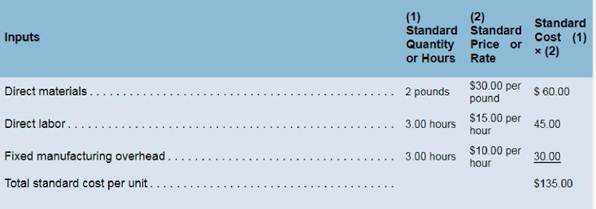

The company's standard cost card for its only product is as follows:

During the year Wallis completed the following transactions:

a. Purchased (with cash) 230.000 pounds of raw material at a price of $29.50 per pound.

b. Added 215.000 pounds of raw material to work in process to produce 95.000 units.

c. Assigned direct labor costs to work in process, The direct laborers (who were paid in cash) worked 245.000 hours at an average cost of S16.00 per hour to manufacture 95.000 units.

d. Applied fixed overhead to work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed to manufacture 95.000 units. Actual fixed overhead costs for the year were $2,740,000. Of this total, $1,340,000 related to items such as insurance, utilities, and pase 463 salaried indirect laborers that were all paid in cash and $1,400,000 related to depreciation of equipment.

e. Transferred 95.000 units from work in process to finished goods.

f. Sold (for cash) 92,000 units to customers at a price of $170 per unit,

g. Transferred the standard cost associated with the 92,000 units sold from finished goods to cost of goods sold.

h. Paid $2,120,000 of selling and administrative expenses. i. Closed all standard cost variances to cost of goods sold.

Required:

1. Compute all direct materials, direct labor, and fixed overhead variances for the year.

2. Using Exhibit 9B-3 as a guide, record transactions a through i for Wallis Company.

3. Compute the ending balances for Wallis Company's balance sheet, Using Exhibit 9B−5 as a guide, prepare Wallis Company's income statement for the year.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Introduction To Managerial Accounting

- When a company incurs an expense but does not yet pay it, what is the entry?A. Debit Expense, Credit CashB. Debit Liability, Credit ExpenseC. Debit Expense, Credit LiabilityD. No entry neededarrow_forwardDont use ai What is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesarrow_forwardWhat is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesi need help ..arrow_forward

- Get the Correct Answer with calculation of this General Accounting Questionarrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardHello Dear Tutor Please Need Answer of this Question as possible fast and Correctarrow_forward15. The balance in the dividends account is closed to:A. CashB. RevenueC. Retained EarningsD. Common Stock dont use AIarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub